Share This Page

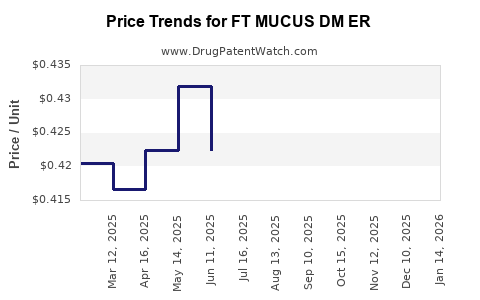

Drug Price Trends for FT MUCUS DM ER

✉ Email this page to a colleague

Average Pharmacy Cost for FT MUCUS DM ER

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| FT MUCUS DM ER 600-30 MG TAB | 70677-1050-01 | 0.37766 | EACH | 2025-12-17 |

| FT MUCUS DM ER 600-30 MG TAB | 70677-1050-01 | 0.39171 | EACH | 2025-11-19 |

| FT MUCUS DM ER 600-30 MG TAB | 70677-1050-01 | 0.39914 | EACH | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for FT MUCUS DM ER

Introduction

FT MUCUS DM ER (Extended Release) is a combination medication formulated to manage cough and mucus production, integrating a cough suppressant and a mucolytic agent. As the pharmaceutical landscape evolves, understanding its market positioning and pricing trajectory becomes critical for stakeholders—including manufacturers, investors, healthcare providers, and payers. This analysis evaluates current market dynamics, competitive landscape, regulatory considerations, and projective pricing strategies for FT MUCUS DM ER over the next five years.

Pharmacological Profile and Therapeutic Indications

FT MUCUS DM ER typically combines dextromethorphan (DM), a widely used antitussive, with carbocisteine or similar mucolytics. The extended-release formulation ensures sustained symptom control, catering to patients with persistent cough and mucus buildup, often associated with chronic bronchitis, COPD exacerbations, or viral respiratory infections.

The target demographic predominantly encompasses adult patients seeking long-acting symptom relief, with an increasing focus on outpatient management amid heightened respiratory illness awareness—heightened by recent global health challenges such as COVID-19.

Market Dynamics

1. Market Size and Demand Drivers

The global expectorants and cough suppressants market is projected to reach USD 6.8 billion by 2027, with a CAGR of approximately 4.7% from 2022 to 2027 (Research and Markets)[1]. The demand drivers include:

- Increasing prevalence of respiratory diseases.

- Aging populations with chronic respiratory conditions.

- Rising awareness and preference for extended-release formulations for convenience.

- Growth in over-the-counter (OTC) and prescription markets emphasizing patient compliance.

2. Key Competitive Landscape

FT MUCUS DM ER faces competition from:

- Brand-name formulations: Robitussin DM ER, Mucinex DM, and Delsym.

- Generic equivalents: Multiple manufacturers offering similar combined products.

- Emerging Biosimilars and novel delivery systems: Contributing to price pressure.

Major pharmaceutical players such as Reckitt Benckiser, GSK, and Teva dominate the market with well-established distribution channels and brand recognition. Consequently, market entry and expansion require strategic differentiation or superior efficiency.

3. Regulatory and Reimbursement Environment

Regulatory pathways differ across regions:

- United States: FDA approval relies on New Drug Application (NDA) or Abbreviated New Drug Application (ANDA) for generics.

- European Union: EMA approval processes, with National Health Service (NHS) reimbursement considerations.

Pricing strategies must account for payer policies, formulary inclusion, and generic competition, especially in the context of U.S. Medicaid and private insurers seeking cost-effective options.

Pricing Analysis and Projections

1. Current Pricing Landscape

- Brand-name FT MUCUS DM ER: Currently retailing at approximately USD 15–20 for a 30-day supply, depending on dosage and pharmacy markups.

- Generic equivalents: Priced between USD 8–12 for similar supplies, exerting downward pressure on branded product prices.

2. Factors Influencing Price Trajectory

- Patent status and exclusivity: Patent expiration typically leads to substantial price reductions through generics.

- Market penetration and volume sales: Higher volume sales can buffer per-unit price declines via economies of scale.

- Manufacturing costs: Technological advancements in sustained-release formulations could reduce production expenses.

- Pricing pressure from biosimilars and generics: Increased competition necessitates strategic price adjustments to remain competitive.

