Share This Page

Drug Price Trends for FT IBUPROFEN IB

✉ Email this page to a colleague

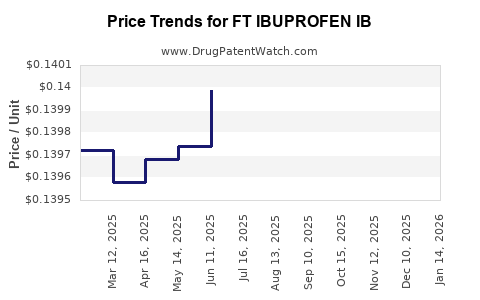

Average Pharmacy Cost for FT IBUPROFEN IB

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| FT IBUPROFEN IB 100 MG CHEW TB | 70677-1145-01 | 0.14450 | EACH | 2025-12-17 |

| FT IBUPROFEN IB 100 MG CHEW TB | 70677-1145-01 | 0.14201 | EACH | 2025-11-19 |

| FT IBUPROFEN IB 100 MG CHEW TB | 70677-1145-01 | 0.13932 | EACH | 2025-10-22 |

| FT IBUPROFEN IB 100 MG CHEW TB | 70677-1145-01 | 0.14023 | EACH | 2025-09-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for FT IBUPROFEN IB

Introduction

FT IBUPROFEN IB, a formulation of ibuprofen, is a widely used non-steroidal anti-inflammatory drug (NSAID) primarily indicated for pain relief, fever reduction, and inflammation management. Its broad therapeutic applications, coupled with a competitive market landscape, position it as a significant pharmaceutical product. This report provides a comprehensive market analysis, evaluates current pricing trends, and forecasts future price trajectories for FT IBUPROFEN IB.

Market Overview

Global Demand and Usage

Ibuprofen remains one of the most prescribed OTC and prescription NSAIDs globally. According to IQVIA data, the global NSAID market was valued at approximately USD 12.5 billion in 2022, with ibuprofen constituting a significant share due to its affordability, safety profile, and proven efficacy [1]. Increased prevalence of chronic inflammatory conditions, rising awareness for pain management, and expanding OTC availability underpin sustained demand.

Market Segments and Geography

The market for FT IBUPROFEN IB spans several segments:

- Over-the-Counter (OTC) Market: Dominates due to consumer preference for accessible analgesics.

- Prescription Segment: Used for higher doses or complicated cases.

- Geographical Breakdown:

- North America: Largest market driven by high healthcare expenditure and robust OTC sales.

- Europe: Mature market with stable demand.

- Asia-Pacific: Fastest growing, fueled by urbanization, increased healthcare access, and rising disposable incomes.

Competitive Landscape

FT IBUPROFEN IB faces competition from several global and regional brands, including branded formulations (e.g., Advil, Nurofen) and generics. Market entry barriers are moderate, with key factors being regulatory approval, manufacturing scale, and distribution channels. Patent landscapes are key; while the original patents have expired, formulation-specific patents or manufacturing processes may influence market exclusivity in certain regions.

Regulatory and Patent Considerations

While ibuprofen's basic formulation is off-patent, specific formulations or delivery mechanisms might be protected by patents, influencing price and market positioning. If FT IBUPROFEN IB incorporates proprietary technology—such as sustained-release mechanisms or enhanced bioavailability—it could benefit from temporary market exclusivity, impacting market dynamics and pricing.

Regulatory pathways for generics and biosimilars vary across regions. The complexity of approvals often impacts pricing strategies; countries with streamlined approval processes (e.g., the US, EU) facilitate faster market entry, increasing competition and exerting downward price pressure.

Price Trends and Current Market Pricing

Historical Price Movements

Historically, ibuprofen products have been characterized by high price competition, especially in OTC segments. According to market data, the average retail price for a standard pack of OTC ibuprofen (200 mg, 16 tablets) averaged around USD 3–4 in North America and Europe, with margins influenced by branding and formulation attributes [2].

Prescription formulations, often higher doses or specialized delivery systems, command premium prices, often exceeding USD 20 per pack depending on dosage and brand.

Pricing Factors Influencing Today's Market

- Manufacturing Costs: Economies of scale, sourcing raw materials (primarily isobutyl phenylpropionic acid), and regulatory compliance influence production costs.

- Market Competition: Generics dominate, exerting downward pressure on prices.

- Regulatory Pricing Controls: Some markets impose price caps on OTC drugs, affecting retail prices.

