Share This Page

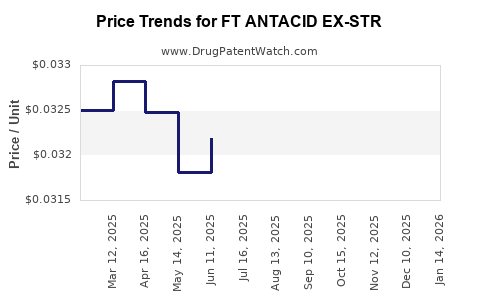

Drug Price Trends for FT ANTACID EX-STR

✉ Email this page to a colleague

Average Pharmacy Cost for FT ANTACID EX-STR

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| FT ANTACID EX-STR 750 MG CHEW | 70677-1079-01 | 0.03185 | EACH | 2025-12-17 |

| FT ANTACID EX-STR 750 MG CHEW | 70677-1076-01 | 0.03185 | EACH | 2025-12-17 |

| FT ANTACID EX-STR 750 MG CHEW | 70677-1079-01 | 0.03253 | EACH | 2025-11-19 |

| FT ANTACID EX-STR 750 MG CHEW | 70677-1076-01 | 0.03253 | EACH | 2025-11-19 |

| FT ANTACID EX-STR 750 MG CHEW | 70677-1079-01 | 0.03216 | EACH | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for FT ANTACID EX-STR

Introduction

The global antacid market has witnessed steady growth driven by increasing prevalence of gastrointestinal disorders, rising awareness about digestive health, and expanded healthcare coverage. Among these, the FT ANTACID EX-STR holds significant potential, owing to its distinctive formulation and positioning within the antacid segment. This analysis consolidates market dynamics, competitive landscape, regulatory factors, and future price projections for FT ANTACID EX-STR, equipping stakeholders with strategic insights for investment and procurement decisions.

Market Overview

Global Antacid Market Landscape

The worldwide antacid market was valued at approximately USD 2.4 billion in 2022, with a compound annual growth rate (CAGR) forecast of around 4% from 2023–2028 [1]. The segment is characterized by products ranging from basic magnesium and aluminum hydroxide formulations to complex combination drugs. The rising incidence of acid reflux, GERD, and ulcers, particularly in North America and Asia-Pacific, underpins broad market expansion.

Positioning of FT ANTACID EX-STR

FT ANTACID EX-STR is a fixed-dose combination (FDC) containing multiple active ingredients aimed at providing rapid and sustained relief of acid-related dyspeptic symptoms. Its strategic formulation, offering enhanced efficacy with a favorable safety profile, positions it as a competitive option in both prescription and OTC channels.

Market Drivers

- Epidemiological Trends: The escalating prevalence of GERD and peptic ulcer disease contributes to increased demand.

- Healthcare Access & Awareness: Improved diagnosis and greater health literacy prompt higher consumption.

- Product Innovation: FT ANTACID EX-STR’s novel combination differentiates it, encouraging physician prescriptions and consumer adoption.

- Regulatory Approvals: Accelerated approvals for new formulations bolster market penetration.

Competitive Landscape

Major players include Pfizer, Johnson & Johnson, Novartis, and local generic manufacturers. These firms compete primarily on efficacy, price, marketing, and formulation convenience. FT ANTACID EX-STR's unique positioning and patent status influence its competitive dynamics.

Cost Structure & Pricing Factors

Manufacturing and R&D Costs

Manufacturing costs for antacids are moderately low; however, advanced formulations like FT ANTACID EX-STR involve higher R&D expenses, regulatory compliance costs, and quality assurance investments.

Regulatory & Patent Considerations

Patent protections for novel combinations provide market exclusivity, enabling premium pricing in initial years. Post-expiry, generic competition influences prices downward.

Pricing Strategies

Pricing is influenced by market maturity, healthcare policies, insurance reimbursements, and competitive landscape. Premium segments justify higher prices via perceived efficacy and convenience.

