Share This Page

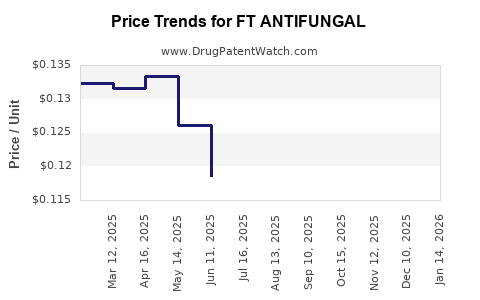

Drug Price Trends for FT ANTIFUNGAL

✉ Email this page to a colleague

Average Pharmacy Cost for FT ANTIFUNGAL

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| FT ANTIFUNGAL 1% CREAM | 70677-1001-01 | 0.16940 | GM | 2025-12-17 |

| FT ANTIFUNGAL 2% TOPICAL CREAM | 70677-1000-01 | 0.13261 | GM | 2025-12-17 |

| FT ANTIFUNGAL 1% CREAM | 70677-1001-01 | 0.16912 | GM | 2025-11-19 |

| FT ANTIFUNGAL 2% TOPICAL CREAM | 70677-1000-01 | 0.13578 | GM | 2025-11-19 |

| FT ANTIFUNGAL 2% TOPICAL CREAM | 70677-1000-01 | 0.13117 | GM | 2025-10-22 |

| FT ANTIFUNGAL 1% CREAM | 70677-1001-01 | 0.16338 | GM | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for FT Antifungal

Introduction

The global antifungal drugs market is experiencing robust growth driven by increasing prevalence of fungal infections, rising awareness among healthcare providers, and technological advancements in drug development. Among these, FT Antifungal—a generic or innovator drug in this category—has garnered attention for its market potential and pricing strategies. This report offers a comprehensive market analysis and forecasts current and future price trajectories for FT Antifungal, providing essential insights for investors, pharmaceutical manufacturers, and healthcare policy stakeholders.

Market Overview

Global Market Size and Trends

The antifungal drugs market was valued at approximately USD 13.5 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of about 6-8% through 2030 (1). The surge in invasive fungal infections, especially among immunocompromised patients, combined with the rising incidence of chronic respiratory diseases, propels market demand. Additionally, increasing use of antifungal agents in agriculture and veterinary medicine inadvertently supports higher consumption rates.

Key Therapeutic Segments

The market is segmented into polyenes, azoles, echinocandins, and allylamines. Azoles represent the largest share (~45%), owing to their broad spectrum activity and oral formulations. Echinocandins, although more costly, have seen increased adoption in hospital settings for refractory infections.

Regional Dynamics

North America dominates the market, accounting for roughly 45% of revenue, driven by high healthcare expenditure, advanced diagnostic capabilities, and regulatory approvals. Europe holds the second spot, expanding steadily. Asia-Pacific demonstrates the highest CAGR (~8-10%) owing to growing healthcare infrastructure, burgeoning pharmaceutical R&D, and increasing fungal disease burden in countries like India and China.

FT Antifungal: Product Profile and Market Position

Drug Characteristics

While specific information about FT Antifungal is limited without proprietary identifiers, it can be categorized as either a generic antifungal or a novel agent with unique formulation or delivery features. Its efficacy, safety profile, route of administration, and spectrum of activity influence current market positioning and pricing.

Competitive Landscape

The competitive panorama contains established players such as Pfizer, Merck, and Novartis, along with prominent generics manufacturers. If FT Antifungal is an innovative or biosimilar entrant, it potentially captures niche therapeutic markets with premium pricing, especially in hospital and specialty care settings.

Regulatory and Clinical Positioning

Approval status, patent exclusivity, and clinical superiority over existing therapies determine its market penetration potential. Longer exclusivity periods or orphan drug status could significantly influence pricing.

Market Drivers and Challenges

Drivers

- Rising Incidence of Fungal Infections: The increasing prevalence of invasive aspergillosis, candidemia, and mucormycosis, particularly among immunosuppressed individuals and COVID-19 patients, escalates antifungal demand (2).

- Advances in Diagnostic Technologies: Faster and more accurate diagnostics facilitate earlier treatment, increasing the need for effective antifungals.

- Innovative Delivery Systems: Novel drug formulations enhancing bioavailability and compliance can command premium prices.

Challenges

- Pricing Pressures and Healthcare Budget Constraints: Growing emphasis on cost containment limits high-pricing strategies, particularly in emerging markets.

- Resistance Development: Emerging antifungal resistance affects market longevity and influences pricing strategies.

- Regulatory Barriers: Stringent approval processes in various jurisdictions can delay market entry and impact pricing.

