Share This Page

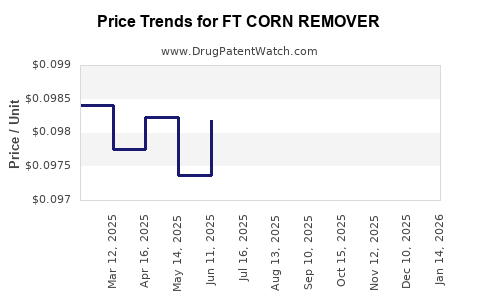

Drug Price Trends for FT CORN REMOVER

✉ Email this page to a colleague

Average Pharmacy Cost for FT CORN REMOVER

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| FT CORN REMOVER 40% DISC | 70677-1237-01 | 0.10231 | EACH | 2025-12-17 |

| FT CORN REMOVER 40% DISC | 70677-1237-01 | 0.09579 | EACH | 2025-11-19 |

| FT CORN REMOVER 40% DISC | 70677-1237-01 | 0.09422 | EACH | 2025-10-22 |

| FT CORN REMOVER 40% DISC | 70677-1237-01 | 0.09288 | EACH | 2025-09-17 |

| FT CORN REMOVER 40% DISC | 70677-1237-01 | 0.09705 | EACH | 2025-08-20 |

| FT CORN REMOVER 40% DISC | 70677-1237-01 | 0.09560 | EACH | 2025-07-23 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for FT Corn Remover

Introduction

FT Corn Remover is a topical dermatological product formulated to address corns, calluses, and keratotic skin lesions. As a specialized skin care medication, its market dynamics are influenced by dermatological treatment trends, consumer preferences, regulatory environment, and competitive landscape. This analysis evaluates current market conditions, growth prospects, pricing strategies, and future price projections.

Product Overview

FT Corn Remover contains active ingredients designed to soften keratinized skin, facilitating safe removal of corns and calluses. The product's appeals hinge on ease of use, efficacy, minimal side effects, and accessibility. With dermatological products increasingly driven by consumer demand for OTC solutions, FT Corn Remover occupies a niche within both pharmaceutical and cosmetic markets.

Market Landscape

Global Market Size and Segments

The global corn treatment market initiated steady growth in recent years, projected to reach approximately USD 3.2 billion by 2027, growing at a compound annual growth rate (CAGR) of around 4.8% [1]. Within this, topical corns and callus removers account for a significant share, driven by aging populations, rising footwear-related foot ailments, and increased awareness of foot health.

Regional Market Analysis

- North America: Dominant due to high healthcare awareness, OTC product adoption, and prevalence of foot-related conditions. The US foot health market alone is valued at over USD 400 million [2].

- Europe: Mature market with robust demand, especially in countries with aging demographics like Germany and the UK.

- Asia-Pacific: Fastest growth, fueled by urbanization, increasing disposable income, and expanding healthcare infrastructure.

Key Drivers

- Growing elderly population prone to callus and corn formation.

- Rising consumer preference for self-care and OTC dermatological treatments.

- Increased retail distribution channels, including pharmacies and online platforms.

- Advances in formulation improving ease of application and safety.

Competitive Landscape

FT Corn Remover competes in a crowded segment comprising both branded and generic products, including:

- Salicylic acid-based formulations

- Urea-based keratolytics

- Plant-derived remedies

Major players include Reckitt Benckiser, Scholl, and Dr. Scholl’s, with notable patent expirations leading to increased generic availability.

Pricing Analysis

Current Price Range

Over-the-counter (OTC) corn removers like FT Corn Remover are typically priced between USD 5-15 per unit, depending on formulation, brand positioning, and regional market factors [3]. Premium formulations with enhanced delivery systems command higher prices, while generics compete on affordability.

Pricing Strategies

- Premium Pricing: For products with innovative application methods or additional dermatological benefits.

- Penetration Pricing: To expand market share in emerging markets with lower income levels.

- Discounting and Promotions: Common in retail pharmacies and online sales channels to stimulate trial and repeat purchase.

