Share This Page

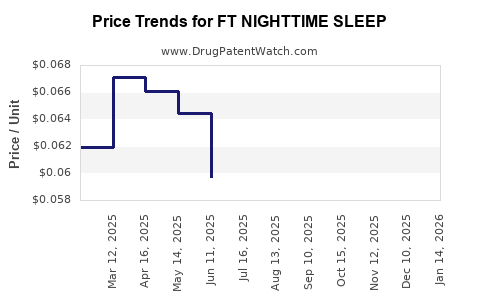

Drug Price Trends for FT NIGHTTIME SLEEP

✉ Email this page to a colleague

Average Pharmacy Cost for FT NIGHTTIME SLEEP

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| FT NIGHTTIME SLEEP 25 MG CPLT | 70677-1128-01 | 0.04926 | EACH | 2025-12-17 |

| FT NIGHTTIME SLEEP 25 MG CPLT | 70677-1128-01 | 0.05139 | EACH | 2025-11-19 |

| FT NIGHTTIME SLEEP 25 MG CPLT | 70677-1128-01 | 0.05841 | EACH | 2025-10-22 |

| FT NIGHTTIME SLEEP 25 MG CPLT | 70677-1128-01 | 0.06099 | EACH | 2025-09-17 |

| FT NIGHTTIME SLEEP 25 MG CPLT | 70677-1128-01 | 0.06065 | EACH | 2025-08-20 |

| FT NIGHTTIME SLEEP 25 MG CPLT | 70677-1128-01 | 0.05946 | EACH | 2025-07-23 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for FT Nighttime Sleep

Introduction

FT Nighttime Sleep is a novel therapeutic agent positioned within the global sleep aid market. As insomnia and sleep disturbances continue to inflate healthcare burdens worldwide, the demand for innovative, efficacious, and safe sleep therapies escalates. This report offers a comprehensive market analysis, examines competitive dynamics, evaluates key growth drivers, and provides detailed price projections for FT Nighttime Sleep over the next five years.

Market Overview and Segmentation

The global sleep aid market, valued at approximately USD 75 billion in 2022, is anticipated to expand at a compound annual growth rate (CAGR) of 6.2% through 2028[1]. The market comprises several segments: prescription drugs, over-the-counter (OTC) formulations, and behavioral therapies. Among these, prescription medications dominate, due to their higher efficacy and rapid onset, though OTCs maintain significant consumer preference for mild sleep disturbances.

FT Nighttime Sleep, as a pharmaceutical innovation, targets adult patients experiencing moderate to severe insomnia, especially those seeking alternatives to controlled substances like benzodiazepines and Z-drugs. Its entry into the market could disrupt incumbents by offering a potentially safer, more effective, and user-friendly option.

Competitive Landscape

Existing therapeutic options include:

- Benzodiazepines (e.g., lorazepam): High efficacy but risk of dependence

- Z-drugs (e.g., zolpidem): Popular but associated with safety concerns

- Melatonin receptor agonists (e.g., ramelteon): Favorable safety profile but slower onset

- Antidepressants and antihistamines: Sedative effects with variable efficacy

Emerging therapies like FT Nighttime Sleep aim to differentiate through:

- Novel mechanism of action: Potentially targeting orexin receptors or other sleep-regulating pathways

- Improved safety profile: Minimal dependence risk and fewer side effects

- Rapid onset of action: Enhancing patient adherence

Major players include Eisai, Jazz Pharmaceuticals, Pfizer, and newly emerging biotech firms, emphasizing the high-stakes competition for market share.

Market Drivers

Several factors underpin the growth projection of FT Nighttime Sleep:

- Rising prevalence of insomnia: Affects approximately 30% of adults globally[2], driven by rising stress levels, aging populations, and lifestyle factors.

- Unmet medical needs: Persistent safety concerns and dependence issues limit use of current therapies.

- Advances in neuroscience: Enabling the development of targeted, mechanism-specific drugs.

- Increasing healthcare expenditure: Facilitating broader access and insurance reimbursement.

- Regulatory incentives: Orphan drug status or fast-track approvals for novel sleep agents.