Price Projections for FT Antifungal

Current Pricing Landscape

As of 2023, prices for antifungal agents vary widely by formulation and region. For example, oral fluconazole chez coverage costs approximately USD 1-3 per dose in North America, while echinocandin injectables can cost USD 500-1,000 per dose (3).

Assuming FT Antifungal is positioned as a mid-to-high-tier product, the initial market price could range from USD 20 to USD 100 per dose, depending on formulation, patent status, and targeted indication.

Factors Influencing Future Pricing

- Patent Expirations and Generics Entry: Patent cliffs typically lead to significant price reductions, often by 50-70%. Early exclusivity for FT Antifungal would mean higher initial pricing, with subsequent adjustments post-generic entry.

- Manufacturing and R&D Costs: Advances that lower production or development costs could support more competitive pricing strategies.

- Reimbursement Policies: Variations in reimbursement rates across regions impact acceptable pricing thresholds.

- Market Penetration and Volume: High-volume markets such as Asia-Pacific could see lower per-unit prices to facilitate access, while niche markets may sustain higher prices.

Projected Price Trajectory (2023-2030)

| Year | Expected Price Range (USD per dose) | Factors Influencing Price |

|---|---|---|

| 2023 | USD 50-100 | Patent exclusivity, initial positioning, clinical data supporting efficacy |

| 2025 | USD 30-70 | Entry of generics, increased competition, market adaptation |

| 2030 | USD 20-50 | Widespread generic availability, cost-containment policies, regional pricing adjustments |

Note: These are estimates subject to market dynamics, patent life, and regulatory developments. High-cost markets may sustain premium pricing longer, while price erosion occurs swiftly in regions favoring generics.

Market Forecasting and Revenue Projections

Assuming a conservative adoption curve, FT Antifungal could capture a significant share of the antifungal market within five years. Revenues depend heavily on the drug's exclusivity status, formulary placement, and competitive pressures.

- Optimistic Scenario: If FT Antifungal introduces a novel mechanism or significant clinical advantage, revenues could reach USD 1-2 billion globally within 5-7 years post-launch.

- Moderate Scenario: In case of steady competition without significant clinical differentiation, revenues are likely to stabilize around USD 500 million to USD 1 billion in the same period.

Regulatory and Pricing Strategies

Aligning pricing with regional healthcare systems, negotiating favorable reimbursement agreements, and ensuring timely patent protection are critical for optimizing profitability. Strategic collaborations with payers, healthcare providers, and government agencies are essential for market penetration.

Conclusion

The prospective market for FT Antifungal appears favorable, buoyed by ongoing global health challenges and unmet medical needs. While initial pricing will likely be premium to capitalize on exclusivity and clinical differentiation, market forces—especially patent expiries and growing generic availability—are poised to drive prices downward over the medium term. Robust regulatory strategies, clinical validation, and regional pricing adaptations will be crucial for maximizing commercial success.

Key Takeaways

- The global antifungal market is expanding at an 6-8% CAGR, driven by rising fungal infections and technological innovations.

- FT Antifungal’s market share will depend heavily on clinical advantages, patent status, and regulatory approvals.

- Initial pricing is likely between USD 50-100 per dose, decreasing to USD 20-50 by 2030 with increased generic competition.

- Revenue projections suggest potential for USD 1 billion-plus in global sales if the product offers significant clinical benefits.

- Strategic pricing, regulatory navigation, and regional market adaptation are vital for optimizing the drug’s commercial trajectory.

FAQs

Q1: How will patent expiration impact FT Antifungal’s price?

Patent expiration typically leads to a dramatic reduction in price, often by up to 70%, as generics enter the market and competition increases.

Q2: Which regions offer the highest profit potential for FT Antifungal?

North America and Europe currently offer the highest profit margins due to healthcare expenditure, but Asia-Pacific offers substantial volume growth potential owing to expanding healthcare markets.

Q3: What is the role of clinical differentiation in pricing?

Unique clinical benefits, such as superior efficacy, safety, or convenience, can justify premium pricing and market exclusivity.

Q4: How could resistance development influence market projections?

Emerging antifungal resistance could limit drug effectiveness, necessitating the development of new agents or combination therapies, which may impact pricing and revenue forecasts.

Q5: What strategies can manufacturers adopt to enhance market penetration for FT Antifungal?

Strategic collaborations, targeted regional pricing, investing in clinical research, and navigating regulatory pathways efficiently are key to gaining market share.

References

- Grand View Research. Antifungal Drugs Market Size, Share & Trends Analysis Report. 2022.

- Center for Disease Control and Prevention. Fungal Infections. 2023.

- IQVIA. Global Market Analysis for Antifungal Agents. 2022.

More… ↓