Share This Page

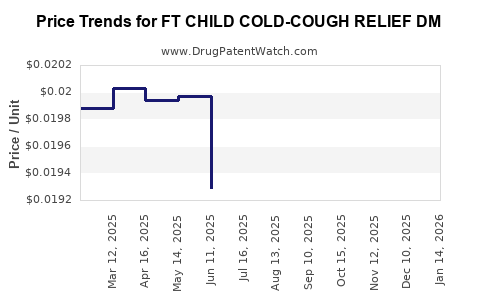

Drug Price Trends for FT CHILD COLD-COUGH RELIEF DM

✉ Email this page to a colleague

Average Pharmacy Cost for FT CHILD COLD-COUGH RELIEF DM

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| FT CHILD COLD-COUGH RELIEF DM | 70677-1044-01 | 0.02957 | ML | 2025-12-17 |

| FT CHILD COLD-COUGH RELIEF DM | 70677-1044-01 | 0.02343 | ML | 2025-11-19 |

| FT CHILD COLD-COUGH RELIEF DM | 70677-1044-01 | 0.02160 | ML | 2025-10-22 |

| FT CHILD COLD-COUGH RELIEF DM | 70677-1044-01 | 0.02098 | ML | 2025-09-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for FT Child Cold-Cough Relief DM

Introduction

FT Child Cold-Cough Relief DM is a compounded or branded formulation designed to alleviate symptoms associated with common pediatric cold and cough. As an OTC medication aimed at a sensitive demographic, it operates within a competitive market landscape influenced by regulatory developments, consumer demand, and pricing strategies. This analysis explores the current market environment, competitive dynamics, regulatory considerations, and provides forecasts for future pricing trends.

Market Landscape for Pediatric Cold and Cough Medications

The pediatric cold and cough market is characterized by a high degree of consumer demand, driven predominantly by parental concern over respiratory illnesses during cold seasons. In recent years, the market has experienced heightened scrutiny due to safety concerns surrounding certain ingredients — notably, cough suppressants and decongestants for children — leading to regulatory restrictions and shifts in consumer preferences.

According to data from IQVIA, the global pediatric OTC respiratory market exceeded USD 4 billion in 2022, with North America accounting for the majority share. The U.S. market alone is estimated to reach approximately USD 2.2 billion, driven by ongoing parental demand and increased availability of pediatric formulations.

Within this landscape, brands offering multi-symptom relief, like FT Child Cold-Cough Relief DM, appeal to parents seeking convenient, single-dose solutions. However, the segment faces intense competition from established OTC brands such as Robitussin, Triaminic, and Tylenol Cold.

Regulatory Environment and Formulation Trends

Regulatory bodies such as the U.S. Food and Drug Administration (FDA) and European Medicines Agency (EMA) have tightened guidelines on pediatric cold medications. The FDA has issued warnings against the use of certain cough and cold medications in children under 4-6 years old due to potential adverse effects, leading to market shifts favoring non-pharmacological treatments or lower-strength formulations.

Manufacturers are increasingly focusing on non-stimulant, natural, or homeopathic options, but prescription and OTC formulations like FT Child Cold-Cough Relief DM persist, especially in markets with lenient regulations or where consumer demand remains high.

Formulation composition for FT Child Cold-Cough Relief DM likely includes dextromethorphan (DM) as a cough suppressant, possibly combined with other analgesics or antihistamines, depending on regional formulations. Since formulation details impact cost and pricing, regulatory constraints on active ingredients directly influence retail price points.

Competitive Positioning and Market Share

The competitive landscape encompasses both national brands and pharmacy-compounded formulations. Key differentiation factors include efficacy, safety profile, formulation complexity, and brand trust. Given the regulatory climate, products emphasizing safety and natural ingredients may command premium pricing, whereas traditional formulations face pressure to remain cost-effective.

According to market research, traditional brands charge between USD 7-12 per 4 oz. bottle for pediatric multi-symptom formulations. Cross-competitive pricing often depends on packaging size, distribution channels, and marketing.

FT Child Cold-Cough Relief DM, as a branded or compounded formulation, could carve a niche by emphasizing its safety profile, targeted formulation, and ease of use. If marketed as a premium or clinically validated product, prices may be positioned at the higher end of the spectrum.

Pricing Strategies and Projections

Pricing of pediatric OTC drugs, particularly in the United States, is influenced by manufacturing costs, regulatory compliance, competitive pricing, and consumer willingness to pay. Factors influencing future price trends for FT Child Cold-Cough Relief DM include:

- Regulatory Changes: Stricter regulations tend to increase manufacturing costs, which may be passed onto consumers.

