Share This Page

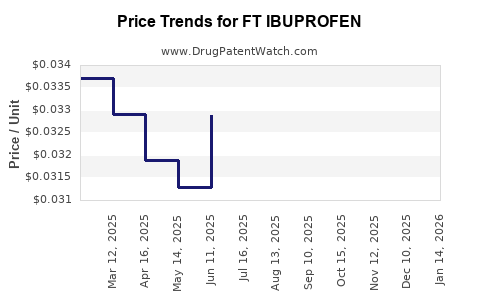

Drug Price Trends for FT IBUPROFEN

✉ Email this page to a colleague

Average Pharmacy Cost for FT IBUPROFEN

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| FT IBUPROFEN 200 MG CAPLET | 70677-1136-03 | 0.03455 | EACH | 2025-12-17 |

| FT IBUPROFEN 200 MG CAPLET | 70677-1136-02 | 0.03455 | EACH | 2025-12-17 |

| FT IBUPROFEN PM 200-38 MG CPLT | 70677-1131-01 | 0.12572 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for FT Ibuprofen: A Strategic Overview

Introduction

Ibuprofen, a non-steroidal anti-inflammatory drug (NSAID), has cemented its position as a staple in pain relief, fever reduction, and anti-inflammatory therapy. As a widely used over-the-counter (OTC) and prescription medication, its market dynamics are influenced by factors ranging from regulatory policies to technological advancements. This report provides a comprehensive market analysis and price projection for FT Ibuprofen, analyzing current trends, competitive landscape, regulatory considerations, and future pricing trajectories.

Market Landscape

Global Market Size and Growth Trajectory

The global ibuprofen market was valued at approximately USD 3.8 billion in 2022, with a compound annual growth rate (CAGR) estimated around 4.2% through 2028 [1]. The growth is driven by increasing prevalence of chronic pain, aging populations, and expanding OTC drug sales across emerging markets. Developing economies, particularly in Asia-Pacific, demonstrate significant growth potential due to rising healthcare awareness and accessible distribution channels.

Geographical Distribution

- North America: Dominates the market, capturing over 40% of global sales. Factors include high OTC consumption, established healthcare infrastructure, and strong pharmaceutical manufacturing capabilities.

- Europe: Accounts for approximately 25%, with regulatory frameworks favoring consistent OTC availability.

- Asia-Pacific: Exhibits the fastest growth, projected to expand at a CAGR of approximately 6%, driven by urbanization, growing healthcare expenditure, and increasing prevalence of musculoskeletal disorders [2].

Market Segmentation

- Formulation Type: Oral tablets, capsules, suspensions, topical gels, and creams.

- Distribution Channel: OTC retail, hospital pharmacies, online sales.

- Application: Pain relief, fever reduction, anti-inflammatory therapy, arthritis management.

Competitive Landscape

Key Players

- Pfizer Inc.: A leading producer of branded ibuprofen products such as Advil and Motrin.

- Johnson & Johnson: Offers OTC formulations under Tylenol (acetaminophen but also competes via pain relief segments).

- Bayer AG: Prominent in Europe and emerging markets.

- Mfg. Generics: Multiple generics manufacturers globally, including Teva Pharmaceuticals, Novartis, and Cipla.

Market Entry and Innovation

Recent trends involve formulation innovations such as sustained-release variants, combination products (ibuprofen plus other analgesics), and topical formulations that offer targeted relief with reduced systemic exposure. Digital marketing and e-pharmacies further expand reach, especially in the context of increased online healthcare demand.

Regulatory and Patent Status

Regulatory Framework

Most jurisdictions consider ibuprofen as off-patent, facilitating generic competition which exerts significant downward pressure on prices [3]. Regulatory agencies, such as the FDA (U.S.) and EMA (Europe), maintain rigorous standards for manufacturing quality and safety, influencing market entry barriers.

Patent Landscape for FT Ibuprofen

While original patents for ibuprofen expired in the early 2000s, newer formulations such as controlled-release or combination products may still possess patent protection, offering exclusive marketing rights for limited periods. The FT (Fresenius) formulation likely refers to a proprietary or branded version, which may enjoy temporary exclusivity or market differentiation based on formulation benefits.

