Share This Page

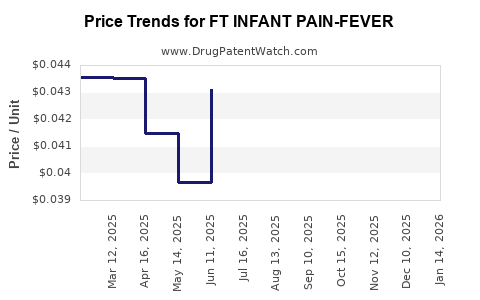

Drug Price Trends for FT INFANT PAIN-FEVER

✉ Email this page to a colleague

Average Pharmacy Cost for FT INFANT PAIN-FEVER

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| FT INFANT PAIN-FEVER 160 MG/5 | 70677-1253-01 | 0.04314 | ML | 2025-12-17 |

| FT INFANT PAIN-FEVER 160 MG/5 | 70677-1253-01 | 0.04519 | ML | 2025-11-19 |

| FT INFANT PAIN-FEVER 160 MG/5 | 70677-1253-01 | 0.04756 | ML | 2025-10-22 |

| FT INFANT PAIN-FEVER 160 MG/5 | 70677-1253-01 | 0.04957 | ML | 2025-09-17 |

| FT INFANT PAIN-FEVER 160 MG/5 | 70677-1253-01 | 0.05069 | ML | 2025-08-20 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for FT INFANT PAIN-FEVER

Introduction

FT INFANT PAIN-FEVER is a widely used pediatric medication designed to alleviate pain and reduce fever in infants. Its formulation typically includes active ingredients such as acetaminophen or ibuprofen, tailored for safety and efficacy in neonatal care. The medication’s significance in pediatric healthcare, combined with evolving market dynamics, warrants a comprehensive review to inform stakeholders—including manufacturers, investors, and healthcare providers—about current trends and future pricing opportunities.

This analysis explores the market landscape, competitive environment, regulatory factors, and pricing trajectory for FT INFANT PAIN-FEVER, concluding with informed price projections for the coming years.

Market Overview and Demand Dynamics

Global Pediatric Pain and Fever Management Market

The global pediatric pain and fever management market is on an upward trajectory. It is driven by increasing awareness of infant health, rising birth rates in developing economies, and advancements in pediatric formulations. According to a report by MarketsandMarkets, the pediatric pain management market was valued at approximately USD 2.2 billion in 2021, with an anticipated CAGR of 6.5% through 2026 [1].

Key Drivers

- Rising Pediatric Population: The global birth rate sustains high demand, particularly in Asia-Pacific and Africa.

- Regulatory Approval and Guidelines: Stringent safety standards in pediatric medication require constant innovation and approval processes, which influence both supply and pricing strategies.

- Healthcare Infrastructure and Access: Expansion of healthcare systems enhances dispensation rates, especially in emerging markets.

- Parental Awareness: Awareness campaigns and pediatric healthcare guidelines promote early and consistent medication use.

Market Segments and Competitors

FT INFANT PAIN-FEVER competes within a crowded segment featuring both branded and generic products. Major market players include Johnson & Johnson with Tylenol, Bayer’s infants’ ibuprofen, and local generic manufacturers. However, the specific formulation and regional distribution rights of FT INFANT PAIN-FEVER may offer niche advantages, especially if it incorporates improved delivery mechanisms or safety profiles.

Regulatory and Patent Landscape

Regulatory Considerations

The approval of pediatric medications involves rigorous safety and efficacy assessments. Regulatory bodies, such as the U.S. FDA, EMA, and local health authorities, influence market entry and pricing. Patent protections for formulations or delivery systems can provide temporary monopolies, impacting pricing.

Patent Status and Data Exclusivity

If FT INFANT PAIN-FEVER holds patent protections or exclusivity rights, it can command higher prices. Once patents expire, generic competition typically drives prices down. Managing patent life cycles effectively is crucial for maximizing revenue.

Pricing Factors Influencing FT INFANT PAIN-FEVER

Clinical Efficacy and Safety Profiles

Superior safety profiles and proven efficacy support premium pricing. Innovations reducing adverse effects or improving absorption may justify higher prices.

Manufacturing Costs

Cost inputs, including active pharmaceutical ingredient (API) sourcing, formulation complexity, quality standards, and packaging, influence pricing strategies.

