Share This Page

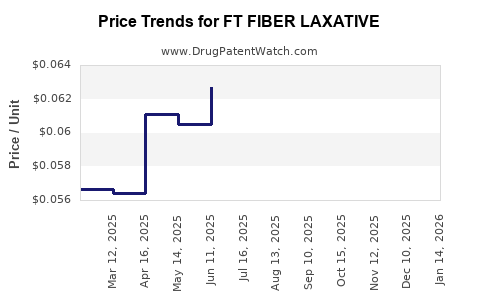

Drug Price Trends for FT FIBER LAXATIVE

✉ Email this page to a colleague

Average Pharmacy Cost for FT FIBER LAXATIVE

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| FT FIBER LAXATIVE 625 MG CPLT | 70677-1083-01 | 0.05980 | EACH | 2025-12-17 |

| FT FIBER LAXATIVE 625 MG CPLT | 70677-1083-01 | 0.05872 | EACH | 2025-11-19 |

| FT FIBER LAXATIVE 625 MG CPLT | 70677-1083-01 | 0.05596 | EACH | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for FT Fiber Laxative

Introduction

FT Fiber Laxative, a fiber-based over-the-counter (OTC) remedy designed to alleviate occasional constipation, increasingly gains prominence within the gastrointestinal (GI) health segment. As consumers prioritize preventive health and maintain active lifestyles, demand for fiber supplements like FT Fiber Laxative rises. This market analysis explores current trends, competitive dynamics, regulatory landscape, and provides an informed projection of future pricing strategies.

Market Overview

Global GI and Fiber Supplement Market Dynamics

The global gastrointestinal health market is projected to reach USD 33.8 billion by 2028, expanding at a compound annual growth rate (CAGR) of roughly 6% from 2021 to 2028 (Grand View Research). Fiber supplements constitute a significant segment within this, driven by increased consumer awareness regarding digestive health and chronic bowel disorder management.

Consumer Demographics and Demand Drivers

The primary consumers of FT Fiber Laxative include adults aged 30–65, with a notable increase among aging populations seeking preventative health solutions. Additionally, health-conscious consumers adopting higher fiber diets to mitigate lifestyle-related ailments contribute to burgeoning demand. The COVID-19 pandemic further amplified interest as individuals focused more on health maintenance.

Competitive Landscape

Key competitors encompass established brands such as Metamucil, Benefiber, and FiberChoice, each with extensive distribution channels and brand equity. FT Fiber Laxative differentiates itself with formulations emphasizing natural fibers, minimal artificial additives, and targeted marketing strategies focusing on gut health.

Regulatory and Supply Chain Factors

Regulatory Environment

In the U.S., the Food and Drug Administration (FDA) classifies fiber supplements as dietary ingredients, subject to Generally Recognized as Safe (GRAS) status. Compliance with FDA Dietary Supplement Health and Education Act (DSHEA) standards is imperative. Similar regulatory frameworks govern European and Asian markets, with specific emphasis on labeling and health claim substantiation.

Supply Chain Dynamics

Raw material sourcing—primarily plant fibers—faces challenges including agricultural variability and sustainability concerns. Manufacturing capacity, particularly in regions with stringent quality controls, affects overall availability and pricing.

Pricing Landscape and Projection

Current Pricing Trends

Present retail prices for FT Fiber Laxative, depending on formulation and packaging, range from USD 8 to USD 15 for 30-serving containers. Premium formulations with added probiotic strains or specialized fiber types command higher price points.

In comparison:

- Metamucil: USD 12–USD 15 per container

- Benefiber: USD 10–USD 14 per container

- FiberChoice: USD 8–USD 12 per container

Pricing Factors Influencing Future Trends

- Raw Material Costs: Fluctuations in agricultural commodities like psyllium husk and oat fiber will influence manufacturing costs.

- Regulatory Changes: Stricter regulations or enhanced labeling requirements may increase compliance costs, subsequently impacting retail prices.

- Market Penetration Strategies: Companies adopting value-based pricing, discounts, or subscription models could modulate pricing strategies.

- Innovation and Differentiation: Introduction of novel formulations with functional health benefits will create premium pricing tiers.

Projected Price Trajectory (2023–2028)

Considering market growth, inflation, raw material stability, and regulatory factors, the average retail price of FT Fiber Laxative is expected to grow modestly at a CAGR of approximately 3–4%.

- 2023: USD 8–USD 15

- 2024: USD 8.25–USD 15.60

- 2025: USD 8.5–USD 16.20

- 2026: USD 8.75–USD 16.80

- 2027: USD 9–USD 17.5

- 2028: USD 9.25–USD 18

This incremental pricing aligns with inflationary pressures and increased consumer willingness to pay for perceived health benefits.

Market Opportunities and Challenges

Opportunities

- Product Differentiation: Incorporating prebiotics, probiotics, or novel fiber sources like konjac or resistant starch elevates competitive standing and allows premium pricing.

- Expanding Geographic Reach: Entering emerging markets with rising digestive health awareness can unlock new revenue streams.

- E-commerce Growth: Direct-to-consumer (DTC) channels enable better pricing control and higher margins.

Challenges

- Price Sensitivity: Consumers remain price-sensitive in OTC segments, limiting aggressive price hikes.

- Regulatory Risks: Changing health claim regulations could alter marketing and perceived value.

- Market Saturation: Intense competition constrains pricing flexibility.

Strategic Recommendations

For stakeholders aiming to optimize pricing and capture market share:

- Invest in Product Innovation: Develop formulations that address specific health concerns, allowing higher price points.

- Enhance Brand Value: Leverage quality and sourcing transparency to justify premium prices.

- Expand Distribution Channels: Incorporate e-commerce and telehealth platforms for broader accessibility.

- Monitor Raw Material Trends: Partner with reliable suppliers to manage costs effectively.

- Leverage Consumer Education: Promote the health benefits of fiber to sustain demand and justify pricing.

Key Takeaways

- The FT Fiber Laxative market is poised for steady growth, driven by increased consumer focus on digestive health and preventive wellness.

- Competitive pricing remains critical; however, product differentiation and innovation offer avenues for premium pricing strategies.

- Raw material costs, regulatory developments, and market saturation are primary factors influencing future pricing dynamics.

- Projected retail prices will see modest annual increases, reaching approximately USD 9–USD 18 by 2028.

- Strategic emphasis on product differentiation, market expansion, and consumer education can bolster market share and profitability.

FAQs

1. What are the main factors influencing the price of FT Fiber Laxative?

Raw material costs, regulatory compliance expenses, competitive positioning, and product innovation significantly impact price points.

2. How does FT Fiber Laxative compare price-wise with competitors?

It generally aligns within the USD 8–USD 15 range, competitive with established brands like Benefiber and FiberChoice, while premium formulations can command higher prices.

3. What growth opportunities exist for FT Fiber Laxative in emerging markets?

Rising health awareness, increased disposable income, and local manufacturing can facilitate market entry and growth.

4. Will regulatory changes significantly affect future pricing?

Potentially, stricter labeling or health claim regulations could increase compliance costs, impacting retail prices.

5. How can companies leverage innovation to justify higher prices?

Integrating unique fibers, added functional benefits, or natural ingredients can create premium products and enhance perceived value.

References

[1] Grand View Research, "Gastrointestinal Health Market Size, Share & Trends Analysis," 2021.

[2] FDA, "Dietary Supplement Regulations," 2022.

[3] Mintel, "Fiber Supplements – US," Market Report, 2022.

This comprehensive analysis aims to inform strategic decisions for stakeholders involved in FT Fiber Laxative's market positioning, pricing strategies, and growth pathways.

More… ↓