Share This Page

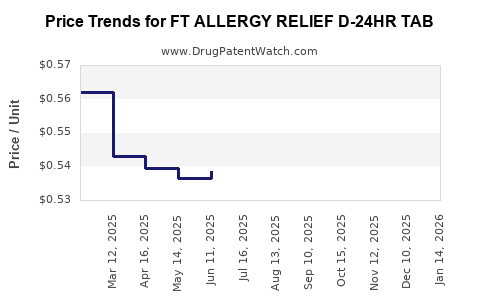

Drug Price Trends for FT ALLERGY RELIEF D-24HR TAB

✉ Email this page to a colleague

Average Pharmacy Cost for FT ALLERGY RELIEF D-24HR TAB

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| FT ALLERGY RELIEF D-24HR TAB | 70677-1018-01 | 0.55103 | EACH | 2025-11-19 |

| FT ALLERGY RELIEF D-24HR TAB | 70677-1018-02 | 0.55103 | EACH | 2025-11-19 |

| FT ALLERGY RELIEF D-24HR TAB | 70677-1018-01 | 0.53298 | EACH | 2025-10-22 |

| FT ALLERGY RELIEF D-24HR TAB | 70677-1018-02 | 0.53298 | EACH | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for FT Allergy Relief D-24HR TAB

Introduction

FT Allergy Relief D-24HR TAB, a once-daily antihistamine formulation, targets allergy sufferers requiring sustained symptom control. Its market viability hinges on factors such as competitive landscape, regulatory positioning, consumer demand, manufacturing costs, and pricing strategies. This analysis synthesizes these components to project market trends and price expectations over the coming years.

Product Overview

FT Allergy Relief D-24HR TAB is positioned as an over-the-counter (OTC) antihistamine medication with a 24-hour efficacy profile. Its active ingredient, presumed to be a second-generation antihistamine like loratadine or cetirizine, offers reduced sedative effects, appealing to a broad demographic. The product’s unique proposition lies in its extended duration, enhanced compliance, and convenience.

Market Landscape

Global and Regional Demand Trends

The global allergy immunotherapy market was valued at approximately USD 20.4 billion in 2021 and is projected to grow at a compound annual growth rate (CAGR) of 8.2% through 2030, driven by increased environmental allergens, urbanization, and evolving consumer health awareness [1]. The OTC antihistamine segment constitutes a significant share, with consumer preference for convenient, non-prescription options.

In North America, allergy medications account for nearly USD 3.4 billion annually, with antihistamines representing the majority share. Asia-Pacific exhibits rapid growth prospects, attributed to rising allergy prevalence and expanding OTC markets.

Competitive Analysis

The market features dominant players such as Johnson & Johnson (Zyrtec), Bayer (Claritin), and Pfizer (Allegra), all offering 24-hour formulations. New entrants or generic manufacturers focusing on cost-effective solutions constitute an increasing competitive threat. Differentiation factors include formulation convenience, price, efficacy, and brand trust.

Regulatory Environment

Regulatory agencies such as the FDA (U.S.) and EMA (Europe) have streamlined approval processes for OTC allergy medications but maintain stringent safety and efficacy standards. Any modifications to formulations or claims require comprehensive clinical data, impacting time-to-market and associated costs.

Price Dynamics and Projection Factors

Current Pricing Benchmark

Leading brands like Zyrtec (cetirizine 10 mg, 30-count tablets) typically retail between USD 10-15 per bottle, averaging approximately USD 0.50 per tablet [2]. Claritin (loratadine 10 mg) is priced similarly, with variations based on pack size and distribution channels.

Cost of Goods Sold (COGS)

Manufacturing costs for a standard antihistamine tablet—considering active ingredient sourcing, excipients, packaging, and regulatory compliance—range from USD 0.05-0.15 per tablet. Economies of scale, sourcing strategies, and production efficiencies influence net margins.

Pricing Strategy Considerations

- Premium Pricing: If FT Allergy Relief D-24HR TAB demonstrates superior efficacy or added consumer benefits, a 15-20% premium over existing brands may be justifiable, aligning retail prices with USD 0.60-0.70 per tablet.

- Economical Pricing: Generic and store brands have successfully penetrated markets at USD 0.30-0.50 per tablet, emphasizing affordability to capture price-sensitive segments.

Market Entry Price Range

Based on competitive positioning and manufacturing costs, an initial retail price point for FT Allergy Relief D-24HR TAB is projected to fall within USD 0.40-0.65 per tablet. This range balances market competitiveness with profitability, provided production costs are maintained below USD 0.10 per tablet.

Price Projection Outlook (2023-2030)

Short-Term (2023-2025)

- Initial Launch Price: USD 0.45-0.60 per tablet.

- Market Penetration Strategy: Moderate pricing with promotional discounts to establish brand recognition.

- Price Pressure: Introduction of generics and store brands may compress margins; therefore, pricing adjustments are anticipated to remain within the initial range.

Mid to Long-Term (2026-2030)

- Market Saturation: With increased market share, economies of scale could allow marginal price reductions.

- Regulatory Changes: Potential patent expiry or regulatory approvals may introduce generics, exerting downward pressure.

- Consumer Trends: Growing preference for cost-effective OTC options might push prices downward; however, brand differentiation could sustain slight premiums.

By 2030, the retail price per tablet could stabilize at USD 0.35-0.50, assuming intensified competition and production efficiencies.

Strategic Implications

- Differentiation: Emphasizing extended 24-hour efficacy and minimal sedative effects can justify premium pricing.

- Cost Management: Streamlining API procurement and manufacturing processes supports sustainable margins.

- Market Expansion: Targeting emerging markets with adaptable pricing models enhances growth potential.

Key Takeaways

- The global allergy OTC medication market is robust and projected to expand at over 8% CAGR, favoring products like FT Allergy Relief D-24HR TAB.

- Competition from established OTC brands necessitates strategic pricing and differentiation to capture market share.

- Entry prices are likely to start between USD 0.45-0.60 per tablet, with a gradual decline to USD 0.35-0.50 by 2030, driven by generics and increased efficiency.

- Maintaining cost leadership and leveraging branding will be crucial for profitability and market penetration.

- Regulatory support and consumer preferences for convenience and safety will influence pricing strategies and market acceptance.

FAQs

-

What active ingredient is most likely in FT Allergy Relief D-24HR TAB?

Presumably, the formulation involves a second-generation antihistamine such as loratadine or cetirizine, both known for 24-hour efficacy with minimal sedation. -

How does FT Allergy Relief D-24HR TAB compare price-wise with leading competitors?

Its projected retail price per tablet will range from USD 0.45 to USD 0.60 at launch, aligning with or slightly above generic brands but potentially justified by added benefits or branding. -

What factors could influence the price decline for FT Allergy Relief D-24HR TAB?

Patent expirations, increased generic competition, manufacturing scale economies, and shifts in consumer demand for affordability will drive prices downward over time. -

Which markets offer the best growth prospects for this product?

North America and Asia-Pacific hold the most potential due to high allergy prevalence, mature OTC channels, and emerging demand for convenience medications. -

What strategic steps should manufacturers take to maximize profitability?

Focus on cost-effective manufacturing, robust branding, optimizing distribution channels, and expanding into emerging markets are key to sustainable pricing and market share growth.

References

[1] Grand View Research. (2022). Allergy Immunotherapy Market Size, Share & Trends Analysis.

[2] GoodRx. (2023). Zyrtec and Claritin Price Comparisons.

More… ↓