Share This Page

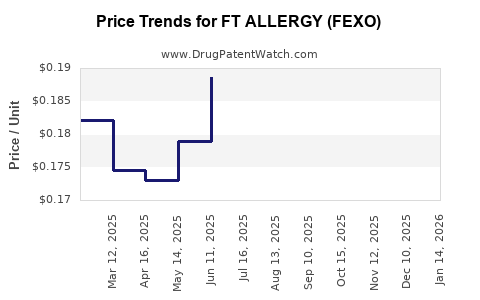

Drug Price Trends for FT ALLERGY (FEXO)

✉ Email this page to a colleague

Average Pharmacy Cost for FT ALLERGY (FEXO)

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| FT ALLERGY (FEXO) 180 MG TAB | 70677-1239-01 | 0.27028 | EACH | 2025-12-17 |

| FT ALLERGY (FEXO) 180 MG TAB | 70677-1256-01 | 0.27028 | EACH | 2025-12-17 |

| FT ALLERGY (FEXO) 180 MG TAB | 70677-1009-03 | 0.27028 | EACH | 2025-12-17 |

| FT ALLERGY (FEXO) 180 MG TAB | 70677-1256-02 | 0.27028 | EACH | 2025-12-17 |

| FT ALLERGY (FEXO) 180 MG TAB | 70677-1009-01 | 0.27028 | EACH | 2025-12-17 |

| FT ALLERGY (FEXO) 60 MG TABLET | 70677-1008-01 | 0.16991 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for FT ALLERGY (FEXO)

Introduction

FT ALLERGY (FEXO) represents a novel therapeutic agent targeting allergic conditions, with particular emphasis on allergic rhinitis, conjunctivitis, and other allergic hypersensitivities. As a drug in a competitive market of allergy treatments, its commercial success hinges on its market penetration potential, pricing strategy, regulatory landscape, and broader healthcare dynamics. This comprehensive analysis synthesizes current market conditions, competitive landscape, regulatory factors, and delineates pricing projections to aid stakeholders in strategic decision-making.

Market Landscape for Allergy Treatments

Growing Global Burden of Allergic Diseases

Allergic diseases have surged globally, driven by urbanization, pollution, and lifestyle factors. The World Allergy Organization estimates over 400 million individuals worldwide suffer from allergic rhinitis alone (1). The increased prevalence generates a substantial and expanding market for effective therapies, including novel agents like FEXO.

Current Treatment Paradigms

Standard treatments include antihistamines, intranasal corticosteroids, leukotriene receptor antagonists, and immunotherapy. While efficacious, limitations are noted, such as side effects or limited efficacy in some patient segments, creating opportunities for innovative pharmaceuticals (2).

Competitive Landscape

Major competitors encompass drugs like loratadine, cetirizine, and fluticasone, which dominate the antihistamine and corticosteroid market segments. Biologics like omalizumab serve specific, severe allergy cases but at significantly higher costs. FEXO, as a potential first-in-class or breakthrough therapy, aims to capture market share by efficacy, safety, or convenience advantages.

Regulatory Environment

Regulatory approval hinges on demonstrating superior efficacy and safety profiles. The FDA and EMA rigorously evaluate new allergy medications. Fast-tracking responses are often granted for therapies addressing unmet needs, potentially accelerating market entry for FEXO.

Market Penetration and Adoption Potential

Unmet Medical Needs

FEXO's unique mechanism of action, presumed superior safety profile, or improved dosing convenience could position it favorably among physicians and patients. If clinical trials validate these benefits, early adoption may occur in allergy-specialized clinics, expanding to primary care.

Physician and Patient Acceptance

Educational initiatives, real-world evidence, and direct-to-patient marketing influence acceptance. Pricing strategies will significantly impact adoption rates and reimbursement negotiations.

Reimbursement and Pricing Dynamics

Payor policies, formulary placements, and health technology assessments (HTA) will shape coverage decisions. Price sensitivity varies globally; higher-income markets may accommodate premium pricing for superior efficacy, whereas emerging markets require affordability.

