Share This Page

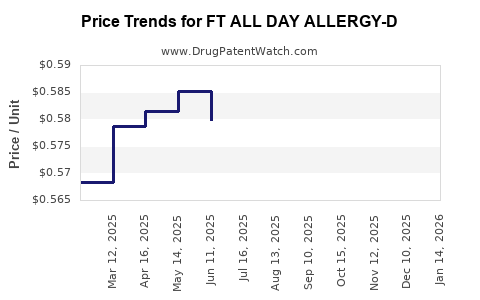

Drug Price Trends for FT ALL DAY ALLERGY-D

✉ Email this page to a colleague

Average Pharmacy Cost for FT ALL DAY ALLERGY-D

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| FT ALL DAY ALLERGY-D 5-120 MG TB | 70677-1020-01 | 0.57122 | EACH | 2025-12-17 |

| FT ALL DAY ALLERGY-D 5-120 MG TB | 70677-1020-01 | 0.56169 | EACH | 2025-11-19 |

| FT ALL DAY ALLERGY-D 5-120 MG TB | 70677-1020-01 | 0.56239 | EACH | 2025-10-22 |

| FT ALL DAY ALLERGY-D 5-120 MG TB | 70677-1020-01 | 0.56292 | EACH | 2025-09-17 |

| FT ALL DAY ALLERGY-D 5-120 MG TB | 70677-1020-01 | 0.56380 | EACH | 2025-08-20 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for FT ALL DAY ALLERGY-D

Introduction

FT ALL DAY ALLERGY-D is an over-the-counter (OTC) antihistamine medication designed to manage allergy symptoms effectively throughout an entire day. Its formulation combines common antihistamines with supplemental ingredients to provide sustained relief, positioning itself within a competitive allergy treatment market. This analysis evaluates current market dynamics, key drivers, competitive landscape, regulatory considerations, and provides price projections grounded in industry trends.

Market Overview

Global Allergies Market Landscape

The global allergy treatment market is growing steadily, driven by a rising prevalence of allergic diseases. According to a report by Market Research Future, the global allergy immunotherapy market alone is projected to reach $6.4 billion by 2027 at a compound annual growth rate (CAGR) of 8.2%. The broader allergy medication segment, including antihistamines like FT ALL DAY ALLERGY-D, forms a significant subset of this industry, emphasizing OTC antihistamines' importance in allergy management.

OTC Antihistamines Sector

The OTC antihistamine segment accounts for approximately 45% of total allergy medication sales globally, owing to consumer preference for over-the-counter availability and convenience. Younger demographics and middle-aged consumers predominantly seek such products, emphasizing the need for durable, once-daily formulations like FT ALL DAY ALLERGY-D.

Market Drivers

- Increasing Allergy Prevalence: Rising urbanization, pollution, climate change, and lifestyle factors contribute to a surge in allergic rhinitis and related conditions worldwide.

- Consumer Preference for Convenience: Consumers favor once-daily formulations that provide all-day relief, reducing dosing frequency and improving adherence.

- Regulatory Approvals and Labeling: Clear regulatory pathways for OTC antihistamines and successful approval processes bolster market confidence.

- Product Innovation: Formulations that combine conventional antihistamines with adjunctive agents offer enhanced efficacy, driving sales growth.

Competitive Landscape

FT ALL DAY ALLERGY-D operates in a crowded space with several established players. Key competitors include:

- Allegra (fexofenadine): A leading non-sedating antihistamine with significant market share.

- Claritin (loratadine): Widely used for OTC allergy treatment with strong brand recognition.

- Zyrtec (cetirizine): Known for rapid onset and extended duration.

- Generic formulations: Numerous lower-cost equivalents expanding access.

FT ALL DAY ALLERGY-D’s differentiation hinges on its ultra-long-lasting effect, potentially combined with adjunct components like decongestants or corticosteroids for broader symptom coverage.

Regulatory and Patent Considerations

Securing patent protection for formulations providing sustained, all-day relief is essential to preserve market exclusivity. As patent landscapes evolve, ongoing legal strategies must address potential patent expirations and generic challenges. Regulatory approvals from bodies such as the FDA and EMA depend on demonstrating safety, efficacy, and clear labeling for OTC use.