Distribution Channels

- Pharmacies and drugstores: Primary sales point, often influence pricing via retailer margins.

- Online platforms: Growing importance, often offering competitive prices due to lower overheads.

- Supermarkets and convenience stores: Supplementary channels, usually at lower price points.

Future Price Projections

Factors Influencing Price Trends

- Patent Status: Pending patents or formulation innovations can sustain premium pricing.

- Regulatory Developments: Compliance costs influence final consumer prices; stricter regulations might inflate costs.

- Market Penetration: Increasing competition from generics may lead to downward price pressures.

- Manufacturing Costs: Raw material price fluctuations impact final pricing; for instance, key ingredients like salicylic acid are influenced by global supply chains.

Projection Scenarios

- Conservative Estimate: A gradual decrease of 2-3% annually over the next five years, driven by commoditization and increased competition.

- Optimistic Scenario: Stabilized or slightly increased prices (1-2%) in premium market segments due to innovation, with overall average prices remaining within USD 7-12.

- Emerging Markets: Lesser-developed regions could see prices declining more aggressively due to increased generic entry and price-sensitive consumers.

Overall, expect an average price stabilization with slight downward trends, settling around USD 6-10 for standard packs by 2028, influenced by competitive pressures and distribution efficiencies.

Regulatory and Patent Considerations

Patents related to FT Corn Remover formulations or delivery systems can sustain higher prices temporarily. Patent expirations over the next 3-5 years could open pathways for generics, exerting downward pressure on prices. Regulatory costs, including approvals, influence pricing strategies by manufacturers.

Market Opportunities and Risks

- Opportunities: Leveraging online advertising, expanding into emerging markets, introducing value-added formulations (e.g., faster-acting or combined treatments).

- Risks: Regulatory delays, patent challenges, price wars, and shifts towards natural or alternative remedies.

Conclusion

FT Corn Remover exists within a mature yet evolving dermatological segment showing resilient growth driven by demographic and behavioral factors. Its pricing strategy will likely balance maintaining premium positioning through innovation with the necessity to remain competitive amid increasing generic activity. Manufacturers and distributors should focus on differentiation, expansion into high-growth economies, and optimizing distribution channels to sustain profitability and market share.

Key Takeaways

- The global market for corn removal treatments is projected to reach USD 3.2 billion by 2027, with steady growth.

- Pricing varies between USD 5-15 per unit, influenced by formulation, distribution channel, and regional economic factors.

- Future price trends suggest slight declines driven by increased competition and patent expirations, with potential stabilization in premium segments.

- Strategic focus on innovation, expansion into emerging markets, and e-commerce channels can enhance profitability.

- Regulatory developments and patent statuses are critical factors shaping future pricing landscapes.

FAQs

1. How does the patent status of FT Corn Remover influence its pricing?

Patent protections enable manufacturers to set premium prices by preventing generic competition. Expiration or challenges to patents typically lead to price reductions as generics enter the market.

2. What are the main competitive advantages of FT Corn Remover?

Its key advantages include targeted keratolytic formulation, ease of application, and safety profile. Differentiation from competitors often hinges on formulation innovation and brand recognition.

3. Which geographic markets offer the most growth opportunities for FT Corn Remover?

Emerging markets in Asia-Pacific, Latin America, and parts of Africa present significant expansion opportunities due to rising disposable income and footwear-related foot conditions.

4. How might online retail impact the pricing of FT Corn Remover?

Online platforms enable competitive pricing, price comparison, and promotional discounts, potentially driving prices downward while increasing accessibility.

5. What factors could lead to the price increase of FT Corn Remover in the future?

Factors include formulation enhancements, regulatory mandates increasing manufacturing costs, supply chain disruptions, and brand positioning strategies targeting premium segments.

Sources:

[1] MarketResearch.com. "Global Corn Treatment Market," 2022.

[2] IBISWorld. "Foot Care Markets in the US," 2023.

[3] Statista. "Over-the-Counter Foot Care Product Prices," 2022.

More… ↓