Share This Page

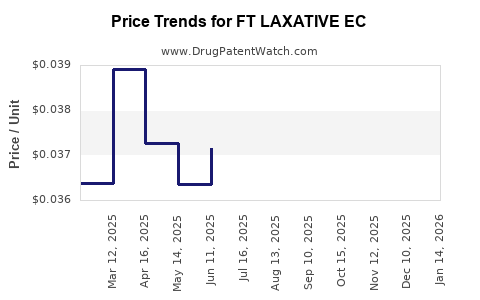

Drug Price Trends for FT LAXATIVE EC

✉ Email this page to a colleague

Average Pharmacy Cost for FT LAXATIVE EC

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| FT LAXATIVE EC 5 MG TABLET | 70677-1086-03 | 0.03854 | EACH | 2025-12-17 |

| FT LAXATIVE EC 5 MG TABLET | 70677-1086-02 | 0.03854 | EACH | 2025-12-17 |

| FT LAXATIVE EC 5 MG TABLET | 70677-1086-01 | 0.03854 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for FT LAXATIVE EC

Introduction

FT LAXATIVE EC is a widely used over-the-counter (OTC) bowel Regulator, primarily catering to individuals suffering from constipation. As a stimulant laxative, it contains ingredients designed to promote bowel movements through active stimulation of intestinal activity. Its market positioning, competitive landscape, and pricing trajectory are vital for stakeholders aiming to capitalize on its potential growth. This report offers a detailed examination of the current market dynamics, competitive environment, and future price projections for FT LAXATIVE EC.

Product Overview

FT LAXATIVE EC features a formulation combining stimulant agents such as senna or bisacodyl within an enteric-coated tablet, aimed at providing sustained and targeted release. The enteric coating ensures delayed release, reducing gastrointestinal irritation and improving patient compliance. Its efficacy, safety profile, and convenience of use make it a popular choice among consumers seeking rapid relief from constipation.

Market Landscape Analysis

Global OTC Laxatives Market

The global OTC laxatives market is projected to grow at a Compound Annual Growth Rate (CAGR) of approximately 4.2% between 2023 and 2028, driven by rising incidences of gastrointestinal disorders, aging populations, and increasing awareness about digestive health [1]. North America and Europe dominate this segment due to higher healthcare awareness and OTC marketing infrastructure, while Asia-Pacific is experiencing rapid expansion owing to urbanization and lifestyle shifts.

Key Market Drivers

- Aging Population: Elderly individuals are more prone to chronic constipation, fueling demand.

- Lifestyle Factors: Sedentary lifestyles, dietary changes, and increased stress levels contribute to gastrointestinal issues.

- Self-Medication Trends: Growing preference for OTC products over prescription medication enhances accessibility.

- Regulatory Support: Favorable regulatory environments encourage product innovation and market entry.

Competitive Landscape

Major competitors include Senokot (Senna), Dulcolax (Bisacodyl), and generic brands. These products dominate shelf space—especially in retail chains and pharmacy outlets—due to brand recognition and established efficacy. FT LAXATIVE EC’s differentiation focuses on its enteric-coated formulation, targeting consumers seeking minimized gastrointestinal discomfort.

Distribution Channels

- Pharmacies and Drugstores: Approximately 65% of sales, reflecting trust and accessibility.

- Supermarkets and Hypermarkets: Account for 20%, driven by bulk purchasing options.

- Online Retail: Emerging rapidly, especially during the COVID-19 pandemic, now representing approximately 15% of sales.

- Hospital and Clinic Dispensing: Limited, mainly for specific cases or prescriptions.

Market Challenges

- Regulatory Scrutiny: Stringent regulations concerning OTC laxatives, especially relating to safety warnings and labeling.

- Consumer Perception: Skepticism regarding stimulant laxatives' long-term safety impacts acceptance.

- Generic Competition: Price erosion among generics constrains revenue growth.

- Adverse Effect Profile: Concerns about potential dependence or alteration of gut motility may impact demand.

