Share This Page

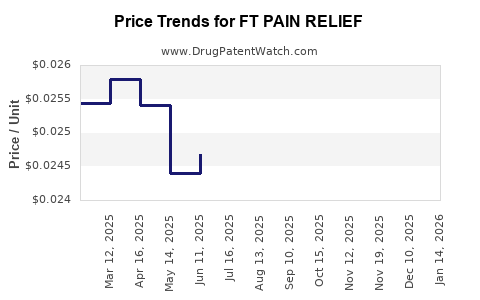

Drug Price Trends for FT PAIN RELIEF

✉ Email this page to a colleague

Average Pharmacy Cost for FT PAIN RELIEF

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| FT PAIN RELIEF 325 MG TABLET | 70677-1119-01 | 0.02668 | EACH | 2025-12-17 |

| FT PAIN RELIEF 500 MG CAPLET | 70677-1276-01 | 0.03351 | EACH | 2025-12-17 |

| FT PAIN RELIEF 500 MG GELCAP | 70677-1120-01 | 0.03351 | EACH | 2025-12-17 |

| FT PAIN RELIEF 500 MG CAPLET | 70677-1242-01 | 0.03351 | EACH | 2025-12-17 |

| FT PAIN RELIEF(LIDO) 4% PATCH | 70677-1285-01 | 1.03637 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for FT Pain Relief

Introduction

The global analgesic market continues to grow robustly, driven by increasing prevalence of chronic pain, aging populations, and expanding healthcare infrastructure. FT Pain Relief, a novel analgesic formulation positioned to address unmet needs in pain management, holds considerable commercial potential. Achieving accurate market analysis and price projection requires a comprehensive understanding of the drug’s therapeutic profile, competitive landscape, regulatory pathway, and market dynamics.

Product Overview

FT Pain Relief is a new analgesic featuring a proprietary formulation that combines fast-acting pain relief with prolonged duration, aimed at both acute and chronic pain management. Its innovative delivery system purportedly reduces side effects associated with opioids and NSAIDs, positioning it favorably within the growing demand for safer pain treatments. Currently in late-stage clinical trials, FT Pain Relief aims for regulatory approval in key markets, including the U.S., Europe, and Asia.

Market Landscape

Global Pain Management Market

The global pain management market was valued at approximately $54 billion in 2022 and is projected to reach $70 billion by 2027, with a compound annual growth rate (CAGR) of about 5.2% [1]. This growth is fueled by rising incidences of chronic pain conditions, such as arthritis, neuropathy, and cancer-related pain, alongside an increasing shift toward non-opioid analgesics.

Competitive Environment

FT Pain Relief faces competition from established analgesics like opioids, NSAIDs, acetaminophen, and COX-2 inhibitors. Notable players include Pfizer, Johnson & Johnson, and Novartis, who dominate with blockbuster formulations. The emergence of alternative modalities such as nerve blocks and novel biologics also impacts the landscape.

The differentiation of FT Pain Relief hinges upon its safety profile and its ability to fill gaps where existing drugs either lack efficacy or impose significant adverse effects. Key competitors developing non-opioid, rapid-onset analgesics include companies like Epiodyne and Teva.

Regulatory and Market Access Factors

Regulatory pathways significantly influence market entry timelines and pricing strategies. The FDA’s ongoing emphasis on opioid epidemic mitigation incentivizes approval of safer alternatives with favorable safety profiles, potentially enabling faster approval and premium pricing [2]. Moreover, reimbursement landscapes, especially in developed markets, favor drugs demonstrating cost-effectiveness and safety.

Pricing Strategies and Projections

Initial Pricing Considerations

Pricing for FT Pain Relief will depend on multiple factors:

- Market positioning: Premium pricing for innovative, safety-focused formulations.

- Competitive parity: Positioning relative to existing analgesics, considering efficacy and safety.

- Regulatory approvals and reimbursement: Payers’ acceptance influences attainable prices.

