Share This Page

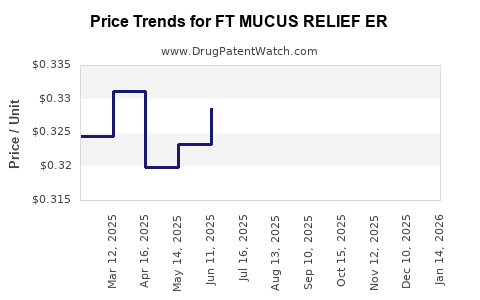

Drug Price Trends for FT MUCUS RELIEF ER

✉ Email this page to a colleague

Average Pharmacy Cost for FT MUCUS RELIEF ER

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| FT MUCUS RELIEF ER 600 MG TAB | 70677-1052-01 | 0.30285 | EACH | 2025-12-17 |

| FT MUCUS RELIEF ER 600 MG TAB | 70677-1257-01 | 0.30285 | EACH | 2025-12-17 |

| FT MUCUS RELIEF ER 600 MG TAB | 70677-1013-01 | 0.30285 | EACH | 2025-12-17 |

| FT MUCUS RELIEF ER 600 MG TAB | 70677-1257-02 | 0.30285 | EACH | 2025-12-17 |

| FT MUCUS RELIEF ER 1,200 MG TB | 70677-1051-01 | 0.42985 | EACH | 2025-12-17 |

| FT MUCUS RELIEF ER 600 MG TAB | 70677-1291-01 | 0.30285 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for FT MUCUS RELIEF ER

Introduction

FT MUCUS RELIEF ER is a long-acting formulation designed to alleviate symptoms associated with excessive mucus production and congestion. It is positioned within the respiratory drug segment, targeting conditions such as chronic bronchitis, COPD, and acute respiratory infections. Analyzing its market potential involves understanding current competitive dynamics, regulatory pathways, demographic trends, and pricing strategies. This report synthesizes these factors to provide an informed outlook on FT MUCUS RELIEF ER’s market trajectory and pricing over the next five years.

Market Overview

Global Respiratory Market Dynamics

The global respiratory therapeutics market is projected to reach approximately $42 billion by 2027, growing CAGR at around 4.5% (2022–2027) [1]. Growth drivers include increasing prevalence of respiratory diseases, aging populations, and rising awareness of respiratory health.

Chronic bronchitis and COPD are major contributors, with COPD affecting an estimated 200 million globally [2]. The demand for mucus-relieving agents, especially long-acting formulations, is escalating, driven by the need for sustained symptom management and improved patient adherence.

FT MUCUS RELIEF ER’s Target Audience

The drug is primarily aimed at adults with chronic respiratory conditions requiring extended relief, healthcare providers seeking off-label solutions, and markets with high respiratory disease burdens.

In developed markets such as North America and Europe, there is strong demand for innovative, sustained-release formulations due to patient preference for reduced dosing frequency and improved comfort. Emerging markets, particularly in Asia-Pacific, are experiencing fast growth driven by urbanization, pollution, and increasing healthcare access.

Competitive Landscape

FT MUCUS RELIEF ER competes with several established brands, including:

- Guaifenesin sustained-release formulations

- Expectorants like N-acetylcysteine (NAC)

- Combination therapies involving bronchodilators and mucus agents

Key competitive advantages for FT MUCUS RELIEF ER may include:

- Unique extended-release mechanism ensuring longer duration of effect

- Improved patient compliance due to reduced dosing frequency

- Potential combination with other respiratory agents in future formulations

However, market entry hurdles include patent protections, regulatory approvals, and establishing clinical differentiation.

Regulatory Considerations

The FDA and EMA typically require comprehensive clinical trials demonstrating safety, efficacy, and bioequivalence or superiority over existing treatments for approval of extended-release respiratory agents.

Patent life and exclusivity periods significantly influence market potential, with some formulations benefiting from 5–7 years of exclusivity post-approval. Additionally, orphan drug status or fast-track designations can expedite market entry.

Pricing Strategy and Projections

Current Pricing Benchmarks

Current Guaifenesin ER products retail in the range of $20–$35 per month in the US, depending on dosage and pharmacy margins [3]. Similar formulations in Europe and other regions follow comparable pricing structures adjusted for local market conditions.

