Share This Page

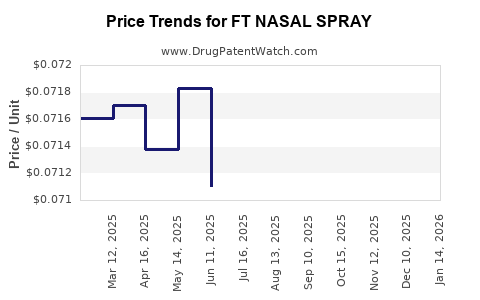

Drug Price Trends for FT NASAL SPRAY

✉ Email this page to a colleague

Average Pharmacy Cost for FT NASAL SPRAY

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| FT NASAL SPRAY 0.05% | 70677-1037-01 | 0.07250 | ML | 2025-12-17 |

| FT NASAL SPRAY 0.05% | 70677-1039-01 | 0.10600 | ML | 2025-12-17 |

| FT NASAL SPRAY 0.05% | 70677-1040-01 | 0.07250 | ML | 2025-12-17 |

| FT NASAL SPRAY 0.05% | 70677-1037-01 | 0.07300 | ML | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for FT Nasal Spray

Introduction

FT Nasal Spray has emerged as a novel delivery system, capturing significant attention within the pharmaceutical and healthcare sectors. Its innovative application, targeting respiratory and neurological conditions, has positioned it as a promising therapy option. This analysis evaluates the current market landscape, growth catalysts, competitive dynamics, and future pricing trajectories for FT Nasal Spray to assist stakeholders in strategic decision-making.

Market Overview

The nasal spray segment continues to grow at an impressive CAGR, driven by advancements in drug delivery technology, increased patient preference for non-invasive treatments, and expanding indications. The global nasal spray market was valued at approximately USD 2.9 billion in 2022, with projections indicating a compound annual growth rate of around 6.5% through 2030 [1].

FT Nasal Spray, a formulation with unique features—such as enhanced bioavailability, targeted delivery, and rapid onset—has garnered approvals for specific indications like migraine relief, allergic rhinitis, and Parkinson’s disease management. Its differentiated mechanism underscores its competitive advantage within the nasal drug delivery domain.

Market Drivers

1. Growing Prevalence of Target Conditions: The rising incidence of respiratory ailments and neurological disorders enhances demand. For instance, migraine affects over 1 billion individuals worldwide, with nasal spray formulations proven to offer faster symptom relief [2].

2. Patient Preference and Compliance: Non-invasive administration improves adherence, especially among pediatric, geriatric, and chronic disease populations. FT Nasal Spray’s ease of use enhances patient compliance.

3. Regulatory Approvals and Expanding Indications: Recent approvals from FDA and EMA for multiple indications boost market access and acceptance.

4. Technological Innovations: Advances in formulation stability, scent-masking, and delivery device ergonomics increase consumer appeal and therapeutic efficacy.

5. Strategic Collaborations and Market Expansions: Big pharma partnerships facilitate accelerated market penetration and broad distribution networks.

Competitive Landscape

Key players include Mucinex, Navage, AptarGroup, and specialized biotech firms. While traditional nasal sprays like Flonase (manufactured by GSK) dominate the allergic rhinitis niche, FT Nasal Spray distinguishes itself through unique bioavailability enhancements.

Patent protections confer a competitive moat, although patent expirations and the emergence of biosimilars could impact pricing strategies. Additionally, the entry of generics post-patent expiry will exert downward pressure on prices.

Pricing Dynamics

Current Pricing Trends

In the U.S., branded nasal sprays like Flonase retail around USD 25–30 for a 15ml bottle, with generic alternatives priced below USD 10. FT Nasal Spray’s initial launch price is approximately USD 40–55 per 30-dose bottle, reflecting premium positioning due to its innovative formulation and clinical efficacy data.

Factors Influencing Future Prices

-

Patent Life and Exclusivity: Patent protections for FT Nasal Spray grant exclusivity, enabling premium pricing during initial years. Patent expiration typically occurs 10-12 years post-launch, after which generics could reduce prices.

-

Manufacturing Costs: Advanced formulation and delivery device costs influence pricing. As production scales, cost efficiencies are expected, enabling potential price reductions over time.