Price Analysis and Historical Trends

Current Price Range

FT LAXATIVE EC generally retails at a median OTC price of USD 4.00 to USD 7.00 per box (containing 20-30 tablets). Price variation hinges on packaging, retailer markups, and regional factors.

Pricing Strategies

Manufacturers typically employ penetration strategies through introductory offers, in-store promotions, and bundling with other digestive health products. Premium pricing occurs where formulations include additional features—such as longer-lasting enteric coating or combination formulations.

Historical Price Trends

Over the past five years, retail prices of similar stimulant laxatives have exhibited moderate stability, with variations attributable to raw material costs, regulatory tariffs, and inflation. Notably, the entrance of generic brands has exerted downward pressure on prices, resulting in a nearly 10% decrease in average retail price between 2018 and 2022.

Forecasting Price Trajectories (2023-2028)

Assumptions

- Stable regulatory environment with no significant restrictions on sales.

- Continued growth in demand driven by aging populations and lifestyle factors.

- Competitive pressures from generics maintain a price ceiling.

- Marginal input cost increases, primarily raw materials (senna/bisacodyl derivatives), are anticipated.

Projected Price Range

Based on current trends and market dynamics, the average retail price for FT LAXATIVE EC is expected to hover around USD 3.50 to USD 6.50 over the next five years. Specific projections include:

- 2023-2024: Slight decline to USD 3.50–USD 5.50 due to intensified generic competition.

- 2025-2026: Stabilization at USD 4.00–USD 6.00, as brands focus on value differentiation.

- 2027-2028: Potential price compression to USD 4.00–USD 6.50, sustained by consumer price sensitivity and cost pressures.

Influencing Factors

- Regulatory Changes: Stricter safety regulations might increase manufacturing costs, potentially raising consumer prices.

- Market Penetration: Expansion into emerging markets could lead to volume-driven sales but may exert downward pricing pressure.

- Consumer Preferences: Growing demand for natural or FDA-approved ingredients could influence formulation costs and pricing.

Strategic Recommendations

- Focus on Differentiation: Emphasize safety, efficacy, and convenience to justify premium pricing.

- Leverage Digital Channels: Expand online sales platforms to capitalize on growing e-commerce trends.

- Invest in Branding: Reinforce trust and reliability to counteract generic price erosion.

- Monitor Regulatory Landscape: Proactively adapt to new safety mandates or novel formulation restrictions.

Key Takeaways

- The global OTC laxatives market, including FT LAXATIVE EC, is poised for steady growth, primarily fueled by demographic trends and lifestyle changes.

- Market competition is intense, with generics driving price reductions; differentiation in formulation and branding remains critical.

- Current retail prices of FT LAXATIVE EC range between USD 4.00 and USD 7.00; projections indicate a slight downward trend, stabilizing at roughly USD 4.00–USD 6.50 over the next five years.

- Price sensitivity among consumers necessitates strategic positioning to balance affordability with perceived value.

- Future success depends on R&D innovation, regulatory compliance, and expansion into emerging markets.

FAQs

-

What are the primary drivers influencing the price of FT LAXATIVE EC?

Market demand, competitive pressure from generic brands, ingredient costs, regulatory policies, and distribution channel dynamics notably impact pricing. -

How does the enteric-coated formulation affect the product’s market position?

The coating enhances safety and efficacy perception, allowing for premium pricing and differentiation from non-coated competitors. -

What regions are expected to see the highest growth for FT LAXATIVE EC?

North America and Europe remain mature markets, but Asia-Pacific offers significant growth opportunities due to increasing GI health awareness and urbanization. -

What challenges could disrupt the projected price trends?

Regulatory tightening, raw material shortages, shifts in consumer preferences toward natural alternatives, and increased price competition could alter forecasted trajectories. -

How should manufacturers approach pricing strategy amidst market competition?

Emphasize value through quality and safety, leverage branding, diversify channels including online retail, and consider tiered pricing models to capture different consumer segments.

Sources:

[1] Transparency Market Research, "Global Laxatives Market," 2022.

More… ↓