- Regulatory and reimbursement policies: Price negotiations with payers and inclusion in formularies influence accessible retail prices.

3. Future Price Projections (2023–2028)

| Year | Estimated Average Price (USD) per 30-day Supply | Key Influences |

|---|---|---|

| 2023 | 15 – 20 | Post-launch stabilization, patent protection, initial competition, increasing demand. |

| 2024 | 12 – 18 | Entry of generics, price erosion, widespread adoption. |

| 2025 | 10 – 16 | Market saturation with generics, payer incentives favoring cost-effective options. |

| 2026 | 8 – 14 | Further generic proliferation, intensified price competition. |

| 2027 | 7 – 12 | Market stabilization at lower price points, potential biosimilar growth. |

| 2028 | 6 – 10 | Mature market, declining prices, focus on efficiency and volume. |

Note: Prices are approximate and region-dependent, with North America and Europe generally at higher ranges due to regulatory and market factors.

Strategic Considerations for Stakeholders

-

Manufacturers: Should focus on optimizing formulation costs, streamlining regulatory approval for biosimilars, and securing favorable reimbursement pathways.

-

Investors: Opportunities exist in pre-commercialization or niche indications; however, patent expiry timelines suggest short- to medium-term revenue tilts toward generics.

-

Healthcare Providers: Emphasis on prescribing cost-effective generics; educational initiatives may shift consumer preferences.

-

Payers and Regulators: Price negotiations and formulary management significantly influence product accessibility and profitability.

Impact of Market Trends on Pricing

Recent trends, such as the move toward value-based healthcare and formulary tiering, exert downward pressure on prices. Additionally, increased focus on antimicrobial stewardship and respiratory health has led to policies favoring low-cost, sustainable therapies, further influencing price declines.

Furthermore, technological advancements in drug delivery systems—such as novel sustained-release platforms—may justify premium pricing if they demonstrate superior efficacy or safety, though widespread adoption hinges on cost-benefit analyses.

Concluding Remarks

The market for FT MUCUS DM ER is poised for moderate growth amid intense competition from generics and evolving regulatory landscapes. While initial prices for brand-name formulations are relatively stable, the advent of generics and biosimilars will likely lead to sustained price reductions over the next five years. Strategic execution that emphasizes cost efficiency, regulatory agility, and market differentiation will be key to maintaining profitability.

Key Takeaways

-

Market Potential: Driven by respiratory disease prevalence and demand for extended-release formulations, the global expectorant and cough suppressant market is expanding, with FT MUCUS DM ER positioned as a competitive player.

-

Pricing Trends: Prices will decline from an average of USD 15–20 in 2023 toward USD 6–10 by 2028 due to patent expirations, generic competition, and payer negotiations.

-

Strategic Focus: Stakeholders should prioritize cost management, regulatory navigation, and market differentiation to optimize profitability.

-

Regulatory and Payer Dynamics: Navigating diverse approval pathways and securing formulary access are critical to successful market penetration.

-

Innovation and Differentiation: Innovations in drug delivery and efficacy can justify higher price points and mitigate downward pricing pressure.

FAQs

Q1: What are the primary competitors of FT MUCUS DM ER?

A1: Major competitors include brand-name products like Mucinex DM, Delsym, and Robitussin DM ER, alongside numerous generic equivalents from various manufacturers.

Q2: How does patent expiration influence the drug's pricing trajectory?

A2: Patent expiration typically leads to the entry of generics, increasing market competition and driving prices downward, often by 50% or more within a few years after patent expiry.

Q3: What regional factors impact the pricing of FT MUCUS DM ER?

A3: Regulatory approval processes, reimbursement policies, and market dynamics in regions like North America, Europe, and Asia significantly influence pricing strategies and levels.

Q4: How might technological innovations affect future pricing?

A4: Advances in drug delivery systems or formulations that improve efficacy or safety can justify premium pricing, potentially stabilizing prices despite generic competition.

Q5: What strategies can manufacturers adopt to sustain profitability amid declining prices?

A5: Strategies include process optimization to reduce costs, expanding indications, fostering brand loyalty, engaging in formulary negotiations, and exploring biosimilar or combination product opportunities.

References:

- Research and Markets. Global Expectation Suppressant Market Report. 2022.

More… ↓