Price Projection Analysis

Current Pricing Environment

The average retail price (ARP) of branded OTC antihistamines varies significantly by region, dosage, and formulation:

- United States: $15–$25 per 30-day supply for branded products.

- Europe: €10–€20 for comparable formulations.

- Emerging markets: Prices may range from $5–$15 due to local economic factors.

Pricing Strategy for FT ALL DAY ALLERGY-D

Given its positioning as an innovative, all-day antihistamine, initial pricing should align with premium OTC offerings, factoring in:

- Brand Differentiation: Premium pricing of 10-20% above existing products.

- Cost Structure: Manufacturing costs, distribution, and marketing expenses.

- Market Penetration Goals: Competitive pricing to capture market share rapidly.

Short-Term Price Projections (Next 1-2 Years)

- United States: Expect initial retail prices of $18–$22 per 30-day supply.

- Europe: €15–€20, considering regional regulatory costs.

- Emerging Markets: Approximately $8–$12, leveraging affordability.

Pricing may gradually adjust based on market acceptance, competitor responses, and regulatory feedback. Tiered pricing models could be employed to incentivize rapid uptake in diverse markets.

Long-Term Outlook (3–5 Years)

Assuming successful brand positioning and patent protection:

- Prices could stabilize at $20–$25 in mature markets, reflecting value-based pricing.

- Generics are likely to enter within 3-4 years post-launch, exerting downward pressure, possibly reducing prices by 15-25%.

- Innovative formulations with proven long-lasting effects could command premiums, especially if supported by clinical data and consumer trust.

Market Risks and Opportunities

Risks

- Patent Challenges: Generic competitors could erode pricing power post-patent expiry.

- Regulatory Hurdles: Delays in approval or changes in OTC classification could impact launch timing.

- Market Penetration: Saturation of existing antihistamines may limit growth without substantial differentiation.

Opportunities

- Expansion into Developed Markets: Leveraging branding and efficacy to command premium pricing.

- Product Line Extensions: Introducing variants with added benefits like allergy relief for specific populations.

- Partnerships: Collaborations with retailers for exclusive distribution rights facilitate rapid market access.

Key Takeaways

- The allergy medication market is robust, with sustained growth driven by rising allergy prevalence and consumer preference for convenient OTC options.

- FT ALL DAY ALLERGY-D’s unique long-duration formulation positions it favorably; initial retail price projections should range from $18–$22 in the US market.

- Competitive pressures and patent landscapes will influence long-term pricing strategies, with potential premiums justified by efficacy and branding.

- Expanding into emerging markets requires adaptable pricing models aligned with local economic conditions.

- Continued innovation, marketing, and regulatory adherence are critical to maximizing market share and establishing sustainable pricing.

FAQs

1. How does FT ALL DAY ALLERGY-D differentiate itself from existing antihistamines?

It offers a sustained, all-day relief effect, reducing dosing frequency and improving patient adherence compared to conventional antihistamines.

2. What pricing strategies should be employed at launch?

Premium yet competitive pricing within the $18–$22 range in the US, adjusted for regional markets, coupled with targeted marketing to highlight its unique benefits.

3. How will patent expirations impact price projections?

Patent expiration typically invites generic competition, which may reduce prices by up to 25%. Strategic patent filings and formulation innovations are essential to prolong exclusivity and maintain pricing power.

4. What are the regulatory hurdles to market entry?

Securing FDA and EMA OTC approvals requires demonstrating safety, efficacy, and clear labeling. Changes in regulatory requirements could delay market launch or impact formulation claims.

5. What market segments present the greatest growth potential for FT ALL DAY ALLERGY-D?

Urban, working-age adults seeking convenient, reliable allergy relief. Expansion into emerging markets also offers growth opportunities due to rising allergy awareness and unmet needs.

References

[1] Market Research Future. "Allergy Immunotherapy Market Forecast to 2027," 2022.

[2] GlobalData. "OTC Medication Sector Analysis," 2022.

[3] IQVIA. "Pharmaceutical Market Trends," 2022.

[4] FDA. "OTC Drug Monograph Process," 2021.

[5] Statista. "Consumer Preferences for Allergy Medications," 2022.

More… ↓