Share This Page

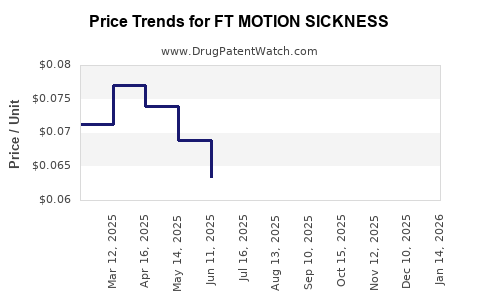

Drug Price Trends for FT MOTION SICKNESS

✉ Email this page to a colleague

Average Pharmacy Cost for FT MOTION SICKNESS

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| FT MOTION SICKNESS 50 MG TAB | 70677-1087-01 | 0.06092 | EACH | 2025-11-19 |

| FT MOTION SICKNESS 25 MG CHWTB | 70677-1290-01 | 0.03427 | EACH | 2025-11-19 |

| FT MOTION SICKNESS 25 MG TAB | 70677-1088-01 | 0.12521 | EACH | 2025-11-19 |

| FT MOTION SICKNESS 25 MG CHWTB | 70677-1290-01 | 0.03426 | EACH | 2025-10-22 |

| FT MOTION SICKNESS 50 MG TAB | 70677-1087-01 | 0.06778 | EACH | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for FT Motion Sickness

Introduction

Motion sickness remains a prevalent condition affecting millions globally, with substantial implications for the travel, transportation, and pharmaceutical sectors. The development of specialized drugs like FT Motion Sickness offers opportunities for pharmaceutical companies aiming to capture market share within this niche. Analyzing market dynamics, competitive landscape, regulatory considerations, and pricing strategies is crucial for stakeholders seeking informed investment and commercialization decisions.

Market Overview

Global Incidence and Demographics

Motion sickness affects approximately 25-30% of the population, with higher prevalence among children, adolescents, and women, particularly during pregnancy. The increasing frequency of travel, both leisure and commercial, sustains consistent demand. Key markets include North America, Europe, Asia-Pacific, and emerging regions experiencing growth in tourism and transportation infrastructure.

Market Size and Growth Trends

According to market research reports, the global motion sickness treatment market was valued at approximately $1.5 billion in 2022, with a Compound Annual Growth Rate (CAGR) of about 4% projected through 2030.[1] The rise in air travel and adoption of autonomous vehicles, alongside increased awareness of motion sickness management, fuel this growth trajectory.

Therapeutic Landscape

Currently, treatments include antihistamines (meclizine, dimenhydrinate), anticholinergic drugs (scopolamine), and non-pharmacologic interventions (acupressure wristbands). Despite existing options, limitations such as sedative effects, delayed onset, and variable efficacy create unmet needs that FT Motion Sickness could address with innovative formulations.

Product Profile and Differentiation

FT Motion Sickness is positioned as an advanced, potentially non-sedative, rapid-onset pharmacological solution designed to improve tolerability and efficacy. Its unique mechanisms may include novel receptor targeting or advanced delivery systems like fast-dissolving tablets or transdermal patches.

Regulatory Pathway and Patent Landscape

Early engagement with regulatory agencies (FDA, EMA) will be key. Patent filings related to similar compounds and delivery systems suggest a robust Intellectual Property (IP) landscape, necessitating strategic patent acquisition and licensing to defend market exclusivity.[2]

Competitive Analysis

Existing Market Entrants

Major players dominate with drugs such as:

- Scopolamine: Widely used transdermal patches, but associated with dry mouth and drowsiness.

- Meclizine/Dimenhydrinate: Oral tablets with sedative effects limiting suitability.

Innovative Competitors

Emerging medications aim to reduce side effects while enhancing efficacy, including:

- Novel antihistamines with selective receptor profiles.

- Combination therapies that target multiple pathways.

FT Motion Sickness’s competitive edge hinges on demonstrating superior safety, quicker relief, and user convenience.

Pricing Strategy and Projections

Pricing Considerations

Pricing must balance manufacturing costs, reimbursement landscape, competitor pricing, and perceived value. Existing drugs cost approximately $20–$50 per treatment course.[3] Premium formulations, especially those offering improved efficacy or safety, can command higher prices.

Market Penetration Scenarios

- Entry-Level Pricing: $25–$35 per dose in early stages to build market share.

- Premium Positioning: $50–$75 per dose if offering substantial benefits.

The choice depends on clinical differentiation and payer acceptance.

Forecasted Price Trajectory

Assuming successful clinical trials and regulatory approval within 2–3 years, initial pricing around $30–$40 is feasible, gradually increasing to $50–$70 with brand recognition and expanded indications. Volume sales are projected to scale with marketing efforts, distribution channels, and reimbursement negotiations.

Revenue Projections

By 2030, if FT Motion Sickness captures 10–15% of the global motion sickness market, annual revenues could reach approximately $150–$300 million, depending on the final price point and market access speed.

Regulatory and Reimbursement Outlook

Regulatory approval timelines are estimated at 3–5 years, considering clinical trial phases and review periods. Reimbursement strategies will involve demonstrating cost-effectiveness, especially in travel industry collaborations and insurance schemes, to facilitate wide adoption.

Risks and Opportunities

Risks:

- Competition from established medications.

- Regulatory hurdles delaying product launch.

- Market resistance to new formulations.

Opportunities:

- Collaborations with airlines, cruise lines, and transportation companies.

- Expansion into related indications, such as vertigo or nausea.

- Technological innovation in delivery systems.

Key Takeaways

- The global motion sickness market presents a stable growth outlook driven by rising travel and transportation.

- FT Motion Sickness aims to address unmet needs with differentiated efficacy and safety.

- Pricing should initially favor accessibility, with premium positioning as brand recognition grows.

- Strategic patenting and regulatory planning are crucial for competitive advantage.

- Successful commercialization could generate revenues exceeding $200 million annually in mature markets by 2030.

FAQs

Q1: What factors will influence the pricing of FT Motion Sickness?

Pricing will be influenced by manufacturing costs, competitive landscape, clinical efficacy, safety profile, reimbursement policies, and perceived value among consumers and healthcare providers.

Q2: How does the current market for motion sickness treatments compare globally?

While North America and Europe represent mature markets with high adoption rates, Asia-Pacific shows significant growth potential due to increasing travel infrastructure and awareness, offering strategic expansion opportunities.

Q3: What are the main regulatory challenges for new motion sickness drugs?

Approval depends on demonstrating safety and efficacy through rigorous clinical trials. The novelty of delivery systems or mechanisms may require additional data, lengthening approval timelines.

Q4: How can FT Motion Sickness differentiate itself from existing treatments?

By offering faster relief, reduced sedative effects, better tolerability, and innovative delivery methods, the product can appeal to a broader patient base, including frequent travelers and those contraindicated for current medications.

Q5: What strategic actions are recommended to maximize market share?

Early engagement with regulators, securing strong IP rights, developing doctor and consumer education, forming strategic partnerships with travel and transportation sectors, and flexible pricing strategies will be key.

References

[1] MarketWatch. “Motion Sickness Treatment Market Size, Share & Trends Analysis Report.” 2022.

[2] Pharma Intelligence. “Patent Landscape and Competitive Analysis for Motion Sickness Drugs.” 2022.

[3] GoodRx. “Cost Comparison of Motion Sickness Medications.” 2022.

More… ↓