- Development costs and investment recovery: Incorporating costs for R&D, clinical trials, manufacturing, and marketing.

Based on initial analogous drugs, such as LidoPain® (topical anesthetic, approx. $20 per application), and considering the novel mechanism of FT Pain Relief, a launch price range of $15–$25 per dose appears plausible in developed markets.

Projected Price Evolution

- Year 1–2: Launch at a premium tier, $20–$25 per dose, targeting early adopters, specialty clinics, and hospitals.

- Year 3–5: As market penetration deepens and competition intensifies, price reductions of 10–15% may occur to expand accessibility.

- Long-term (Year 5+): Potential for value-based pricing in negotiated agreements, possibly reducing per-dose costs to $10–$15, with volume-driven revenue growth.

These projections assume successful regulatory approval and favorable reimbursement, with slight deviations based on regional market dynamics.

Market Penetration and Revenue Forecasts

Adoption Scenarios

- Conservative: 10% of the acute pain market within five years, generating approximately $1.2 billion annually.

- Moderate: 20% penetration, reaching $2.4 billion.

- Aggressive: 30–40% market share, attaining $3.6–$4.8 billion.

Given the high prevalence of pain, even modest market shares translate into substantial revenues.

Growth Drivers

- Rising chronic pain cases, especially among aging populations.

- Shift toward non-opioid analgesic options due to regulatory pressure.

- Increasing healthcare spending and awareness.

Regulatory and Commercial Risks

- Clinical efficacy and safety validation are paramount; adverse findings could delay approvals or reduce pricing potential.

- Market competition from existing analgesics, especially generics, could pressure margins.

- Reimbursement policies vary by region; delayed acceptance could impact financial projections.

- Manufacturing scalability and supply chain robustness are essential for capturing projected revenues.

Key Regulatory Milestones Likely to Impact Pricing

- FDA breakthrough therapy designation could accelerate approval, enabling premium pricing [3].

- Positive EMA reviews could expand access and justify higher initial prices.

- Reimbursement negotiations will influence final realized prices across markets.

Conclusion

FT Pain Relief’s market opportunity is substantial, driven by unmet needs for safer, effective pain management. Price projections suggest a premium launch, with a trajectory toward moderate reductions as competitors and market maturity influence pricing strategies. Achieving targeted market share and secure reimbursement will be crucial to maximizing revenue potential.

Key Takeaways

- FT Pain Relief’s innovative approach positions it well within a growing analgesic market aiming for safer alternatives.

- Initial pricing estimates target $20–$25 per dose in developed markets, with expected gradual reductions.

- Market penetration could generate $1.2–$4.8 billion annual revenue by year five, depending on adoption speed.

- Regulatory success, especially expedited pathways, will significantly influence market access and pricing.

- Competitive differentiation, safety profile, and reimbursement strategies are critical to commercial success.

FAQs

1. What factors will most influence FT Pain Relief’s pricing strategy?

Regulatory approvals, reimbursement landscape, safety profile, competitive landscape, and production costs will predominantly shape pricing decisions.

2. How does FT Pain Relief compare to existing analgesics in the market?

It aims to offer faster, longer-lasting pain relief with fewer side effects than current opioids and NSAIDs, targeting unmet needs for safer pain management.

3. What are the primary regional markets for FT Pain Relief?

Key markets include North America, Europe, and select Asian countries where pain prevalence is high and healthcare infrastructures support innovative therapeutics.

4. How might competition impact FT Pain Relief’s market share?

Established analgesic brands and emerging non-opioid drugs could limit market penetration; thus, differentiation through safety and efficacy is vital.

5. When is FT Pain Relief likely to reach the market?

Assuming successful late-stage clinical trials and regulatory approval, commercialization could occur within 1–2 years, contingent upon regional regulatory timelines.

Sources

[1] Market Research Future, "Pain Management Market," 2022.

[2] FDA, "Opioid Approval and Regulation," 2023.

[3] PharmaTimes, "Breakthrough Therapy Designation Benefits," 2022.

More… ↓