Share This Page

Drug Price Trends for FT MUCUS RELIEF D ER

✉ Email this page to a colleague

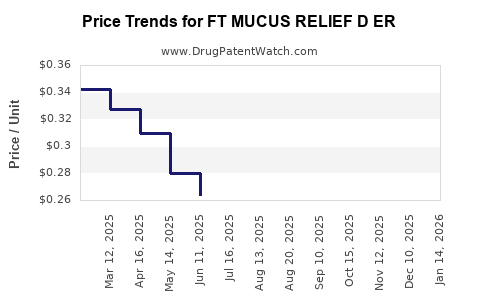

Average Pharmacy Cost for FT MUCUS RELIEF D ER

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| FT MUCUS RELIEF D ER 600-60 MG | 70677-1272-01 | 0.31042 | EACH | 2025-12-17 |

| FT MUCUS RELIEF D ER 600-60 MG | 70677-1263-01 | 0.31042 | EACH | 2025-12-17 |

| FT MUCUS RELIEF D ER 600-60 MG | 70677-1272-01 | 0.30997 | EACH | 2025-11-19 |

| FT MUCUS RELIEF D ER 600-60 MG | 70677-1263-01 | 0.30997 | EACH | 2025-11-19 |

| FT MUCUS RELIEF D ER 600-60 MG | 70677-1263-01 | 0.30557 | EACH | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for FT MUCUS RELIEF D ER

Introduction

The drug FT MUCUS RELIEF D ER is a reformulated extended-release combination medication used primarily to manage symptoms associated with respiratory conditions such as cough, mucus congestion, and cold symptoms. As a combination of an expectorant and a cough suppressant, it occupies a significant niche within over-the-counter (OTC) and prescription formulations. This analysis provides a comprehensive overview of the current market landscape, competitive positioning, regulatory considerations, and future price projections for FT MUCUS RELIEF D ER.

Market Overview

Therapeutic Sector and Demand Drivers

The respiratory therapeutics market, particularly products targeted at cough and cold relief, is a mature yet continuously evolving sector. It encompasses OTC remedies and prescription medications catering to acute and chronic respiratory conditions. The demand for formulations like FT MUCUS RELIEF D ER is driven by several factors:

- Rising prevalence of respiratory infections and chronic conditions such as COPD and asthma.

- Increasing consumer preference for combination therapies that simplify regimens.

- Growing awareness of symptom relief options among aging populations.

According to market research, the global cough, cold, and allergy OTC medications market is projected to reach $30 billion by 2025, with a compound annual growth rate (CAGR) of approximately 4.5% [1].

Market Penetration and Competitive Landscape

FT MUCUS RELIEF D ER faces competition from both branded and generic formulations. Key competitors include:

- Codeine-based combination products

- Other OTC expectorant and cough suppressant combinations (e.g., guaifenesin + dextromethorphan)

- Prescription-only expectorants and antitussives

The drug's extended-release formulation offers differentiation, appealing to consumers seeking sustained symptom relief with reduced dosing frequency, which enhances compliance.

Regulatory Environment

In the U.S., the FDA categorizes FT MUCUS RELIEF D ER as an OTC drug, requiring compliance with monograph regulations unless approved via NDA as a prescription product. Regulatory considerations influence market entry, pricing strategies, and promotional activities.

Market Segmentation and Demographics

Target Population

- Adults and elderly: Higher prevalence of chronic respiratory conditions, favoring extended-release formulations.

- Pediatric populations: Limited use due to safety regulations around opioids and certain expectorants.

Distribution Channels

- Pharmacies and drugstores: Primary retail outlets.

- Hospital and clinic pharmacies: For prescribed formulations.

- Online retail: Growing channel but with regulatory considerations.

Geographic Focus

The drug's primary markets include:

- United States: Largest market, significant OTC sales.

- Europe: Similar demand profile, regulated differently.

- Asia-Pacific: Rapid growth driven by increased healthcare spending and population size.