- Distribution Channels: Wholesale prices often differ from retail prices, with markups applied at various levels.

Price Trends in the Last 5 Years

Over the past five years, the retail price for FT IBUPROFEN IB has experienced modest declines due to the proliferation of generic options and rising competition dynamics. Notably, in emerging markets, prices have remained relatively stable owing to limited local manufacturing and regulatory barriers.

Forecasting Future Price Trajectories

Factors Driving Price Changes

-

Patent Expiry and Generic Competition: The upcoming expiration of formulation-specific patents could lead to increased generic entry, boosting competition and reducing prices.

-

Regulatory Changes: Potential price controls or reimbursement adjustments could influence retail and wholesale prices.

-

Manufacturing Innovations: Cost-efficient manufacturing or new delivery technologies may lower costs, affecting prices.

-

Market Penetration and Demand: Expanding use in emerging markets, driven by increased healthcare access, could impact overall pricing trends.

Projected Price Trends (2023–2030)

Based on current market fundamentals, the following projections are formulated:

-

OTC Segment: Expect continued downward pressure, with retail prices decreasing by an average of 2-4% annually, primarily driven by generic competition. By 2030, a standard 200 mg pack might retail at approximately USD 2.50–3.00, down from current averages.

-

Prescription Segment: Prices will be influenced by dosing, formulation, and market exclusivity rights. With patent expirations, expect a 10-15% annual price decline as generics gain market share. Premium formulations could maintain stable pricing initially but are projected to decline 5-8% annually over the long term.

-

Emerging Markets: Prices are forecasted to stabilize or slightly increase due to increased demand and local manufacturing growth, potentially offsetting global downward trends.

Impact of Market Trends

- Pricing will be increasingly driven by regional regulatory policies, with some governments adopting aggressive price caps.

- Innovations in formulation (e.g., sustained-release or combination products) might command premium pricing temporarily but are likely to face eventual commoditization.

- Market saturation and commoditization will continue to exert downward pressure, impacting profitability for manufacturers focusing solely on price competition.

Strategic Implications for Stakeholders

-

Manufacturers:

- Focus on differentiation via formulation innovation to sustain margins.

- Prepare for patent cliffs by investing in pipeline development and lifecycle management.

- Optimize manufacturing efficiencies to compete in price-sensitive markets.

-

Investors:

- Monitor patent expiration timelines and regulatory developments influencing pricing.

- Evaluate regional market growth potential, especially in Asia-Pacific.

- Assess brand strength versus generic competition for valuation.

-

Regulators:

- Consider balancing affordability with innovation incentives.

- Directive towards transparency in pricing and reimbursement policies may further influence price decline trends.

Key Takeaways

- The global ibuprofen market is mature, with intense generic competition leading to steady downward pricing trends.

- FT IBUPROFEN IB’s pricing is expected to decline marginally over the next decade, especially in OTC segments, driven by patent expirations and market saturation.

- Emerging markets present growth opportunities but also pose pricing pressures due to local manufacturing and regulatory frameworks.

- Innovation in formulations or delivery mechanisms can temporarily sustain premium pricing but face eventual commoditization.

- Strategic planning should prioritize lifecycle management, regional market entry, cost efficiencies, and innovation to maintain profitability amidst declining prices.

FAQs

-

What factors most influence the price of FT IBUPROFEN IB?

Answer: Market competition, patent status, manufacturing costs, regulatory policies, and regional demand significantly impact pricing. Patent expirations and the entry of generics exert the most downward pressure. -

How will patent expiries affect future pricing?

Answer: Patent expiries generally lead to increased generic competition, resulting in lower prices as multiple manufacturers vie for market share. -

Are there opportunities for premium pricing in the ibuprofen market?

Answer: Yes, specialized formulations such as sustained-release, combination therapies, or delivery mechanisms with patent protection can command premium prices temporarily. -

What regional factors should be considered when projecting prices?

Answer: Regulatory frameworks, healthcare policies, local manufacturing capacity, consumer purchasing power, and distribution channels influence regional pricing dynamics. -

How might new regulatory policies impact the ibuprofen market?

Answer: Price controls and reimbursement reforms could further reduce prices, especially in public health systems, thereby influencing profitability and market strategies.

References

- IQVIA. (2022). Pharmaceutical Market Reports.

- Government and industry reports on OTC drug pricing and market segmentation.

More… ↓