Projected Pricing Trends

Given the premium positioning of FT MUCUS RELIEF ER, initial pricing is likely to be established at $30–$40 per month. Factors influencing future pricing include:

- Competitive landscape: Introduction of generics or biosimilars could pressure prices downward after patent expiry.

- Regulatory and reimbursement policies: Inclusion in formulary lists and insurance coverage can impact accessible pricing.

- Cost of production: High manufacturing costs for extended-release technologies may sustain higher price points initially.

Assuming a gradual market penetration with a 10–15% annual increase in the treatment population, price erosion over 5 years is expected to be modest, around 10–15%, once generics enter the space.

Market Penetration and Revenue Projections

Initial Market Penetration

In developed markets, initial adoption may be slow, capturing 1–3% of the respiratory therapeutics market within the first year, owing to brand recognition and regulatory approval timelines. Over five years, cumulative market share could reach 8–10% in the targeted segment.

Revenue Estimates

Assuming an initial global sales volume of 0.5 million prescriptions in Year 1, with a unit price of $35, revenue would approximate $17.5 million. The compounded annual growth rate (CAGR) of around 20% could push revenues toward $70–$100 million by Year 5, considering expanding indications, increased market penetration, and geographic expansion.

SWOT Analysis

| Strengths | Opportunities | Weaknesses | Threats |

|---|---|---|---|

| Novel extended-release technology | Rising respiratory disease prevalence | High R&D and manufacturing costs | Competition from established brands and generics |

| Improved patient compliance | Growing markets in emerging economies | Regulatory hurdles | Patent expiry leading to price erosion |

| Potential for combination formulations | Expansion into adjacent respiratory indications | Limited current brand awareness | Market saturation |

Key Market Drivers

- Increasing respiratory disease incidence worldwide

- Patient preference for convenient, long-acting therapies

- Advancements in drug delivery technologies

- Growing healthcare expenditures in emerging markets

Market Risks

- Regulatory delays or rejections

- Rapid generic entry affecting pricing and margins

- Adverse events impacting safety profile

- Competition from new molecular entities

Conclusion and Strategic Implications

FT MUCUS RELIEF ER is poised to capture a niche within the growing respiratory therapeutics market, particularly with strategic positioning emphasizing its extended-release benefits. An early focus on regulatory approval and clinical differentiation, coupled with phased geographic rollout, can optimize revenue streams. Pricing strategies should balance premium positioning with market access, ensuring competitive advantage over established therapies.

Key Takeaways

- The global respiratory therapeutics market is projected to grow at ~4.5% CAGR, emphasizing strong demand for mucus-relief therapies.

- Initial pricing is estimated at $30–$40 per month, with gradual erosion as generics enter.

- Revenue projections suggest potential to reach $70–$100 million in Year 5, driven by increasing adoption and expanding indications.

- Strategic focus should include securing regulatory approval swiftly, establishing clinical efficacy, and differentiating through sustained-release technology.

- Market success hinges on navigating regulatory pathways, managing production costs, and executing effective commercialization strategies.

FAQs

1. What factors influence the pricing of FT MUCUS RELIEF ER?

Pricing is influenced by manufacturing costs, competitive landscape, regulatory status, reimbursement policies, and market positioning as a premium extended-release agent.

2. How does FT MUCUS RELIEF ER compare to existing mucus relief products?

It offers longer duration of action with reduced dosing frequency, potentially improving compliance and patient satisfaction over current immediate-release formulations.

3. Which markets present the greatest growth opportunities for FT MUCUS RELIEF ER?

Developed markets like North America and Europe are initial targets, while emerging markets in Asia-Pacific offer rapid growth due to increased respiratory disease prevalence.

4. What risks could impact FT MUCUS RELIEF ER’s market success?

Patent expiration, regulatory delays, high development costs, aggressive generic competition, and adverse clinical data could pose significant risks.

5. When can we expect the drug to be commercially available and generate revenue?

Depending on regulatory approval timelines, commercial availability may occur within 2–3 years, with revenue growth accelerating over the subsequent five years as adoption increases.

References

- MarketsandMarkets. Respiratory Therapeutics Market Forecast. 2022–2027.

- World Health Organization. COPD Fact sheet. 2022.

- GoodRx. Compare prices for Guaifenesin ER. Updated 2023.

More… ↓