Pricing Strategy and Historical context

Current Price Points

As a branded extended-release combination product, FT MUCUS RELIEF D ER typically ranges between $12 to $20 for a one-month supply (30-60 tablets), depending on formulation strength and retail outlet. Generic equivalents, if available, are priced approximately 20-40% lower.

Price Components

- Manufacturing costs: Entering the marketplace at scale lowers unit costs.

- Regulatory compliance costs: Ongoing quality and safety monitoring.

- Market positioning: Premium branding for enhanced efficacy and convenience.

Pricing Trends

Historically, prices for combination expectorants and cough suppressants have experienced modest inflation correlating with inflation in raw material costs and regulatory overheads. The introduction of new formulations, particularly extended-release options, can command premium pricing.

Future Price Projections

Factors Influencing Price Trajectory

- Patent and exclusivity status: Patent expiration can lead to generic competition, depressing prices.

- Regulatory approvals: New indications or formulations may allow premium pricing.

- Market penetration: Increasing adoption broadens the revenue base.

- Manufacturing efficiencies: Scale reduces costs, potentially lowering retail prices.

Projected Pricing Outlook (Next 3-5 Years)

-

Scenario 1: Brand Continuity with Patent Protection

Maintains current pricing around $15–$20 per package, driven by brand loyalty and perceived efficacy. Price increases of 3-5% annually are plausible due to inflation and demand. -

Scenario 2: Entry of Generics

When patent expires, generic versions could reduce prices by 30-40%, bringing prices down to $9–$12 for comparable packages. This reduction could significantly impact branded sales but increase overall market volume. -

Scenario 3: Formulation Innovation or New Approvals

Introduction of newer formulations (e.g., combination with additional agents or novel delivery systems) could command a premium of 10-20% over existing prices, especially if backed by clinical advantages.

Regional Variability

Pricing in Europe and Asia-Pacific is likely to be lower owing to pricing controls and market dynamics, with prices for comparable formulations potentially halving current U.S. levels.

Market Opportunities and Risks

Opportunities

- Increasing acceptance of extended-release formulations aligns with consumer preferences.

- Potential for expansion into emerging markets with unmet demand.

- Development of pediatric or special population formulations can open new revenue streams.

Risks

- Price erosion from generic competition post-patent expiry.

- Regulatory delays or restrictions impacting approval for new indications.

- Consumer shifting preferences towards natural or alternative remedies.

Key Takeaways

- Market potential remains robust, driven by aging demographics, increased respiratory conditions, and demand for convenient dosing.

- Pricing strategies should balance premium positioning for novel formulations against expected generic erosion.

- Patent protection significantly influences near-term pricing, with expiration likely forecasted within 3-5 years.

- Emerging markets present significant growth opportunities with adaptable pricing models.

- Innovation in formulation and regulatory approvals may sustain or elevate price points, maintaining competitive advantage.

FAQs

1. When is patent expiration expected for FT MUCUS RELIEF D ER?

Patent expiration typically occurs 7-12 years after launch. Precise timelines depend on patent extensions and jurisdictional filings. Industry estimates suggest patent protection could expire within 3-5 years, opening the market to generics.

2. How does generic competition affect pricing?

Generic entrants typically reduce prices by 30-40%, compelling brand manufacturers to adopt competitive pricing strategies and focus on differentiation through formulation improvements or branding.

3. What are the key factors influencing future demand for this drug?

Growing prevalence of respiratory illnesses, consumer preference for extended-release formulations, aging populations, and expanding OTC availability will shape demand dynamics.

4. Are there any regulatory hurdles that could impact pricing?

Yes, regulatory changes concerning safety, labeling, or new indications can introduce costs or limit market access, influencing average prices.

5. How can manufacturers leverage market trends to maximize revenue?

Innovating with new formulations, expanding into emerging markets, and optimizing supply chains can sustain premium pricing while expanding overall sales volume.

References

[1] "Cough, Cold & Allergy OTC Medications Market Size & Forecast." MarketWatch, 2022.

More… ↓