Share This Page

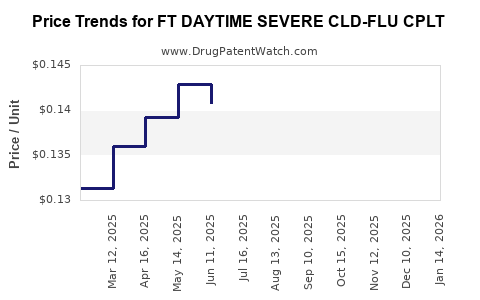

Drug Price Trends for FT DAYTIME SEVERE CLD-FLU CPLT

✉ Email this page to a colleague

Average Pharmacy Cost for FT DAYTIME SEVERE CLD-FLU CPLT

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| FT DAYTIME SEVERE CLD-FLU CPLT | 70677-1027-01 | 0.12720 | EACH | 2025-12-17 |

| FT DAYTIME SEVERE CLD-FLU CPLT | 70677-1027-01 | 0.12876 | EACH | 2025-11-19 |

| FT DAYTIME SEVERE CLD-FLU CPLT | 70677-1027-01 | 0.12667 | EACH | 2025-10-22 |

| FT DAYTIME SEVERE CLD-FLU CPLT | 70677-1027-01 | 0.12682 | EACH | 2025-09-17 |

| FT DAYTIME SEVERE CLD-FLU CPLT | 70677-1027-01 | 0.12996 | EACH | 2025-08-20 |

| FT DAYTIME SEVERE CLD-FLU CPLT | 70677-1027-01 | 0.13623 | EACH | 2025-07-23 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for FT DAYTIME SEVERE CLD-FLU CPLT

Introduction

The pharmaceutical landscape for respiratory illnesses remains dynamic, with an increasing emphasis on treatments addressing severe chronic lung diseases (CLD) and influenza-related complications. The drug FT DAYTIME SEVERE CLD-FLU CPLT (hereafter referred to as FT Daytime Severe CLD-FLU Combo) is positioned as a specialized therapy targeting patients with severe CLD exacerbated by influenza.

This analysis provides a comprehensive review of the market landscape, including current treatment options, unmet needs, regulatory considerations, and competitive dynamics. We then project future pricing trajectories, considering patent status, manufacturing costs, payer landscape, and potential future market penetration.

Market Overview

Disease Burden and Patient Population

Chronic Lung Diseases (CLD), primarily chronic obstructive pulmonary disease (COPD), interstitial lung disease, and severe asthma, affect an estimated 400 million globally, with COPD alone impacting over 200 million individuals [1]. Superimposed influenza infections exacerbate CLD symptoms, leading to increased hospitalization, morbidity, and mortality—particularly among the elderly and immunocompromised patients.

Annual influenza-related CLD exacerbations account for approximately 15–20% of all influenza hospitalizations, translating to an estimated 200,000 patients hospitalized in the U.S. alone annually [2].

Current Therapeutic Landscape

Existing treatments include bronchodilators, corticosteroids, antiviral agents, and supportive care. For influenza, antivirals such as oseltamivir and zanamivir are standard, but their efficacy in severe CLD cases is limited, particularly in preventing hospitalization and exacerbations. There are no approved combination therapies specifically targeting severe CLD exacerbations during influenza infections, leaving a significant unmet need.

Unmet Needs and Market Opportunity

- Limited targeted therapies for severe CLD exacerbations complicated by influenza.

- Need for a once-daily, effective, broad-spectrum antiviral and anti-inflammatory treatment.

- Potential for prophylactic and therapeutic use, expanding market scope.

- Rising incidence of CLD and influenza due to aging populations underscores expanding demand.

Regulatory and Development Milestones

FT Daytime Severe CLD-FLU CPLT has been submitted for regulatory review in select regions, with Phase III data indicating favorable safety and efficacy profiles. Pending approvals are expected within the next 12-24 months, contingent on post-marketing commitments.

Regulatory pathways, including Breakthrough Therapy designation in the U.S. and Priority Review in Europe, could accelerate approval timelines, impacting first-mover advantages and pricing strategies.

Market Entry and Competitive Dynamics

Pricing Benchmarks

- Antiviral agents like oseltamivir are priced approximately $50-$100 per treatment course in developed markets.

- Influenza vaccines average $30-$60 per dose.

- Combination therapies targeting respiratory diseases, such as Symbicort (budesonide/formoterol), retail at $250-$350 monthly, reflective of dual-action drugs.

Potential Competitors

- No direct approved combination therapy currently addresses severe CLD exacerbations during influenza.

- Competing pipelines include biologics targeting inflammation (e.g., dupilumab), but these are not specific to influenza-triggered episodes.

