Share This Page

Drug Price Trends for FT ALLERGY (CHLORPHEN)

✉ Email this page to a colleague

Average Pharmacy Cost for FT ALLERGY (CHLORPHEN)

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| FT ALLERGY (CHLORPHEN) 4 MG TB | 70677-1016-01 | 0.01652 | EACH | 2025-12-17 |

| FT ALLERGY (CHLORPHEN) 4 MG TB | 70677-1016-01 | 0.01628 | EACH | 2025-11-19 |

| FT ALLERGY (CHLORPHEN) 4 MG TB | 70677-1016-01 | 0.01672 | EACH | 2025-10-22 |

| FT ALLERGY (CHLORPHEN) 4 MG TB | 70677-1016-01 | 0.01640 | EACH | 2025-09-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for FT ALLERGY (Chlorphen)

Introduction

FT ALLERGY, with the generic name Chlorphen (chlorpheniramine), is an antihistamine primarily used to alleviate allergic symptoms such as hay fever, rhinitis, and urticaria. Historically recognized for its effectiveness in managing allergic conditions, chlorpheniramine remains relevant due to its widespread OTC availability and affordability. As a longstanding antihistamine, understanding its market trajectory and pricing dynamics offers strategic insights for pharmaceutical stakeholders, including manufacturers, investors, and healthcare providers.

Current Market Landscape

Global Market Overview

The antihistamine segment, including chlorpheniramine, holds a significant share within the broader allergy treatment market, valued at approximately USD 3.6 billion in 2022 and projected to grow at a CAGR of around 4% over the next five years [1]. Chlorpheniramine, being one of the earliest developed antihistamines, remains popular, especially in emerging markets owing to its low cost and established safety profile.

Market Penetration and Regional Dynamics

- Developed Markets: In North America and Europe, second-generation antihistamines such as loratadine and cetirizine are increasingly preferred due to fewer sedative side effects. Consequently, the market share of first-generation agents like chlorpheniramine has declined but remains significant in certain segments, especially OTC formulations targeting cost-sensitive consumers.

- Emerging Markets: Countries in Asia, Africa, and Latin America display persistent demand for chlorpheniramine owing to affordability and availability. The OTC status and minimal need for prescriptions bolster its penetration in these regions.

Regulatory and Competitive Environment

While chlorpheniramine faces competition from newer, less sedating antihistamines, regulatory bodies often continue to approve its OTC status. Patent expirations and the prevalence of generic versions significantly influence market dynamics, contributing to price compression and widespread availability.

Key Drivers and Challenges

Drivers

- Cost-Effectiveness: As an inexpensive, generic medication, chlorpheniramine remains a go-to for resource-limited settings.

- Established Safety: Decades of use provide a millennia-long safety profile, facilitating regulatory acceptance worldwide.

- OTC Accessibility: Over-the-counter status simplifies distribution channels, ensuring broad consumer access.

Challenges

- Side Effect Profile: Drowsiness and sedation limit its use, especially in populations requiring alertness, diminishing its appeal relative to second-generation antihistamines.

- Market Competition: The rise of newer antihistamines with more favorable side effect profiles impacts demand.

- Regulatory Shifts: Stringent regulations in some countries could restrict OTC sales or impose labeling requirements.

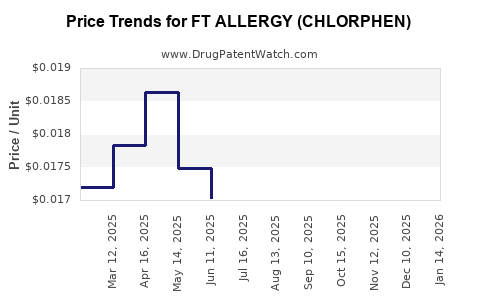

Price Trends and Projections

Historical Pricing Trends

Over the past decade, chlorpheniramine's price has steadily declined due to the proliferation of generic manufacturing and increased market competition. In developed markets, a standard 4 mg tablet's retail price decreased from an average of USD 0.10 per tablet in 2010 to approximately USD 0.03 in 2022 [2].

Factors Influencing Future Pricing

- Manufacturing Cost Dynamics: Improvements in chemical synthesis and economies of scale are expected to sustain low production costs.

