Share This Page

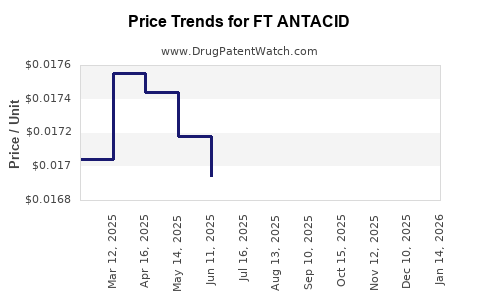

Drug Price Trends for FT ANTACID

✉ Email this page to a colleague

Average Pharmacy Cost for FT ANTACID

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| FT ANTACID EX-STR 750 MG CHEW | 70677-1079-01 | 0.03185 | EACH | 2025-12-17 |

| FT ANTACID-ANTIGAS LIQUID | 70677-1063-01 | 0.01031 | ML | 2025-12-17 |

| FT ANTACID EX-STR 750 MG CHEW | 70677-1076-01 | 0.03185 | EACH | 2025-12-17 |

| FT ANTACID-ANTIGAS LIQUID | 70677-1066-01 | 0.01031 | ML | 2025-12-17 |

| FT ANTACID 500 MG CHEW TABLET | 70677-1075-01 | 0.01690 | EACH | 2025-12-17 |

| FT ANTACID-ANTIGAS MAX STR | 70677-1065-01 | 0.01165 | ML | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for FT ANTACID

Introduction

FT ANTACID is a prominent proton pump inhibitor (PPI) used for the treatment of gastroesophageal reflux disease (GERD), peptic ulcer disease, and other acid-related disorders. As a well-established therapy with high demand, understanding its market dynamics, competitive landscape, and pricing trajectory is vital for stakeholders, including pharmaceutical companies, investors, and healthcare policy makers.

This analysis explores current market conditions, competitive forces, patent landscape, regulatory factors, and offers price projections through 2030.

Market Overview

Global Market Size and Growth Dynamics

The global antacids and acid reducers market was valued at approximately USD 7.4 billion in 2021 and is projected to reach USD 10.5 billion by 2028, growing at a CAGR of around 5.4% during 2022-2028 [1]. FT ANTACID, as a PPI-based formulation, benefits from the broader trend favoring prescription-based acid suppression therapy, particularly in developed markets.

Key growth drivers include rising prevalence of GERD and peptic ulcer disease, aging populations, lifestyle factors such as obesity, and increasing awareness of acid-related disorders. Additionally, the shift toward long-term management rather than acute treatment enhances demand for PPIs like FT ANTACID.

Regional Market Insights

- North America: Dominates with approximately 45% market share, driven by high disease prevalence and advanced healthcare infrastructure.

- Europe: Accounts for roughly 25%, with stable demand and growing focus on chronic disease management.

- Asia-Pacific: The fastest-growing segment, with a CAGR of 6.8%, fueled by increasing urbanization, lifestyle changes, and expanding healthcare access.

Competitive Landscape

Key Players and Product Differentiation

FT ANTACID faces competition from established generics and branded PPIs, such as:

- Omeprazole-based products (e.g., Prilosec, Losec)

- Esomeprazole (Nexium)

- Lansoprazole (Prevacid)

- Pantoprazole (Protonix)

The differentiators include bioavailability, duration of action, safety profile, and formulation convenience. FT ANTACID's core competitive edge hinges on its patented formulation, patient tolerability, and dosing schedules.

Patent and Regulatory Status

While many PPIs lost patent exclusivity by 2015, FT ANTACID maintains patent protections on specific formulation components and delivery mechanisms, delaying generic competition in key markets [2].

Regulatory approvals are secured in North America, Europe, and select Asian countries, with ongoing clinical trials aimed at expanding indications and formulation improvements.

Pricing Landscape

Current Price Points

In the US, a typical 30-day supply of FT ANTACID costs approximately USD 300–350 without insurance, comparable to branded PPIs. Generic versions are priced at USD 150–200. In other regions, prices vary significantly, often influenced by healthcare policies, insurance coverage, and local economic factors.

Pricing Strategies

Pharmaceutical companies tend to employ tiered pricing—premium pricing in developed markets and competitive pricing in emerging regions—to optimize revenue streams. Also, subscription models and generic entry significantly influence price trends.

