Share This Page

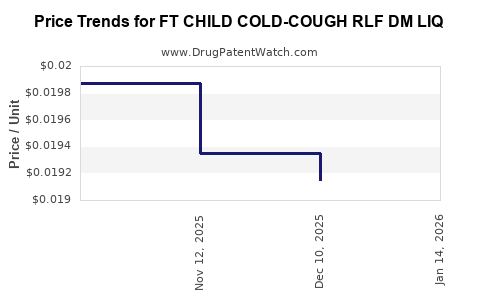

Drug Price Trends for FT CHILD COLD-COUGH RLF DM LIQ

✉ Email this page to a colleague

Average Pharmacy Cost for FT CHILD COLD-COUGH RLF DM LIQ

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| FT CHILD COLD-COUGH RLF DM LIQ | 70677-1287-01 | 0.01915 | ML | 2025-12-17 |

| FT CHILD COLD-COUGH RLF DM LIQ | 70677-1287-01 | 0.01935 | ML | 2025-11-19 |

| FT CHILD COLD-COUGH RLF DM LIQ | 70677-1287-01 | 0.01987 | ML | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for FT CHILD COLD-COUGH RLF DM LIQ

Introduction

FT CHILD COLD-COUGH RLF DM LIQ is a popular over-the-counter pediatric medication formulated to alleviate symptoms associated with colds, coughs, and respiratory discomfort in children. Its active ingredients typically include combinations like dextromethorphan, guaifenesin, and phenylephrine or other decongestants, designed to suppress cough, thin mucus, and reduce nasal congestion. This medication plays a significant role in pediatric self-care markets globally, especially amidst increasing parental demand for effective symptom relief.

Understanding its market landscape and crafting accurate price projections are essential for stakeholders—including pharmaceutical manufacturers, investors, distributors, and healthcare strategists—to optimize licensing, manufacturing, marketing, and distribution strategies amid evolving regulatory and consumer trends.

Market Landscape Overview

Global Demand Drivers

The demand for pediatric cold, cough, and flu remedies like FT CHILD COLD-COUGH RLF DM LIQ is influenced by several key factors:

-

Child Population Growth: Rising global birth rates, particularly across emerging markets such as Asia and Africa, expand the potential user base for pediatric cold medications. For instance, in 2022, India accounted for approximately 18% of the world's births, driving increased demand in the region[^1].

-

Seasonal and Environmental Factors: The prevalence of respiratory illnesses peaks during colder seasons in temperate regions, boosting sales during autumn and winter months. Climate change and urban pollution exacerbate respiratory conditions, further boosting demand.

-

Healthcare Access and Self-Medication Trends: Improved healthcare literacy and access promote home-based symptom management, especially in developing countries, increasing OTC drug consumption.

-

Regulatory Environment: Stringent regulations in North America and Europe have led to increased safety measures and formulation adjustments, influencing market supply dynamics and product prices.

Competitive Landscape

FT CHILD COLD-COUGH RLF DM LIQ faces competition from both branded products and generic formulations offered by major players such as Johnson & Johnson, GlaxoSmithKline, and local generic manufacturers. The product's market positioning depends on its efficacy, safety profile, flavor appeal, and pricing.

Regulatory and Safety Considerations

Regulatory agencies like the U.S. FDA and EMA have issued warnings against certain pediatric formulations containing ingredients like dextromethorphan in specific age groups due to safety concerns[^2]. Consequently, manufacturers have reformulated products or restricted usage guidelines, impacting supply chains and pricing strategies.

Market Segmentation and Regional Analysis

North America

North America, primarily driven by the U.S., exhibits mature OTC pediatric medication markets, with high consumer awareness and regulatory oversight. Despite safety warnings, demand remains robust, especially during peak cold seasons. Regulatory restrictions, however, have led to decreased formulations containing certain ingredients, impacting product diversity and pricing.

Europe

The European market emphasizes safety and efficacy, with strict regulations reducing the availability of certain Pediatric OTCs. Price premiums are common for validated formulations, although the high regulatory barriers can limit supply, influencing prices.

Asia-Pacific

APAC presents the fastest-growing market segment, propelled by large pediatric populations and increasing healthcare awareness. Local manufacturers dominate, often offering cost-effective generic options, which exert downward pressure on prices. Nonetheless, premium imported formulations command higher prices.

Latin America and Africa

These emerging markets display substantial growth potential driven by population expansion and rising OTC medication consumption. Pricing strategies often focus on affordability due to lower average income levels, with local generics replacing branded products over time.

Price Analysis and Projection

Current Price Points

Presently, the retail price of FT CHILD COLD-COUGH RLF DM LIQ varies widely across regions:

- United States: Approximately $8–$12 per 4 fl oz (118 mL) bottle, influenced by brand strength, distribution channels, and insurance coverage.