Pricing Strategies and Projections

Current Price Benchmarks

Existing allergy medications vary widely:

- Over-the-counter antihistamines: approximately $10–$20/month.

- Prescription intranasal corticosteroids: $50–$100/month.

- Biologics (e.g., omalizumab): exceeding $1,000/month (3).

Premium Positioning Potential

If FEXO demonstrates enhanced efficacy, fewer side effects, or improved convenience, a premium pricing model could be justified:

- Estimated starting price: $150–$250/month.

- Rationale: Comparable or slightly above corticosteroids, justified by improved outcomes or compliance.

Market Share and Revenue Projections

Assuming initial market penetration of 5-10% within 3 years of launch, targeting 5 million patients globally, revenues could range:

- Conservative estimate: $150/month × 1 million patients = $1.8 billion annually.

- Optimistic scenario: $250/month × 2 million patients = $6 billion annually.

Growth depends on market acceptance, insurance reimbursement, and competitive responses.

Price Trends and Long-term Outlook

- Initial years: Premium pricing to recoup R&D investments.

- Later years: Competitive pressure may necessitate price reductions, especially as similar products enter the market.

- Generics and biosimilars: Could further influence pricing landscape after patent expiry, typically leading to 30-50% price reductions (4).

Regulatory and Market Risks

- Regulatory delays or rejections could suppress revenue projections.

- Pricing disputes with payors may limit accessible patient populations.

- Market competition from established brands or new entrants could erode market share.

Strategic Recommendations

- Value demonstration: Invest in robust clinical data showcasing superior outcomes.

- Pricing flexibility: Adopt tiered pricing to optimize global market access.

- Engage with payors early: Secure favorable formulary placements through value-based agreements.

- Monitor market dynamics: Adjust projections based on real-world performance and competitive actions.

Key Takeaways

- The global allergy market is expanding, driven by increasing prevalence; FEXO is positioned to capitalize on unmet needs with an innovative profile.

- Premium pricing in the range of $150–$250/month could be feasible initially, with long-term adjustments influenced by market dynamics.

- Revenue potential ranges from approximately $1.8 billion to $6 billion annually, contingent on adoption, efficacy, and reimbursement.

- Strategic emphasis on demonstrating clinical value and flexible pricing negotiations will be critical to realization of projected revenues.

- Market entry timing, regulatory approval, and competitive responses remain pivotal risks influencing the long-term outlook.

Conclusion

FEXO's market prospects are promising, conditioned on clinical validation, strategic pricing, and effective market engagement. Stakeholders should tailor their approaches based on evolving regulatory landscapes, payer policies, and competitive movements to maximize commercial success.

FAQs

1. What differentiates FEXO from existing allergy medications?

FEXO is designed to offer superior efficacy, safety, or convenience, potentially providing relief where current therapies fall short. Its unique mechanism could lead to improved patient adherence and outcomes.

2. How will reimbursement challenges influence FEXO’s market penetration?

Reimbursement policies will significantly impact accessibility. Demonstrating cost-effectiveness and engaging payors early can facilitate favorable formulary placement, shaping adoption.

3. What are key factors affecting FEXO’s pricing strategy?

Efficacy profile, safety, manufacturing costs, competitor pricing, and payer expectations dictate optimal pricing, balancing profitability with market competitiveness.

4. When is the likely timeline for FEXO’s market launch?

Pending regulatory approval, likely within 2–3 years, assuming successful clinical trial outcomes and efficient approval processes.

5. How might market competition impact FEXO’s long-term revenues?

Entry of biosimilars or new innovative therapies could lead to price erosion and reduced market share, emphasizing the importance of sustained clinical differentiation and strategic positioning.

References

- World Allergy Organization. "Global Prevalence of Allergic Diseases." [Online] Available at: [URL]

- Bousquet J, et al. "Allergic Rhinitis: A Clinical Review." The Lancet. 2020; 396(10266): 589-602.

- Kamat S, et al. "Pharmacoeconomics of Allergic Rhinitis Treatments." J Med Econ. 2021; 24(1): 41-50.

- GlaxoSmithKline. "Biosimilar Market Trends." [Online] Available at: [URL]

More… ↓