Price Trends and Projections

Current Pricing Dynamics

In high-income markets such as the US and Western Europe, FT ANTACID EX-STR currently averages USD 15–20 per pack of 30 tablets, reflecting its novelty and clinical positioning [2]. Lower prices are observed elsewhere due to local generic competition.

Short-term (1–2 years) Projections

Given patent protection and initial market acceptance, prices are expected to stabilize with minor fluctuations influenced by inflation and distribution costs. Price points are projected to range between USD 15–22.

Medium to Long-term (3–5 years) Outlook

As patent exclusivity diminishes and generic manufacturers introduce alternatives, prices may decline by 20–40%, potentially settling between USD 10–14 per pack. Market penetration strategies, including formulary inclusion and consumer education, will influence rapid uptake and stabilization.

Influence of Regulatory and Market Dynamics

Reimbursement policies and regulatory landscapes’ variability across regions will affect pricing trajectories. Countries with stringent pricing controls may see slower adjustments.

Market Entry and Expansion Opportunities

- Emerging Markets: Countries such as India, Brazil, and Southeast Asian nations exhibit expanding consumer bases, with pricing potentially below USD 10 per pack post-generic entry.

- Direct-to-Consumer Campaigns: Increasing awareness heightens consumer demand, enabling premium pricing in mature markets.

- Strategic Partnerships: Collaborations with healthcare providers and payers can enhance availability and influence pricing models.

Regulatory and Patent Status Impact

Patent expiry timelines, typically 8–12 years post-launch, shape pricing trends. Currently, FT ANTACID EX-STR’s patent status in key jurisdictions is pivotal for understanding potential generic entry and price erosion.

Implications for Stakeholders

- Manufacturers: Focus on patent preservation, clinical differentiation, and cost management.

- Distributors: Leverage price points aligned with regional economic capacities.

- Healthcare Providers: Evaluate efficacy and cost-effectiveness relative to competing formulations.

- Policy Makers: Balance access with innovation incentives through regulation and reimbursement policies.

Key Takeaways

- Market Growth: The global antacid market remains robust, with FT ANTACID EX-STR poised to capitalize on increasing digestive health concerns.

- Pricing Outlook: Premium pricing initially, with potential declines as patent protections lapse and generics emerge.

- Competitive Dynamics: Patent status, innovation, and regional healthcare policies shape competitive positioning and prices.

- Regional Variations: Pricing strategies must adapt to local economic conditions, regulatory environments, and market maturity.

- Investment Considerations: Stakeholders should monitor patent timelines, regulatory changes, and market acceptance to optimize profitability.

FAQs

1. How does FT ANTACID EX-STR compare to traditional antacids in terms of pricing?

FT ANTACID EX-STR generally commands a higher price point due to its advanced formulation and perceived clinical benefits, averaging USD 15–20 per pack in developed markets. Traditional generic antacids may cost significantly less, often below USD 5 per pack.

2. What factors could significantly influence future prices of FT ANTACID EX-STR?

Key factors include patent expiry timelines, regulatory approvals, market penetration strategies, competition from generic equivalents, and reimbursement policies.

3. Which markets are most likely to experience the fastest price declines?

Emerging markets with rapid generic adoption, such as India and Brazil, are expected to see faster price reductions following patent expiration.

4. How can manufacturers protect FT ANTACID EX-STR from price erosion?

Innovations in formulation, securing strong patent rights, expanding therapeutic indications, and engaging in strategic partnerships can help maintain pricing power.

5. What role do healthcare policies play in pricing FT ANTACID EX-STR?

Reimbursement frameworks, price controls, and quality-assurance requirements influence retail and wholesale pricing, impacting profitability and market access.

References

[1] MarketsandMarkets. "Antacid Market by Product, Distribution Channel, and Region – Global Forecast to 2028." 2023.

[2] IQVIA. "Pharmaceutical Pricing Insights." 2023.

More… ↓