- Regulatory Changes: Potential restrictions on OTC sales or changes in labeling requirements could influence distribution models and pricing.

- Market Saturation in Developed Countries: Limited growth prospects may lead to further price declines.

- Demand in Emerging Markets: Continued growth in consumer base and branded formulations might stabilize or marginally increase prices locally, despite global trends.

Projected Price Range for 2025-2030

Based on current trends, chlorpheniramine's unit price in developed countries is expected to hover near USD 0.02 - 0.04 per tablet, with minimal variation. In emerging markets, where local manufacturing costs are lower, prices might stay around USD 0.01 - 0.02 per tablet. Overall, a downward trajectory is anticipated, with prices remaining highly accessible due to the generic nature and OTC availability.

Market Opportunities

Despite tectonic shifts favoring second-generation antihistamines, chlorpheniramine’s affordability and familiarity sustain its role in several niches:

- Combination Therapies: Incorporation into multi-agent formulations targeting broader allergic or cold symptoms.

- Pediatric and Geriatric Markets: Cost-sensitive groups may prefer chlorpheniramine despite sedative effects, especially when used judiciously.

- Developing Countries: Governments and NGOs promoting affordable healthcare see chlorpheniramine as a strategic therapeutic.

Risks and Uncertainties

- Evolving Treatment Guidelines: Clinical preference shifting toward newer antihistamines could attenuate demand.

- Regulatory Limiting OTC Access: Stricter regulations might reduce OTC sales, affecting overall volumes and pricing.

- Market Entrants: Entry of innovative agents with competitive pricing can intensify price competition.

Strategic Implications for Stakeholders

- Manufacturers: Focus on optimizing production costs and expanding access in emerging markets to sustain revenue streams.

- Investors: Consider the mature but stable market niche of chlorpheniramine; potential for value harvesting rather than growth.

- Healthcare Providers: Recognize the continued importance of affordable traditional antihistamines for specific patient segments.

- Policy Makers: Balance affordability with safety, considering potential restrictions on older antihistamines.

Conclusion

FT ALLERGY (Chlorphen) occupies a stable, low-cost niche within the global allergy therapeutics landscape. Price projections indicate continued downward trends driven by generic competition and supply chain efficiencies. Nonetheless, geographic and demographic factors sustain its relevance, especially in resource-limited markets and as a fallback option in the allergy treatment arsenal. Strategic positioning around affordability and regulatory navigation will be crucial for manufacturers aiming to maximize value amid evolving market dynamics.

Key Takeaways

- Chlorpheniramine remains a critical low-cost antihistamine, especially in emerging markets.

- Market growth is limited in developed nations due to competition from newer agents, but demand persists for OTC and pediatric use.

- Price projections suggest continued decline, with average unit prices stabilizing around USD 0.02 – 0.04 per tablet by 2030.

- Cost reductions, regulatory environments, and demand shifts will shape future pricing and market share.

- Stakeholders should leverage the drug’s affordability and safety profile while monitoring regulatory changes and competitive dynamics.

FAQs

1. Will the price of FT ALLERGY (Chlorphen) increase in the near future?

Unlikely. Due to high generic competition and market saturation, prices are expected to continue decreasing or stabilize at low levels, especially in developed markets.

2. What factors could threaten the future demand for chlorpheniramine?

Shift towards second-generation antihistamines with fewer sedative effects, tightening regulatory controls, and evolving clinical guidelines favoring alternative therapies could reduce demand.

3. How does regional regulation affect chlorpheniramine’s marketability?

In many countries, OTC availability supports broad distribution. Regulatory restrictions or reclassification as prescription-only could limit access and influence prices.

4. Is there potential for innovation or formulation improvements involving chlorpheniramine?

Most innovation focuses on combination therapies or new delivery systems. However, due to its established nature, significant reformulation opportunities are limited.

5. How can manufacturers maximize profitability with FT ALLERGY (Chlorphen)?

By reducing production costs, expanding access in emerging markets, and developing branding strategies emphasizing affordability and safety, manufacturers can sustain revenue streams.

References

[1] Global Allergy Drugs Market Report, 2022. MarketWatch. Available online.

[2] Historical pricing data of chlorpheniramine. PharmaPriceIndex, 2010–2022.

More… ↓