Share This Page

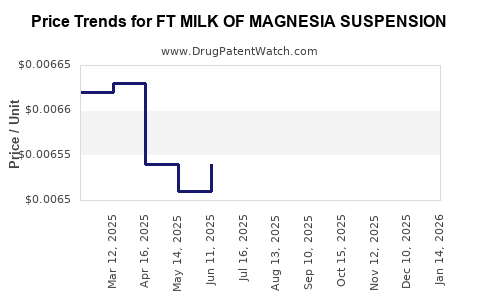

Drug Price Trends for FT MILK OF MAGNESIA SUSPENSION

✉ Email this page to a colleague

Average Pharmacy Cost for FT MILK OF MAGNESIA SUSPENSION

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| FT MILK OF MAGNESIA SUSPENSION | 70677-1074-02 | 0.00646 | ML | 2025-12-17 |

| FT MILK OF MAGNESIA SUSPENSION | 70677-1072-01 | 0.00978 | ML | 2025-12-17 |

| FT MILK OF MAGNESIA SUSPENSION | 70677-1073-01 | 0.00978 | ML | 2025-12-17 |

| FT MILK OF MAGNESIA SUSPENSION | 70677-1074-01 | 0.00978 | ML | 2025-12-17 |

| FT MILK OF MAGNESIA SUSPENSION | 70677-1074-02 | 0.00638 | ML | 2025-11-19 |

| FT MILK OF MAGNESIA SUSPENSION | 70677-1072-01 | 0.00987 | ML | 2025-11-19 |

| FT MILK OF MAGNESIA SUSPENSION | 70677-1074-01 | 0.00987 | ML | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for FT Milk of Magnesia Suspension

Introduction

Milk of Magnesia Suspension (magnesium hydroxide) is a widely used over-the-counter (OTC) laxative and antacid. Its prominent brand, FT Milk of Magnesia Suspension, commands significant market presence within the gastrointestinal health segment. Given its longstanding clinical efficacy, affordability, and broad demographic appeal, understanding its market dynamics and future pricing trajectories is critical for pharmaceutical companies, distributors, and healthcare providers seeking strategic positioning.

Market Overview

Global Market Size and Trends

The global gastrointestinal (GI) health market, encompassing antacids and laxatives, was valued at approximately USD 12 billion in 2021 and projects a compound annual growth rate (CAGR) of roughly 6.2% through 2028 [1]. Milk of Magnesia remains a staple within this domain, renowned for its rapid onset and minimal side effects, which favors its continued consumer acceptance.

Segment Dynamics

The key drivers influencing the FT Milk of Magnesia market include:

- Consumer Preferences: Growing preference for OTC remedies that offer quick relief without prescriptions.

- Aging Population: Increased GI disorders among seniors augment demand.

- Regulatory Trends: Favorable OTC regulations facilitate broader accessibility.

- Competitive Landscape: Market largely dominated by established brands, with variations introduced by local manufacturers.

- Product Innovation: Minimal recent innovation, maintaining a stable demand base.

Regional Market Insights

- North America: Leading market share, driven by high OTC OTC medication utilization, robust distribution channels, and high consumer health awareness.

- Europe: Stable growth with regulatory support, particularly within the UK, Germany, and France.

- Asia-Pacific: Rapid growth, fueled by increasing urbanization, rising healthcare awareness, and expanding retail pharmacy channels.

- Latin America and Africa: Emerging markets with expanding OTC access and increasing consumer health expenditure.

Market Players and Competition

Major players include:

- Reckitt Benckiser (Dulcolax, Gaviscon)—Global leader with strong distribution.

- Prestige Brands—Known for OTC gastrointestinal brands.

- Local and regional manufacturers—Significant in emerging markets.

FT Milk of Magnesia Suspension maintains competitive advantage through price point stability, brand trust, and broad retail presence.

Current Pricing Landscape

Pricing Benchmarks

The retail price of FT Milk of Magnesia Suspension varies across regions:

- United States: Approx. USD 5–8 per 8 oz (237 ml) bottle.

- Europe: EUR 4–7 per 240 ml bottle.

- Asia-Pacific: USD 2–4 per 240 ml bottle, reflecting lower purchasing power and local manufacturing.