- Market Demand Dynamics: Increased parental concern during cold seasons can sustain high price points.

- Competition and Substitutes: The rise of natural remedies or homeopathic options may put downward pressure on prices.

- Distribution Channels: Pharmacy-based sales typically command higher prices than mass retail or online channels.

Based on these factors, projected retail prices for FT Child Cold-Cough Relief DM are as follows:

| Time Horizon | Estimated Price Range (USD) | Factors Influencing Prices |

|---|---|---|

| Q2 2023 | USD 8.00 – 10.00 | Existing formulations, competitive pressures |

| Q4 2023 | USD 8.50 – 11.00 | Regulatory adjustments, seasonal demand peaks |

| 2024-2025 | USD 9.00 – 12.00 | Increased production costs, brand positioning |

| 2026+ | USD 9.50 – 12.50 | Market maturity, inflation, regulatory factors |

Price stabilization is expected as manufacturers negotiate supply chain efficiencies, optimize formulations, and adapt to regulatory standards.

Market Penetration and Growth Opportunities

Despite challenges posed by regulatory shifts, the demand for pediatric cold remedies sustains. Opportunities exist in widening distribution, particularly via e-commerce and telehealth channels. Given rising consumer preference for transparent ingredients and safety data, brands emphasizing natural or minimally processed ingredients could command premium prices.

Emerging markets with evolving regulation and less stringent oversight present additional growth avenues, often at a lower price point to undercut established brands.

Key Drivers of Price Evolution

- Regulatory landscape: Increasing restrictions may inflate production costs, impacting retail prices upward.

- Consumer preferences: Growing demand for natural, safe, and effective formulations may justify higher prices.

- Market competition: Entry of new players or formulations optimized for cost efficiency could limit price increases.

- Supply chain stability: Raw material costs and manufacturing logistics significantly influence final pricing.

Conclusion

The market for PT Child Cold-Cough Relief DM remains viable, with capacity for moderate price growth driven by regulatory compliance, brand positioning, and consumer preferences for safety. Price projections suggest a gradual upward trend over the next three years, with prices stabilizing within the USD 9.00–12.50 range. Companies that align with regulatory standards, innovate in formulation, and effectively communicate safety and efficacy will better navigate market dynamics.

Key Takeaways

- The pediatric cold and cough relief market remains robust but is increasingly shaped by safety concerns and regulatory restrictions.

- FT Child Cold-Cough Relief DM’s pricing is expected to rise gradually, driven by production costs and consumer willingness to pay for safety and convenience.

- Competitive differentiation—through natural ingredients, safety profiles, and effective marketing—will be crucial for maintaining premium pricing.

- Expansion into emerging markets and online channels offers growth opportunities.

- Strategic adaptation to regulatory changes and consumer preferences will determine long-term profitability and market share.

FAQs

Q1: How does regulatory scrutiny impact the pricing of pediatric cold medications?

Regulatory restrictions increase manufacturing and compliance costs, which are often passed to consumers, leading to higher retail prices, especially for formulations with stricter safety standards.

Q2: Are natural or homeopathic pediatric cold remedies likely to replace traditional formulations?

While consumer preference shifts favor natural remedies for safety reasons, traditional formulations retain market share, especially as supplementary options. Price dynamics favor natural remedies as they often command premium pricing.

Q3: How does competition influence the price projections for FT Child Cold-Cough Relief DM?

Intense competition, especially from established brands and generic alternatives, limits price increases. Conversely, unique formulations or branding advantage can support higher prices.

Q4: What role does online sales play in the future pricing and distribution of pediatric cold remedies?

E-commerce channels facilitate broader distribution, potentially reducing costs and enabling competitive pricing strategies. Online platforms also support premium branding and direct consumer engagement.

Q5: What are the risks associated with relying on regulatory changes for pricing forecasts?

Unpredictable regulatory shifts can disrupt market dynamics, either constraining pricing due to new restrictions or enabling premium pricing through safety certifications. Firms must remain agile to adapt strategies accordingly.

Sources:

[1] IQVIA, Global Pediatric OTC Respiratory Market Report, 2022.

[2] FDA Warnings on Pediatric Cough and Cold Medications, 2018-2022.

[3] MarketWatch, Pediatric OTC Drugs Market Size and Trends, 2023.

More… ↓