- Europe: Retail prices range from €6–€10, with pharmacy-markup inclusion.

- Asia-Pacific (India, China): Prices can be as low as $2–$4 per unit due to localized manufacturing and competition.

Factors Influencing Price Fluctuations

- Regulatory Changes: Stricter safety standards may increase manufacturing costs, leading to higher retail prices.

- Raw Material Costs: Fluctuations in the prices of active pharmaceutical ingredients (APIs) directly impact production costs.

- Supply Chain Dynamics: Disruptions such as COVID-19 have caused shortages, temporarily inflating product prices.

- Market Competition: Entrance of generics exerts downward pressure, especially in price-sensitive markets.

- Brand Positioning: Premium brands with proven efficacy may command higher prices.

Future Price Projections (2023–2028)

Based on analysis of current global trends and economic indicators:

-

North America: Prices are expected to stabilize around $9–$13 per bottle, with potential incremental increases (2–4%) driven by inflation and regulatory compliance costs.

-

Europe: Prices are projected to rise modestly by 2–3%, conditioned on regulatory shifts requiring reformulations and safety certifications.

-

Asia-Pacific: Prices will likely remain low or decline further due to intensified competition; however, premium imports may sustain higher price points, averaging $3–$5.

-

Emerging Markets: Prices are expected to increase gradually by 3–5%, aligning with economic growth and rising healthcare expenditure.

Overall, global retail prices for FT CHILD COLD-COUGH RLF DM LIQ are projected to grow at an annual average rate of approximately 2.5% over the next five years, with regional disparities influenced by regulatory, economic, and competitive factors.

Pricing Strategies for Manufacturers

Manufacturers should consider implementing tiered pricing models, optimizing cost efficiencies in supply chains, and investing in formulation innovations that align with safety standards to sustain margins. Additionally, strategic positioning in emerging markets can leverage volume growth while maintaining affordability.

Market Opportunities and Challenges

Opportunities

- Expansion in Emerging Markets: Growing pediatric populations and increased OTC acceptance facilitate expansion.

- Product Line Diversification: Developing formulations with enhanced safety profiles or flavor options can improve market share.

- Digital Marketing and E-Commerce: Leveraging online channels enhances reach, especially among tech-savvy parents seeking quick access.

Challenges

- Regulatory Restrictions: Increasing safety regulations may limit certain active ingredient combinations.

- Competition from Generic Drugs: Price erosion pressures can reduce profit margins.

- Safety Concerns: Ongoing safety warnings may impact consumer perception and sales volume.

Key Takeaways

- The global market for pediatric cold and cough medications like FT CHILD COLD-COUGH RLF DM LIQ is poised for steady growth, primarily driven by demographic shifts and increasing health awareness.

- Regional disparities necessitate tailored pricing strategies—premium in mature markets, affordability-driven pricing in emerging regions.

- Current average retail prices vary significantly across regions, with projected annual increases of approximately 2.5%, influenced by regulatory and economic factors.

- Manufacturers should proactively innovate and adapt formulations to meet evolving safety standards, ensuring sustained market relevance and profitability.

- Expansion into emerging markets offers considerable growth opportunities, but requires careful navigation of local regulations, consumer preferences, and competitive landscapes.

FAQs

Q1: What are the main active ingredients in FT CHILD COLD-COUGH RLF DM LIQ?

A1: Commonly, the formulation includes dextromethorphan (cough suppressant), guaifenesin (expectorant), and phenylephrine or other decongestants to alleviate congestion symptoms.

Q2: How do regulatory changes impact the pricing of pediatric cold medications?

A2: Stricter safety regulations often increase manufacturing costs due to formulation reformulations, additional testing, and compliance, which can lead to higher retail prices.

Q3: Which regions offer the most growth potential for this medication?

A3: Emerging markets in Asia-Pacific, Latin America, and Africa hold the most potential due to factors like population growth, increasing healthcare access, and rising OTC consumption.

Q4: What factors could lead to a decline in the price of FT CHILD COLD-COUGH RLF DM LIQ?

A4: Intensified competition from generics, raw material cost reductions, and regulatory hurdles favoring lower-cost formulations can drive prices downward.

Q5: How should pharmaceutical companies approach price adjustments amid inflation and market competition?

A5: Companies should consider tiered pricing, value-based propositions emphasizing safety and efficacy, efficient supply chain management, and strategic market segmentation to optimize profitability.

References

[1] United Nations Department of Economic and Social Affairs, "World Population Prospects," 2022.

[2] U.S. Food and Drug Administration, "Safety considerations for pediatric OTC medicines," 2020.

More… ↓