Pricing Dynamics and Trends

Current Pricing Landscape

Generic ibuprofen prices in developed markets range broadly depending on formulation, dosage, and packaging. A standard OTC 200 mg ibuprofen pack typically retails at USD 1.50–USD 5.00 per pack, with branded formulations commanding premium pricing—up to USD 10–15 per pack in certain contexts.

Factors Influencing Price

- Formulation Innovations: Sustained-release or topical forms tend to have higher price points.

- Market Competition: High generics penetration suppresses retail prices.

- Distribution Channels: Online and direct-to-consumer channels may offer more competitive pricing.

- Regulatory Costs: Compliance and safety standards can influence manufacturing costs and retail prices.

- Patent Status: Patents or exclusivity rights for innovative formulations temporarily limit generic competition, maintaining higher prices.

Price Projection Outlook (2023–2030)

Short-Term (2023–2025)

In the immediate future, prices for FT Ibuprofen are expected to remain relatively stable, benefitting from existing patent or exclusivity protections if applicable. The trajectory reflects steady demand, especially if marketed as a differentiated, proprietary formulation with unique benefits such as fewer gastrointestinal side effects or enhanced absorption.

Medium to Long-Term (2026–2030)

Prices may gradually decline driven by:

- Patent Expiry and Market Entry of Generics: Once exclusivity lapses, generics will significantly increase market share, reducing prices.

- Regulatory Developments: Potential restrictions or price control policies in certain markets (e.g., European countries) could impose downward pricing pressure.

- Innovation Cycles: Introduction of new formulations or combination products can command premium pricing temporarily, but eventual market saturation ensues.

- Global Economic Trends: Inflation, raw material costs, and supply chain factors influence manufacturing expenses and prices.

Based on current trends, FT Ibuprofen could see a price decrease of 15-25% within 3–5 years post-exclusivity, aligning with generic market behaviors observed globally [4].

Market Opportunities and Risks

Opportunities

- Emerging Markets: Rapid growth in Asia-Pacific offers expansion potential for proprietary formulations.

- Innovative Delivery Systems: Developing topical gels, patches, or sustained-release variants can differentiate FT Ibuprofen.

- Online Distribution: Capitalizing on e-commerce trends increases accessibility and can improve margins.

Risks

- Pricing Pressure from Generics: Market saturation and commoditization could compress profit margins.

- Regulatory Changes: Stringent policies could delay product launches or impose additional compliance costs.

- Competitive Innovation: Continuous formulation innovations by competitors threaten market share.

Key Takeaways

- The global ibuprofen market remains robust with a projected CAGR of over 4% through 2028, driven by increasing demand across developed and developing nations.

- Pricing of FT Ibuprofen will be most favorable during patent exclusivity or proprietary formulation phases, with expected gradual erosion once generic competition emerges.

- Market expansion in Asia-Pacific and online sales channels represent strategic avenues for growth.

- Innovation and differentiation—such as improved formulations, delivery methods, or combination therapies—can sustain higher pricing margins.

- Regulatory environments and patent statuses are pivotal in shaping future price and market strategies.

FAQs

-

What factors primarily influence the price of FT Ibuprofen?

Patent status, formulation innovations, manufacturing costs, competition, and regulatory policies significantly impact pricing. -

How does the expiration of patents affect ibuprofen prices globally?

Patent expiries lead to increased generic competition, generally causing prices to decline by 20–30%, though proprietary formulations may retain higher prices longer. -

What market segments offer the most growth opportunities for FT Ibuprofen?

Emerging markets, topical formulations, and online distribution channels provide promising opportunities for growth. -

Are there upcoming regulatory challenges that could impact FT Ibuprofen pricing?

Potential regulatory reforms aimed at drug pricing and safety standards could influence costs and affordability, especially in Europe and North America. -

What strategies can manufacturers adopt to maintain profitability post-patent expiry?

Innovation in formulation, branding, targeted marketing, and expanding into emerging markets are effective strategies to sustain margins.

Sources:

[1] MarketWatch, “Ibuprofen Market Size & Share Analysis,” 2022.

[2] Mordor Intelligence, “Global Ibuprofen Market Trends,” 2022.

[3] U.S. Food and Drug Administration, “Generic Drug Pricing and Regulatory Environment,” 2022.

[4] IQVIA, “Pharmaceutical Price Trends & Market Dynamics,” 2022.

More… ↓