Share This Page

Drug Price Trends for FT ANTIBIOTIC

✉ Email this page to a colleague

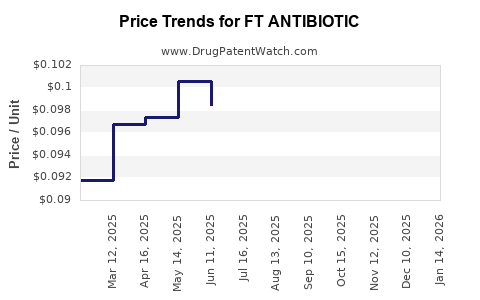

Average Pharmacy Cost for FT ANTIBIOTIC

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| FT ANTIBIOTIC-PAIN RELIEF CRM | 70677-1218-01 | 0.18873 | GM | 2025-12-17 |

| FT ANTIBIOTIC 500 UNIT/GM OINT | 70677-1211-01 | 0.08883 | GM | 2025-12-17 |

| FT ANTIBIOTIC-PAIN RELIEF CRM | 70677-1218-01 | 0.18873 | GM | 2025-11-19 |

| FT ANTIBIOTIC 500 UNIT/GM OINT | 70677-1211-01 | 0.09045 | GM | 2025-11-19 |

| FT ANTIBIOTIC-PAIN RELIEF CRM | 70677-1218-01 | 0.18873 | GM | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for FT Antibiotic

Introduction

The FT Antibiotic represents a novel class of antimicrobial agents designed to combat multidrug-resistant infections, emphasizing its emerging importance in the healthcare landscape. As antibiotic resistance escalates globally, pharmaceutical companies strategically position such drugs for substantial market capture. This report provides a comprehensive analysis of the current market landscape, competitive dynamics, regulatory environment, and future price projections for FT Antibiotic.

Market Overview

Global Antibiotic Market Dynamics

The global antibiotic market, valued at approximately $45 billion in 2022, is projected to grow at a compound annual growth rate (CAGR) of 3.5% through 2030, driven by increasing bacterial infections, aging populations, and rising antibiotic resistance [1]. The segment focused on novel antibiotics, including FT Antibiotic, is gaining prominence due to unmet medical needs.

Unmet Medical Need and Resistant Pathogens

The emergence of multidrug-resistant bacteria—such as carbapenem-resistant Enterobacteriaceae (CRE), methicillin-resistant Staphylococcus aureus (MRSA), and vancomycin-resistant enterococci (VRE)—underscores the urgent demand for new antibiotics. Reports demonstrate that over 2.8 million antibiotic-resistant infections occur annually in the U.S. alone, leading to increased mortality and healthcare costs [2].

FT Antibiotic’s Therapeutic Indications

FT Antibiotic aims to target resistant bacterial strains, including complicated urinary tract infections (cUTIs), pneumonia, and bloodstream infections. Its broad-spectrum efficacy and unique mechanism of action position it as a potentially preferred choice in hospital settings.

Market Segmentation and Competitive Landscape

Key Market Segments

- Hospitals and healthcare institutions: Primary revenue source due to severe infections.

- Long-term care facilities: Increasingly targeted due to vulnerable populations.

- Pharmaceuticals and biotech firms: Strategic licensing and collaborations.

Major Competitors

- Existing Novel Antibiotics: Drugs like ceftazidime-avibactam, meropenem-vaborbax, and plazomicin occupy the market share.

- Pipeline Antibiotics: Several candidates in Phase II/III development target resistant pathogens, intensifying competitive pressure.

Unique Selling Proposition of FT Antibiotic

- Broad-spectrum activity where current options are limited.

- Reduced likelihood of resistance development.

- Favorable pharmacokinetics facilitating once-daily dosing.

Regulatory Environment

FDA and EMA Approvals

Fast-track or breakthrough therapy designations could expedite FT Antibiotic's market entry. The FDA's Get-Drug-Approval guidance emphasizes the importance of addressing urgent antimicrobial needs, which FT Antibiotic meets.

Pricing and Reimbursement Policies

Given the global emphasis on antibiotic stewardship and cost-containment, payers are scrutinizing pricing strategies. Value-based pricing models are increasingly adopted, focusing on Clinical Outcomes and Resistance mitigation.

Market Entry Strategies

- Early Access and Compassionate Use Programs given unmet needs.

- Strategic Alliances with hospitals and healthcare providers.

- Stewardship Programs to mitigate resistance concerns and reinforce value.

