Share This Page

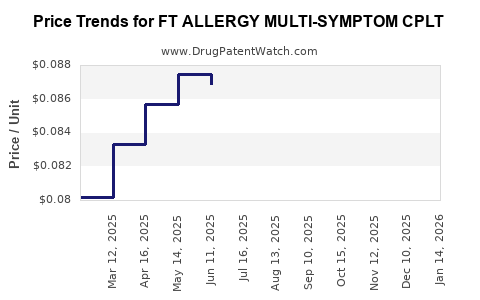

Drug Price Trends for FT ALLERGY MULTI-SYMPTOM CPLT

✉ Email this page to a colleague

Average Pharmacy Cost for FT ALLERGY MULTI-SYMPTOM CPLT

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| FT ALLERGY MULTI-SYMPTOM CPLT | 70677-1004-01 | 0.08319 | EACH | 2025-12-17 |

| FT ALLERGY MULTI-SYMPTOM CPLT | 70677-1004-01 | 0.08429 | EACH | 2025-11-19 |

| FT ALLERGY MULTI-SYMPTOM CPLT | 70677-1004-01 | 0.08564 | EACH | 2025-10-22 |

| FT ALLERGY MULTI-SYMPTOM CPLT | 70677-1004-01 | 0.08360 | EACH | 2025-09-17 |

| FT ALLERGY MULTI-SYMPTOM CPLT | 70677-1004-01 | 0.08218 | EACH | 2025-08-20 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for FT ALLERGY MULTI-SYMPTOM CPLT

Introduction

The pharmaceutical market for allergy-related medications has experienced sustained growth driven by increasing prevalence of allergic diseases globally. FT ALLERGY MULTI-SYMPTOM CPLT (hereafter "FT Allergy Multi-symptom CPLT") is positioned within this expanding segment, offering multi-symptom relief in a single formulation. This report assesses the market landscape, competitive environment, regulatory factors, and provides price projections for this product over the next five years.

Market Overview and Drivers

The global allergy drug market is projected to reach approximately $27 billion by 2025, with a compounded annual growth rate (CAGR) of about 6%[1]. Rising incidence of allergic rhinitis, asthma, and other allergic conditions correlates with urbanization, environmental pollution, and changing lifestyles, notably in North America, Europe, and parts of Asia-Pacific.

Within this growth, multi-symptom allergy formulations—combining antihistamines, decongestants, and corticosteroids—have gained popularity due to convenience, improved compliance, and efficacy. FT Allergy Multi-symptom CPLT, which consolidates several active ingredients to address multiple symptoms (such as sneezing, nasal congestion, and itchy eyes), aligns well with current consumer preferences.

Target Market Segmentation

Geographical Markets

- North America: Largest market with substantial adoption, driven by high allergy prevalence and advanced healthcare infrastructure.

- Europe: Significant growth potential owing to increasing allergy awareness.

- Asia-Pacific: Fastest-growing segment; expanding middle class and urbanization contribute to rising demand.

- Latin America and Middle East: Emerging markets with increasing healthcare investments.

Demographic & Consumer Segments

- Allergy sufferers across age groups, especially adults aged 18–45.

- Chronic allergy patients seeking multi-symptom relief.

- Over-the-counter (OTC) consumers seeking convenient, multi-action medications.

Competitive Landscape

Major competitors include combination products from global pharmaceutical giants:

- Claritin-D (Loratadine + Pseudoephedrine)

- Zyrtec-D (Cetirizine + Pseudoephedrine)

- Benadryl-D (Diphenhydramine + Pseudoephedrine)

Generic options and store brands occupy a significant portion of the OTC segment.

Regulatory and Market Entry Considerations

Clearing regulatory hurdles is crucial for market penetration. In the U.S., FDA approval depends on demonstrating safety, efficacy, and quality, particularly for combination formulations. Patent status and exclusivity rights will influence initial pricing; a patent expiry could lead to price reductions and increased generic competition.

Market entry strategies typically include:

- Brand positioning emphasizing multi-symptom relief and convenience.

