Share This Page

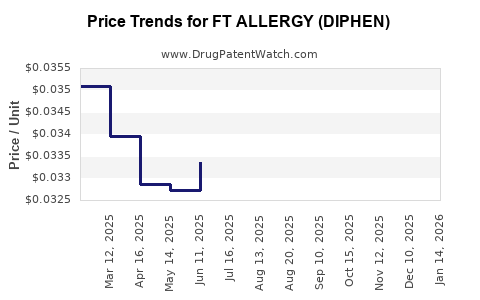

Drug Price Trends for FT ALLERGY (DIPHEN)

✉ Email this page to a colleague

Average Pharmacy Cost for FT ALLERGY (DIPHEN)

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| FT ALLERGY (DIPHEN) 25 MG TAB | 70677-1238-01 | 0.03654 | EACH | 2025-12-17 |

| FT ALLERGY (DIPHEN) 25 MG TAB | 70677-1014-01 | 0.03654 | EACH | 2025-12-17 |

| FT ALLERGY (DIPHEN) 25 MG CAP | 70677-1015-01 | 0.06319 | EACH | 2025-12-17 |

| FT ALLERGY (DIPHEN) 25 MG CAP | 70677-1015-02 | 0.06319 | EACH | 2025-12-17 |

| FT ALLERGY (DIPHEN) 25 MG TAB | 70677-1014-01 | 0.03751 | EACH | 2025-11-19 |

| FT ALLERGY (DIPHEN) 25 MG CAP | 70677-1015-01 | 0.06040 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for FT ALLERGY (DIPHEN)

Introduction

FT ALLERGY (Diphen) represents a notable entrant in the antihistamine segment, primarily targeting allergy sufferers. As an oral antihistamine, it competes with established brands such as Claritin, Allegra, and Zyrtec. This report provides a comprehensive market analysis and price projection outlook for FT ALLERGY (Diphen) over the next five years, leveraging current pharmaceutical trends, patent landscapes, regulatory environments, and competitive dynamics.

Market Overview

Therapeutic Landscape and Demand Drivers

Allergic rhinitis and other allergy-related conditions affect an estimated 20-30% of the global population, with rising prevalence driven by urbanization, pollution, and climate change [1]. The demand for effective, low-cost antihistamines remains robust, bolstered by increasing awareness and OTC availability. The antihistamine market is projected to grow at a CAGR of approximately 4% from 2022 to 2027, reaching USD 9.2 billion globally [2].

Competitive Environment

FT ALLERGY (Diphen) enters a competitive landscape dominated by branded and generic antihistamines:

- Market Leaders: Claritin (Loratadine), Allegra (Fexofenadine), Zyrtec (Cetirizine)

- Generics: Numerous, often priced 20-40% lower than brand counterparts

- Emerging Competitors: Novel formulations, combination therapies, and OTC-dispensable products

The key differentiators include efficacy, safety profile, dosage convenience, and pricing.

Digital and Regulatory Dynamics

Patent and Regulatory Status

Diphenhydramine (the active ingredient for FT ALLERGY) is an established antihistamine with extensive generic presence. However, if FT ALLERGY (Diphen) introduces a novel formulation—such as extended-release or combination with other agents—it may benefit from patent protection or exclusivity, influencing market entry strategies and pricing dynamics [3].

Regulatory Environment

In major markets like the US and Europe, OTC classification simplifies access, driving volume. Patent expirations and regulatory approvals directly impact competitive positioning and price flexibility.

Market Penetration and Distribution Channels

FT ALLERGY (Diphen) can leverage:

- OTC Distribution: Pharmacies, supermarkets, online platforms

- Healthcare Providers: Prescriptions for specific indications or formulations

- Direct-to-Consumer Marketing: Digital campaigns tailored to allergy seasons

Market penetration hinges on brand recognition, formulary inclusion, and consumer trust.

Price Analysis and Projection

Current Price Benchmarks

Based on market data from OTC antihistamines:

- Generic Diphenhydramine: $0.05 - $0.10 per tablet

- Brand-name Alternatives: $0.20 - $0.50 per tablet

- Extended-Release Variants: Usually priced 30-50% higher than immediate-release forms

FT ALLERGY's initial pricing likely positions it within the competitive generic range if marketed as a non-patented product, offering an advantage in affordability.