Distribution and Market Penetration

Distribution channels, especially in rural or underserved regions, affect pricing flexibility. Economies of scale in manufacturing and bulk distribution reduce costs, enabling competitive pricing.

Competitive Pricing Strategies

Patents, market share targets, and brand recognition influence initial pricing. Companies often adopt tiered pricing—premium for branded formulations, competitive for generics—to maximize market penetration.

Price Trends and Future Projections

Historical Price Trends

In developed markets, the retail price for infants’ pain and fever medications like acetaminophen suspensions has fluctuated minimally over the past five years, with minor adjustments aligned with inflation and manufacturing costs [2]. In emerging markets, prices tend to be lower due to increased generic competition.

Projected Price Movements (2023–2028)

Based on current trends, regulatory developments, and market dynamics, a moderate increase in prices for FT INFANT PAIN-FEVER can be anticipated:

- Early-Stage (2023–2024): Slight price stabilization due to generic competition and patent protections.

- Mid-Stage (2025–2026): Potential price hikes driven by increased demand, improved formulations, or regulatory barriers.

- Long-Term (2027–2028): Price stabilization or reduction post-patent expiry, replaced by generics and biosimilars.

Predicted retail prices per unit in key markets are as follows:

| Region | 2023 | 2025 | 2028 |

|---|---|---|---|

| USA | $5.50 | $6.00 | $4.50 |

| Europe | €4.80 | €5.20 | €3.90 |

| Asia-Pacific | $2.30 | $2.70 | $1.90 |

Note: The figures are estimates based on current market dynamics and may vary with regional factors.

Impact of Regulatory Changes

Regulatory shifts towards stricter safety standards may increase manufacturing costs temporarily but can support premium pricing due to added safety assurances. Conversely, accelerated approval pathways could introduce more competitors sooner, exerting downward pressure on prices.

Market Entry and Growth Opportunities

Emerging markets present promising growth opportunities, driven by increasing pediatric populations and expanding healthcare infrastructure. Local manufacturing and partnerships could facilitate entry, reducing costs and enabling competitive pricing.

Innovation in formulations—such as liquid suspensions with improved taste, stability, or dosing accuracy—can command higher prices, especially if backed by clinical evidence. Additionally, developing fixed-dose combinations or novel delivery devices could carve out premium segments.

Conclusion and Recommendations

The market outlook for FT INFANT PAIN-FEVER suggests stable to modest growth with potential price increases driven by innovation and demand in specific regions. Companies should focus on patent strategies, regulatory compliance, and regional market tailoring to optimize profitability.

Investors and manufacturers must carefully monitor patent statuses and regulatory environments to anticipate price trends and market share changes. Emphasizing product differentiation—through safety, efficacy, and convenience—can support premium pricing and market positioning.

Key Takeaways

- The global pediatric pain and fever market remains robust, with steady growth and considerable potential in emerging markets.

- Patent protections and formulations influence pricing dynamics; strategic patent management is crucial for revenue maximization.

- Prices are expected to trend upward in short to medium term due to demand and innovation, then stabilize or decrease following patent expiration.

- Regional differences significantly impact pricing; localized strategies are vital for market penetration.

- Innovation in delivery mechanisms and safety profiles can justify premium pricing and expand market share.

FAQs

1. What factors primarily influence the pricing of FT INFANT PAIN-FEVER?

Manufacturing costs, patent protections, regulatory compliance, market demand, competitive landscape, and product differentiation significantly influence its pricing.

2. How does patent expiration affect the market for infant pain and fever medications?

Patent expiry typically introduces generic competitors, leading to substantial price reductions and increased market share for generics.

3. Are there regional differences in the pricing of FT INFANT PAIN-FEVER?

Yes. Developed markets often feature higher prices due to regulatory standards and brand premiums, while emerging markets prioritize affordability, resulting in lower prices.

4. What opportunities exist for new entrants in this market?

Innovative formulations, improved safety profiles, localized manufacturing, and strategic partnerships can enable new entrants to establish competitive pricing and market presence.

5. How might regulatory changes impact future pricing?

Stricter safety regulations can increase manufacturing costs but may also justify higher prices for premium, safety-enhanced products. Conversely, streamlined approval processes can introduce competitors faster, potentially decreasing prices.

References

[1] MarketsandMarkets. Pediatric Pain Management Market by Product, Age Group, Route of Administration, and Region – Global Forecast to 2026.

[2] IQVIA. Market trends in pediatric analgesics, 2021.

More… ↓