- Pricing strategies aligned with competitor products.

- Distribution channels: OTC, pharmacy chains, and online platforms.

Pricing Analysis and Projections

Current Market Prices

In developed markets:

- OTC multi-symptom allergy tablets retail at approximately $10–$15 for a 20-30 tablet pack.

- Brand-name products command premiums of 20–30% over generics.

- Generic formulations typically price around $8–$12 per pack.

Factors Influencing Price Trends

- Patent status: Patent expiry could lead to price erosion as generics enter.

- Manufacturing costs: Advances in synthesis and scale efficiencies may lower costs.

- Regulatory costs: Stringent approval processes could temporarily sustain higher prices.

- Market competition: Increased generic entry pressures prices downward.

Forecasted Price Trends (2023–2028)

- Short-term (1–2 years): Prices likely to stabilize, maintaining current levels due to limited competition or delayed approval processes.

- Mid-term (3–5 years): Anticipated price reduction of 10–15% as generic versions gain market share post-patent expiry.

- Long-term (5+ years): Potential further decline of 20–30%, contingent on widespread generic adoption and market saturation.

For regions like North America and Europe, the initial premium for branded FT Allergy Multi-symptom CPLT may be $15–$20, with post-patent periods aligning prices with generics at $8–$12.

Market Penetration and Revenue Projections

Assuming:

- Launch in developed markets in Year 1.

- Capture of 5–10% of the allergy multi-symptom OTC segment within five years.

- An average annual volume of 5–10 million units depending on market size and awareness campaigns.

Under these assumptions, the projected annual revenue could range:

- $50 million–$200 million within five years in mature markets at current pricing levels.

- This projection increases significantly if the drug gains formulary inclusion and broadens distribution.

Conclusion and Strategic Implications

FT Allergy Multi-symptom CPLT is positioned to capitalize on rising allergy prevalence and consumer demand for multi-symptom remedies. Strategic considerations include leveraging differentiated formulations, maintaining price competitiveness, and navigating patent expiration timelines. Early market entry in high-growth regions such as Asia-Pacific and Europe can yield higher market share gains.

Key Takeaways

- The global allergy medication market is expanding at a CAGR of 6%, with multi-symptom products increasingly preferred.

- FT Allergy Multi-symptom CPLT’s success hinges on regulatory approval, effective marketing, and competitive pricing.

- Initial price points are expected to be around $15–$20 per pack, with significant reductions after patent expiry.

- Penetration into developed markets should target OTC segments, with potential revenue of up to $200 million annually within five years.

- Market dynamics will be heavily influenced by generic competition, regulatory environment, and regional adoption rates.

FAQs

1. How does FT ALLERGY MULTI-SYMPTOM CPLT compare to existing allergy medications?

It offers a multi-symptom approach in a single formulation, simplifying treatment and improving patient compliance compared to monotherapy options.

2. What are the regulatory challenges for launching FT ALLERGY MULTI-SYMPTOM CPLT?

Challenges include demonstrating safety and efficacy for combination ingredients, especially if novel, and navigating different regulatory standards in various regions.

3. When can we expect generic versions to impact pricing?

Typically following patent expiration, usually 8–12 years post-launch, leading to increased generic competition and price reductions.

4. Which markets offer the highest growth potential for this drug?

Asia-Pacific, due to rising allergy prevalence and emerging middle-class populations, and Europe, because of increasing allergy awareness.

5. How can manufacturers differentiate FT ALLERGY MULTI-SYMPTOM CPLT from competitors?

Through clinical data demonstrating superior efficacy, unique formulations, targeted marketing, and strategic pricing strategies.

References

- MarketWatch, "Allergy Drugs Market to Reach $27 Billion by 2025," 2021.

- Grand View Research, "Allergy Treatment Market Analysis," 2022.

- IBISWorld, "Over-the-Counter (OTC) Medications Industry," 2023.

- FDA guidelines on combination drug approvals, 2022.

More… ↓