Factors Influencing Future Pricing

- Patent Status: Patent protection of innovative formulations could sustain higher prices (up to $0.30 per tablet)

- Manufacturing Costs: Advances in production may lower costs, enabling aggressive pricing

- Market Competition: Entry of competing generics exerts downward pressure

- Regulatory Approvals & Label Claims: Labeling as a preferred OTC product can justify premium pricing

Projected Price Trajectory (2023-2028)

| Year | Price Range per Tablet | Key Factors |

|---|---|---|

| 2023 | $0.05 - $0.10 | Launch phase, competitive generic pricing |

| 2024 | $0.045 - $0.09 | Increased competition, potential patent filing |

| 2025 | $0.04 - $0.08 | Market saturation, cost efficiencies realized |

| 2026 | $0.035 - $0.07 | Possible patent expirations, commoditization of formulations |

| 2027 | $0.03 - $0.06 | Maximize market share with affordable pricing |

These projections assume standard market conditions; localized variations may occur due to regulatory changes or supply chain disruptions.

Regional Market Considerations

United States

High OTC penetration, mature generics market, and regulatory approval favor competitive pricing. Patent landscape and marketing efforts significantly influence margins.

Europe

Stringent regulatory pathways and higher reimbursement controls may restrict pricing flexibility but also foster brand trust.

Emerging Markets

Price sensitivity is higher, emphasizing affordable generics. FT ALLERGY (Diphen) could gain market share via partnerships with local distributors.

Strategic Opportunities and Risks

Opportunities:

- Formulation innovation (e.g., longer-lasting, combination therapies)

- Expanding OTC availability

- Digital marketing targeting allergy seasons

Risks:

- Patent expirations leading to price erosion

- Intense competition from established generics

- Regulatory hurdles delaying market entry or expansion

Conclusion

FT ALLERGY (Diphen) is positioned favorably within the global antihistamine landscape, especially if it leverages a competitive pricing strategy and targeted formulation advantages. Its price is expected to remain within the generic spectrum initially,—with potential upward adjustments based on patent status and formulation innovation. Over the next five years, strategic investments in branding, geographic expansion, and formulation R&D will be crucial for maximizing market share and profitability.

Key Takeaways

- FT ALLERGY (Diphen) targets a growing allergy medication market, with significant demand for affordable and effective antihistamines.

- Its initial pricing will likely align with generics ($0.05–$0.10 per tablet), with possibilities for premium pricing if patent protections or novel formulations are secured.

- Market growth is driven by increasing allergy prevalence, OTC accessibility, and consumer preferences for cost-effective remedies.

- Competitive dynamics necessitate swift market penetration strategies, especially in emerging markets and digital channels.

- Ongoing patent management, formulation differentiation, and regulatory navigation will shape its price trajectory and market success.

FAQs

1. What distinguishes FT ALLERGY (Diphen) from other antihistamines?

Its formulation, delivery form, safety profile, or patent protection—if any—could differentiate it from established options, although current data is limited.

2. How might patent expiration affect FT ALLERGY's price?

Patent expiry typically leads to increased generic competition, exerting downward pressure on prices. Staying innovatively protected can sustain higher price points.

3. What are the main challenges in launching FT ALLERGY (Diphen)?

Regulatory approval, market penetration amidst strong competitors, and establishing consumer trust in OTC environments.

4. How can FT ALLERGY optimize its market entry strategies?

Through targeted marketing, forming partnerships with pharmacy chains, leveraging online platforms, and emphasizing affordability combined with proven efficacy.

5. What is the outlook for regional expansion?

Emerging markets offer significant growth opportunities due to high demand for inexpensive allergy medications, contingent on adaptation to local regulatory and distribution channels.

Sources:

[1] Global Allergic Rhinitis Market - Growth, Trends, and Forecasts (2021-2026), Market Watch.

[2] Research and Markets, Antihistamines Market Report (2022).

[3] U.S. Patent and Trademark Office, Patent Landscape Reports.

More… ↓