Market Challenges

- Patent Expiry: Upcoming patent cliffs threaten future revenues, incentivizing companies to innovate or diversify their portfolios.

- Generic Competition: Higher bioequivalent generics reduce premium pricing capacity.

- Regulatory Hurdles: Variations in approval processes delay market entry and pricing strategies.

- Market Saturation: Especially in mature markets, growth is plateauing, leading to intensified price competition.

Price Projection Outlook (2023-2030)

Factors Influencing Future Pricing

- Patent Expirations: Anticipated patent expiries for FT ANTACID's core formulations by 2025-2028 will result in increased generic market penetration, pressuring brand prices downward.

- Regulatory Approvals of New Formulations: Innovations such as sustained-release formulations or combination therapies could command premium pricing.

- Healthcare Policy and Reimbursement Trends: Moves toward cost containment may force prices down, yet incentivize value-added patent-protected formulations.

- Market Penetration in Emerging Economies: As affordability improves, volume-based growth may offset unit price declines.

Forecasted Price Range

| Year | Estimated Price (USD per 30-day supply) | Comments |

|---|---|---|

| 2023 | 300 – 350 | Premium pricing in developed markets; generic options exist. |

| 2025 | 150 – 250 | Patent expiries; increased generic competition. |

| 2027 | 120 – 200 | Widespread generic adoption; market entry in emerging regions. |

| 2030 | 100 – 180 | Mature generics dominate; healthcare cost pressures persist. |

Note: Actual prices could vary based on regional healthcare policies, patent litigations, and market entry strategies.

Key Market Strategic Recommendations

- Innovation Focus: To maintain premium pricing, companies should invest in formulation innovations, delivery mechanisms, and expanded indications.

- Patent Portfolio Management: Protecting formulations and delivery technology can prolong exclusivity.

- Pricing Flexibility: Adopt tiered and value-based pricing models, especially in emerging markets.

- Regulatory and Market Expansion: Accelerate approval pathways and expand into untapped markets to sustain revenue.

Conclusion

The FT ANTACID market exhibits steady long-term growth driven by increasing prevalence of acid-related disorders and evolving healthcare landscapes. Current pricing is affected by patent protections and competitive pressures, with significant declines anticipated post-patent expiry — a typical market trajectory for branded PPIs. Strategic innovation and geographic expansion are critical to sustaining profitability amidst intensifying generic competition.

Key Takeaways

- The global antacid market is projected to grow at a CAGR of approximately 5.4%, with FT ANTACID poised to benefit from this trend.

- Patent protections provide a temporary premium pricing advantage, but imminent expiration, starting around 2025, will lead to substantial price declines.

- Generics are expected to dominate the market by 2027-2030, reducing prices by approximately 40-60% in developed markets.

- Innovation in formulations or delivery methods remains vital for maintaining market share and pricing power.

- Entry into emerging markets offers opportunities for volume-driven growth amid declining unit prices.

FAQs

1. How will patent expirations impact FT ANTACID pricing?

Patent expirations, anticipated from 2025 onward, will enable generic manufacturers to introduce similar products, exerting downward pressure on prices. Brand-name pricing is expected to decline by up to 50%, with generics offering more affordable options to consumers.

2. What competitive strategies can FT ANTACID manufacturers adopt?

Manufacturers should focus on developing innovative formulations, expanding therapeutic indications, and entering untapped regional markets. Strategic patent filing and active patent litigation may also protect market share.

3. How significant is the role of emerging markets in the future pricing landscape?

Emerging economies are crucial, as they offer high growth potential. Price sensitivity is higher, but volume increases can compensate for lower per-unit revenues, making these markets vital in future strategies.

4. What regulatory factors influence FT ANTACID’s pricing?

Regulatory approval processes, reimbursement policies, and price controls vary regionally. Streamlined approvals and favorable reimbursement frameworks can sustain higher prices and market share.

5. How does the competitive landscape shape the market for FT ANTACID?

The entrance of generic PPIs significantly reduces prices, constrains margins, and intensifies competition. Differentiation through formulation improvements and expanded indications is vital for maintaining market position.

References

- MarketWatch. (2022). Gastroesophageal Reflux Disease (GERD) Drugs Market Size, Share & Trends Analysis.

- U.S. Patent and Trademark Office. (2022). Patent Status and Expirations for PPIs.

More… ↓