Factors Influencing Pricing

- Brand Positioning: Established brands like FT command a premium due to trust and quality.

- Distribution Channels: Higher costs in online and specialty pharmacies versus mass-market retail.

- Regulatory Costs: Variations in compliance costs impact pricing, particularly in stringent markets like Europe.

- Raw Material Costs: Magnesium hydroxide supply stability influences manufacturing costs.

- Competitive Pricing Strategies: Promotions, bundling, and private-label offerings alter consumer prices.

Price Projections for 2024–2028

Market Drivers

- Predominant growth in Asia-Pacific and Latin America suggests potential price compression due to increased local manufacturing.

- A stable global demand for OTC laxatives and antacids sustains baseline pricing, with minor upward adjustments influenced by inflation and raw material costs.

Forecasted Trends

- United States and Europe: Maintains stable pricing with annual inflation-adjusted increases of approximately 2%.

- Emerging Markets: Slight price declines expected as local competition intensifies, with discounts up to 15% on international brands.

- Innovation and Formulation Changes: Minimal impact expected on pricing given the longstanding efficacy of the base formulation.

Projected Price Range (2024–2028)

| Region | 2024 Projection | 2028 Projection |

|---|---|---|

| North America | USD 5.10–8.20 | USD 5.40–8.80 |

| Europe | EUR 4.10–7.20 | EUR 4.30–7.80 |

| Asia-Pacific | USD 2.10–4.20 | USD 2.30–4.50 |

| Latin America | USD 2.50–4.50 | USD 2.70–4.70 |

Note: These projections incorporate inflation, raw material cost trends, and anticipated competitive pressures.

Strategic Implications for Stakeholders

- Manufacturers: Focus on optimizing supply chains to mitigate raw material cost fluctuations; consider diversifying formulations without compromising efficacy.

- Distributors: Leverage emerging market growth by establishing local manufacturing partnerships to reduce import costs.

- Healthcare Providers: Educate consumers on OTC options, emphasizing affordability and efficacy to sustain demand.

- Investors: Monitor raw material markets and regional regulatory changes for potential volatility.

Conclusion

The FT Milk of Magnesia Suspension stands as a resilient, cost-effective solution within the OTC gastrointestinal segment. Its market stability, combined with regional growth patterns, forecasts modest price increases aligned with inflation and operational costs, especially in developed markets. Emerging markets offer growth opportunities but may pressure prices downward as local manufacturing infrastructure matures.

Key Takeaways

- The global OTC laxative market is projected to grow steadily, with Milk of Magnesia Suspension maintaining a significant segment.

- Price stability prevails in mature markets, with slight inflation-driven increases projected through 2028.

- Rising regional demand in Asia-Pacific and Latin America presents growth opportunities, potentially offsetting pricing pressures.

- Raw material cost management will be pivotal for manufacturers to preserve margins.

- Market dynamics favor established brands like FT Milk of Magnesia, but competitive positioning requires attention to local manufacturing and pricing strategies.

FAQs

1. What factors influence the price of FT Milk of Magnesia Suspension?

Pricing is influenced by raw material costs, distribution channels, regional regulatory requirements, brand positioning, and competitive dynamics.

2. How is the emerging Asian market affecting the global price projection?

Rapid growth in Asia-Pacific, driven by increasing urbanization and healthcare awareness, is expected to reinforce stable or slightly decreasing prices due to heightened local manufacturing.

3. Will new formulation innovations impact the price of FT Milk of Magnesia?

Given the longstanding efficacy and minimal recent innovation in this segment, significant formulation changes are unlikely to influence pricing markedly.

4. How might raw material supply issues impact future prices?

Disruptions in magnesium hydroxide supply could increase manufacturing costs, leading to upward pressure on retail prices, especially if shortages persist.

5. What strategies should manufacturers adopt to remain competitive?

Focusing on cost optimization, strengthening distribution, and tailoring regional pricing strategies can help manufacturers sustain profitability amid market fluctuations.

Sources:

[1] Grand View Research. “Gastrointestinal Drugs Market Size, Share & Trends Analysis Report,” 2021.

More… ↓