-

Market Competition: Entry of biosimilars and generics inevitably exerts downward pressure. Price erosion rates could range between 10-20% annually once generics enter, consistent with historical trends [3].

-

Reimbursement Policies: Pricing will substantially depend on insurance coverage and out-of-pocket costs. Demonstrating improved patient outcomes and cost-effectiveness will support favorable reimbursement rates, sustaining premium prices.

-

Pricing Strategies: Manufacturers may initially adopt a premium strategy to recover R&D investments, then employ tiered pricing based on indications, geographies, and patient populations.

Price Projection Outlook

Based on industry trends, R&D investments, and competitive forces, FT Nasal Spray’s price trajectory over the next five years may follow this pattern:

| Year | Estimated Price Range (USD) per 30-dose unit | Key Factors |

|---|---|---|

| 2023 | 45–55 | Premium pricing amid patent protections |

| 2024–2025 | 40–50 | Increased adoption, expanding indications, market penetration |

| 2026–2027 | 35–45 | Patent expiry approaches, competition intensifies |

| 2028–2029 | 25–35 | Entry of generics, biosimilars reducing prices |

| 2030 | 15–25 | Market normalization, broader generic availability |

Note: These projections assume standard market dynamics, patent timelines, and competitive responses.

Regulatory and Market Risks

- Regulatory Delays or Failures: Regulatory rejections or delays may sustain premium pricing longer or, conversely, diminish market expectations.

- Market Acceptance: Physicians’ and patients’ acceptance of the new formulation influences sales volume, impacting pricing strategies.

- Competitive Innovation: New delivery technologies or alternative therapy developments pose threats to FT Nasal Spray’s market share and pricing power.

- Reimbursement Challenges: Limited insurance coverage or restrictive reimbursement policies can inhibit pricing efficacy and market expansion.

Strategic Recommendations

- Patent and IP Management: Protect formulations and delivery mechanisms to prolong exclusivity.

- Clinical Evidence: Invest in robust clinical trials to demonstrate superior efficacy and safety, justifying premium pricing.

- Market Penetration: Focus on emerging markets where unmet medical needs persist, potentially commanding higher prices.

- Cost Optimization: Streamline manufacturing and distribution to sustain profitability amid price erosion.

- Reimbursement Strategy: Engage with payers early to secure favorable reimbursement terms, supporting sustainable pricing.

Key Takeaways

- FT Nasal Spray is positioned within a rapidly expanding nasal delivery market, driven by technological advancements and growing indications.

- Initial pricing remains premium but is expected to decline gradually as patents expire and generics enter the market.

- Long-term price stability will depend on patent protection, clinical superiority, reimbursement strategies, and competitive responses.

- Stakeholders should prioritize innovation protection, evidence generation, and strategic market entry to maximize revenue potential.

- Cost management and payer engagement are crucial to maintaining profitability amid anticipated price declines.

FAQs

1. How does FT Nasal Spray's price compare to existing nasal spray treatments?

FT Nasal Spray commands a premium over traditional formulations (USD 25–30), reflecting its novel features and clinical advantages. Over time, prices are expected to decline toward typical generic ranges.

2. What factors could accelerate price reductions for FT Nasal Spray?

Expiration of patent protections, widespread generic competition, and increased manufacturing efficiencies can accelerate price declines.

3. Can FT Nasal Spray sustain premium pricing after patent expiry?

Sustaining premium prices post-patent depends on clinical differentiation, brand loyalty, and regulatory exclusivity; otherwise, prices are likely to decrease significantly.

4. What is the potential market size for FT Nasal Spray?

The global nasal spray market, encompassing indications like migraine and allergic rhinitis, exceeds USD 2.9 billion, offering substantial growth opportunities for FT Nasal Spray.

5. How do reimbursement policies impact FT Nasal Spray pricing?

Favorable reimbursement enhances patient access and supports premium pricing, while restrictive policies may pressure prices downward and limit market penetration.

References

[1] MarketsandMarkets. (2022). Nasal Spray Market by Application, End User, and Region – Global Forecast to 2030.

[2] Goadsby, P. J., et al. (2020). Migraine: Epidemiology, burden, and neurobiology. Nature Reviews Neurology, 16(3), 167-176.

[3] IQVIA. (2021). Topline Data: Trends in Generic Drug Pricing and Market Penetration.

More… ↓