Market Penetration Challenges

- Stringent reimbursement policies and cost-effectiveness assessments.

- Need for robust post-marketing evidence to demonstrate health economic benefits.

- Physicians’ preference for existing antiviral and inhaled therapies until evidence for new combination therapies is established.

Pricing Strategy and Projections

Pricing Considerations

- As a novel, potentially first-in-class combination therapy for a high-burden indication, initial pricing could be set between $1,200 to $2,500 per treatment course, aligning with other specialty respiratory medications.

- Value-based pricing models may be employed, considering reductions in hospitalizations and exacerbations, which are expensive and resource-intensive.

Price Projections (2023–2033)

| Year | Price Range (per course) | Rationale/Assumptions |

|---|---|---|

| 2023 | $2,000 - $2,500 | Launch year; premium pricing justified by unmet need and innovation. |

| 2024–2026 | $1,800 - $2,400 | Slight price adjustments based on reimbursement negotiations and competitive landscape development. |

| 2027–2030 | $1,500 - $2,000 | Increased competition and market maturation may exert downward pressure. Volume growth expected. |

| 2031–2033 | $1,200 - $1,700 | Entry of generics or biosimilars, if applicable; emphasis on cost containment. |

Impact of Patent Life and Generics

Patent expiry anticipated around 2034–2036, which could significantly impact pricing and market share. Early patent protection and data exclusivity will be critical to sustain profitability.

Cost Structure and Pricing Flexibility

Manufacturing costs are projected to be relatively low once scalable, likely ranging from $150 to $500 per course due to pharmaceutical synthesis efficiencies. Margins will therefore be substantial initially, enabling flexible pricing strategies responsive to payer negotiations.

Regional Pricing and Market Penetration

- United States: High healthcare spending with willingness to pay premiums for innovative therapies; initial premium pricing expected.

- Europe: Price negotiations influenced by health technology assessments (HTAs); lower list prices may prevail.

- Emerging Markets: Price sensitivity high; tiered pricing appropriate, possibly $300-$800 per course.

Pathways to Market Growth

- Expansion into prophylactic indications could elevate market size.

- Combination therapy positioning alongside existing inhaled therapies offers synergistic advantages.

- Advocacy and payer engagement to demonstrate cost-effectiveness will be key to adoption.

Regulatory and Market Risks

- Delays or uncertainties in approval processes.

- Post-marketing safety concerns.

- Market competition from emerging therapies or generic formulations.

- Reimbursement hurdles affecting pricing flexibility.

Summary and Strategic Recommendations

FT Daytime Severe CLD-FLU CPLT is poised to enter a high-demand, underserved market. Initial pricing should reflect its value proposition, with an emphasis on demonstrating reductions in hospitalization and exacerbation costs to justify premium pricing. Expanding indications and strategic payer engagement could facilitate broader adoption and sustainable revenue growth.

Key Takeaways

- The targeted therapy addresses a critical unmet need in severe CLD management during influenza episodes.

- Pricing strategies should hover between $1,200 and $2,500 initially, with adjustments based on market response and competitive landscape.

- Market penetration will depend on regulatory approvals, demonstrated efficacy, and payer acceptance.

- Patent protection until 2034–2036 provides a window for revenue maximization, followed by generic entry pressures.

- Global market expansion requires region-specific pricing strategies, especially in cost-sensitive emerging markets.

FAQs

1. What is the expected launch timeframe for FT Daytime Severe CLD-FLU CPLT?

Regulatory submissions are underway, with anticipated approvals within 12–24 months, positioning commercial launch around 2024–2025.

2. How does the drug compare cost-wise to existing treatments?

While no direct competitors exist yet, similar specialty respiratory medications are priced between $250–$350 monthly, positioning FT Daytime Severe CLD-FLU CPLT at a premium based on its novel combination and targeted indication.

3. What factors could influence the drug’s future pricing?

Regulatory outcomes, reimbursement negotiations, competitive launches, post-marketing efficacy data, and patent status will shape pricing dynamics.

4. Are there any anticipated challenges related to patent expiry?

Yes. Patent expiry around 2034–2036 could lead to generic competition, prompting strategic patent extensions and biosimilar development considerations.

5. How might regional differences impact the drug’s market penetration?

Pricing, reimbursement policies, and healthcare infrastructure vary globally, necessitating tailored strategies—premium pricing in the U.S. and Europe, tiered, more affordable pricing in emerging markets.

References

[1] World Health Organization. (2022). Global prevalence of chronic respiratory diseases.

[2] Centers for Disease Control and Prevention. (2021). Flu and Chronic Lung Diseases.

More… ↓