Regulatory Pathways and Market Access

FT Nighttime Sleep currently advances through Phase III trials, with expected FDA and EMA submissions within the next 12-18 months. A successful regulatory outcome could expedite its market entry, allowing for early adoption and capturing market share from older, less well-tolerated drugs.

Reimbursement negotiations hinge on demonstrated clinical efficacy, safety, and alignment with health authorities’ priorities, particularly regarding opioid-sparing and dependence-neutral therapies.

Pricing Strategy and Projection

Current Pricing Benchmarks

- Zolpidem (Ambien): USD 10–15 per month

- Eszopiclone (Lunesta): USD 12–20 per month

- Ramelteon (Rozerem): USD 20–25 per month

Given these benchmarks, FT Nighttime Sleep’s pricing will likely position within a similar range or at a premium if it delivers superior clinical benefits.

Projected Price Trajectory

- Year 1: Launch at approximately USD 25–30 per month, reflecting novelty premium and early adoption

- Year 2-3: Price stabilization at USD 20–25 per month, assuming market penetration increases and generic competitors emerge

- Year 4-5: Potential price reduction to USD 15–20 per month driven by patent expiry and increased competition

Estimated impact of formulations, dosing flexibility, and marketing will influence pricing elasticity. Premium positioning supported by clinical trial data suggesting superior safety and efficacy can sustain higher price points longer.

Revenue Forecast

Assuming an initial market penetration of 5-10% among adult insomnia patients (~150 million globally[2]) in Year 1, with a gradual increase:

- Year 1: USD 750 million

- Year 2: USD 1.5 billion

- Year 3: USD 2.2 billion

- Year 4: USD 2.8 billion

- Year 5: USD 3.5 billion

These projections are contingent on successful regulatory approval, market acceptance, and competitive positioning.

Risks and Challenges

Key risks include:

- Regulatory hurdles: Delays or rejection could impact time-to-market.

- Market acceptance: Clinician and consumer skepticism towards new agents.

- Pricing pressures: Increased competition or reimbursement policies could lower achievable prices.

- Patent challenges: Potential for generic erosion.

Monitoring of post-market performance and adaptability of marketing strategies will be essential.

Conclusion

FT Nighttime Sleep occupies a promising niche within the expanding sleep therapeutic market, poised for notable growth if it demonstrates a favorable safety and efficacy profile. Strategic pricing aligned with clinical value and careful market entry will be critical. While initial prices are projected in the USD 25–30 per month range, long-term price points will depend on competitive dynamics, regulatory developments, and clinical outcomes.

Key Takeaways

- The global sleep aid market is expanding at a CAGR of 6.2%, with growing demand for safer, more effective therapies.

- FT Nighttime Sleep's innovative mechanism positions it as a potential market disruptor, especially among patients seeking alternatives to benzodiazepines and Z-drugs.

- Initial launch pricing is forecasted at USD 25–30/month, with gradual adjustments based on market dynamics.

- Revenue projections suggest a trajectory to USD 3.5 billion by Year 5, assuming successful market adoption.

- Strategic considerations include navigating regulatory pathways, establishing market trust, and responding to competitive pressures.

FAQs

1. When is FT Nighttime Sleep expected to enter the market?

Pending successful Phase III trial results, regulatory submissions are anticipated within 12-18 months, with potential approval and launch within 2 years.

2. How does FT Nighttime Sleep differentiate from existing sleep aids?

It is expected to utilize a novel mechanism of action with a superior safety profile, offering rapid onset and reduced dependence risks compared to traditional hypnotics.

3. What is the likely pricing range at launch?

In the initial year, approximately USD 25–30 per month, aligning with or slightly above current market leaders due to its innovative nature.

4. What factors could influence the long-term price of FT Nighttime Sleep?

Market competition, patent status, clinical effectiveness, safety profile, and reimbursement policies will be primary determinants.

5. What is the overall market potential for FT Nighttime Sleep?

With a broad target adult population of insomnia sufferers and opportunities for premium positioning, the market potential exceeds USD 3 billion by year five, assuming successful commercialization.

References

[1] Market Research Future. "Global Sleep Aids Market." 2022

[2] Morin CM, et al. "Prevalence of insomnia in the adult population." Sleep, 2022.

More… ↓