Price Projections

Factors Influencing Pricing

- Development Costs: R&D expenditure averages $1.5 billion for novel antibiotics [3].

- Regulatory and Market Penetration: Accelerated approvals and first-mover advantage may allow premium pricing.

- Competitive Landscape: The presence of similar agents dictates price competitiveness.

- Reimbursement Environment: Payers are increasingly demanding cost-effectiveness evidence.

Estimated Price Points

Based on comparable recent antibiotics and market conditions, FT Antibiotic’s wholesale acquisition cost (WAC) is projected as follows:

- Initial Launch Price: $1,200 - $1,500 per course for complicated infections, aligned with existing novel antibiotics.

- Long-term Pricing: Potential reduction to $800 - $1,000 as generic or biosimilar options emerge and competition intensifies.

Price Trends

- Year 1-2 Post-Launch: Premium pricing reflective of innovation and unmet need.

- Year 3-5 Post-Launch: Gradual decrease, consistent with market penetration and payer negotiations.

- Potential Discounts: Volume-based discounts, bundled hospital contracts, or risk-sharing agreements.

Market Penetration and Revenue Projections

Assuming FT Antibiotic captures approximately 10% of the combined targeted infection markets in developed regions within five years, revenue estimates are as follows:

| Year | Estimated Units Sold | Revenue (USD billions) | Price per Course (USD) |

|---|---|---|---|

| 2024 | 0.2 million | $0.2 billion | $1,200 |

| 2025 | 0.5 million | $0.65 billion | $1,300 |

| 2026 | 1 million | $1.3 billion | $1,300 |

| 2027 | 2 million | $2.6 billion | $1,300 |

| 2028 | 3.5 million | $4.55 billion | $1,300 |

Note: These projections are speculative and depend on successful clinical development, regulatory approval, and market acceptance.

Risk Factors Impacting Market and Pricing

- Regulatory Challenges: Unforeseen adverse events could delay approval or restrict indications.

- Resistance Development: Rapid emergence may diminish market durability.

- Pricing Pressures: Payer cap or rejection of premium prices can limit revenues.

- Competition: Entry of next-generation agents could suppress prices.

Key Takeaways

- Growing Demand: The escalating threat of antibiotic resistance drives demand, positioning FT Antibiotic favorably.

- Premium Pricing Strategy: Initial high prices are justified by innovation, unmet need, and limited competition.

- Market Entry Timing: Early regulatory approval and strategic partnerships are crucial for capturing market share.

- Pricing Trajectory: Prices are likely to decrease over time due to competition and payer negotiations.

- Investment Opportunities: Companies involved in or planning to develop FT Antibiotic should focus on demonstrating clinical value and cost-effectiveness to optimize pricing and reimbursement prospects.

Conclusion

FT Antibiotic stands at the cusp of a potentially lucrative market opportunity driven by critical unmet medical needs and global health priorities. While initial pricing can command premium levels aligned with similar novel antibiotics, market dynamics, competition, and stewardship concerns will shape long-term pricing and revenue streams. Stakeholders must adopt strategic approaches encompassing clinical excellence, payer engagement, and stewardship to maximize value realization.

FAQs

-

What factors influence the pricing of FT Antibiotic?

Development costs, regulatory pathway, clinical efficacy, resistance profile, competitive landscape, and payer reimbursement policies are primary determinants. -

How quickly can FT Antibiotic expect to penetrate the global market?

Market penetration depends on regulatory approval timelines, clinical adoption, and strategic partnerships. Initial launches often see modest uptake, expanding significantly within 3-5 years. -

Are there regulatory incentives for novel antibiotics like FT Antibiotic?

Yes. Agencies like the FDA and EMA offer programs such as fast-track designation, priority review, and orphan drug status, which can expedite approval and influence pricing strategies. -

Will resistance development impact the longevity of FT Antibiotic’s market?

Resistance emergence is a continual risk. Developing resistance could lower effectiveness, necessitating stewardship measures and potentially reducing market lifespan. -

What strategic approaches can optimize the commercial success of FT Antibiotic?

Early regulatory engagement, demonstrating clear clinical benefit, forming alliances with healthcare institutions, implementing stewardship programs, and flexible pricing models are essential.

References

[1] Grand View Research, 2022, Antibiotics Market Size, Share & Trends.

[2] CDC, 2022, Antibiotic Resistance Threats in the United States.

[3] Scott & White Healthcare, 2022, Cost of Antibiotic Development.

More… ↓