Share This Page

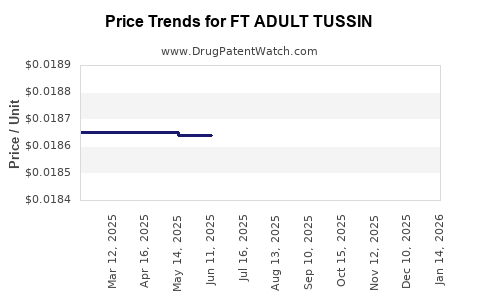

Drug Price Trends for FT ADULT TUSSIN

✉ Email this page to a colleague

Average Pharmacy Cost for FT ADULT TUSSIN

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| FT ADULT TUSSIN CF LIQUID | 70677-1187-01 | 0.01859 | ML | 2025-12-17 |

| FT ADULT TUSSIN 200 MG/10 ML | 70677-1186-01 | 0.02221 | ML | 2025-12-17 |

| FT ADULT TUSSIN 200 MG/10 ML | 70677-1186-02 | 0.01858 | ML | 2025-12-17 |

| FT ADULT TUSSIN CF LIQUID | 70677-1187-01 | 0.01860 | ML | 2025-11-19 |

| FT ADULT TUSSIN 200 MG/10 ML | 70677-1186-01 | 0.02148 | ML | 2025-11-19 |

| FT ADULT TUSSIN 200 MG/10 ML | 70677-1186-02 | 0.01881 | ML | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for FT ADULT TUSSIN

Introduction

FT ADULT TUSSIN, a widely used over-the-counter (OTC) cough suppressant and cold remedy, holds a prominent position within the respiratory medication market. As consumers increasingly prioritize effective, accessible, and trusted cold and cough remedies, detailed market analysis and precise price projections for FT ADULT TUSSIN become essential for stakeholders ranging from pharmaceutical manufacturers to investors. This analysis explores current market dynamics, competitive landscape, regulatory factors, and future pricing trajectories.

Market Overview

Product Profile and Positioning:

FT ADULT TUSSIN primarily offers multi-symptom relief, targeting cough, congestion, sore throat, and related cold symptoms in adult consumers. Its popularity stems from brand recognition, efficacy, and availability across retail channels. It typically contains active ingredients such as dextromethorphan (antitussive), guaifenesin (expectorant), and phenylephrine (decongestant), aligning with consumer demand for comprehensive symptom management.

Market Size and Growth:

The OTC cough and cold market in the United States reflects consistent demand, with estimates reaching approximately USD 8 billion annually [1]. The segment is projected to grow at a compounded annual growth rate (CAGR) of 3-4% over the next five years, driven by aging populations, increased health awareness, and ongoing viral respiratory outbreaks such as influenza and COVID-19.

Consumer Demographics and Behavior:

Adults aged 35-65 constitute the primary consumer base, valuing convenience and trusted brands. The rise of e-commerce platforms, including digital pharmacy services, enhances accessibility, bolstering sales volumes. Natural and organic alternatives are emerging, but traditional remedies like FT ADULT TUSSIN maintain dominance due to entrenched consumer loyalty.

Competitive Landscape

The competitive environment for FT ADULT TUSSIN involves both branded and generic players, with key competitors including Mucinex, Robitussin, and store brands from CVS, Walgreens, and Walmart. Brand loyalty, pricing strategies, marketing campaigns, and formulations contribute significantly to market share.

Regulatory Factors:

The US Food and Drug Administration (FDA) regulates OTC cough and cold medicines, influencing formulation standards, labeling, and packaging. Recent regulatory discussions centered on safety concerns regarding dextromethorphan, with certain age-based restrictions and media coverage impacting consumer perception and sales [2].

Distribution Channels:

Mainstream retail chains, supermarkets, drugstores, and e-pharmacies comprise the primary distribution channels. Direct-to-consumer sales are facilitated through online platforms, driven by pandemic-related shifts toward home deliveries.

Current Pricing Dynamics

Price Range and Factors:

Pricing for FT ADULT TUSSIN varies based on package size, formulation, and retailer. A typical 4 fl oz (118 ml) bottle retails between USD 6-8, with larger packs (8-12 fl oz) priced proportionally higher. Competitive pricing contributes to consumer retention, while promotional discounts and loyalty programs influence purchasing patterns.

Market Influences on Price:

Factors such as raw material costs (notably active pharmaceutical ingredients), manufacturing expenses, logistic costs, and regulatory compliance influence consumer retail prices. Vibrant competition from generics exerts downward pressure, maintaining price stability in the mid-range segment.

Price Projections (2023–2028)

Short-term Outlook (2023–2025):

Given current market trends, the price of FT ADULT TUSSIN is expected to remain relatively stable with marginal fluctuations, primarily driven by inflationary pressures in raw materials and distribution costs. The average retail price of existing formulations is projected to rise modestly at a CAGR of approximately 1-2% per annum.

Long-term Outlook (2025–2028):

Emerging factors could influence pricing trajectories:

- Regulatory Changes: Tightening of safety regulations could lead to reformulation costs or product reformulations, potentially affecting prices.

- Market Expansion: Introduction of new formulations (e.g., multi-symptom variants, natural ingredients) could command premium pricing.

- Competitive Dynamics: Increased generic penetration would likely sustain or depress prices, emphasizing value propositions.

- Supply Chain Disruptions: Fluctuations in raw material availability, especially amid geopolitical or pandemic-related disruptions, may temporarily inflate prices.

Considering these factors, FT ADULT TUSSIN's retail price is projected to grow at a CAGR of 1-3% over the next five years, maintaining parity with inflation and competitive positioning.

Market Trends and Strategic Implications

-

Growth of Natural and Organic Alternatives:

Demand for cleaner formulations could pressure traditional brands to innovate, potentially elevating prices for premium natural variants and influencing market segmentation. -

Digital Transformation:

E-commerce sales channels may offer competitive discounts, constraining retail pricing but increasing overall volume. -

Consumer Education and Safety:

Heightened awareness campaigns around OTC medication safety may alter purchasing behaviors, prompting manufacturers to innovate with lower-dose or reformulated products aligned with regulatory standards. -

Global Expansion:

Emerging markets presenting unmet demand for OTC cold remedies could become significant expansion avenues, possibly impacting pricing strategies through localized formulations and pricing.

Key Takeaways

-

Stable Core Market: FT ADULT TUSSIN is positioned in a mature, stable OTC cold remedy segment, with modest growth driven by demographic factors and seasonal demand patterns.

-

Pricing Trajectory: Expect minor annual price increases (1-2%) driven by inflation, raw material costs, and regulatory compliance, with potential for premium formulations to command higher prices.

-

Competitive Pressure: Intense competition from generics and store brands will continue to exert downward pricing pressures, emphasizing value-based offerings.

-

Innovation and Regulation: Emerging safety regulations and consumer preferences will shape future formulations, potentially driving prices upward for non-traditional variants.

-

Market Expansion: International markets and e-commerce platforms offer growth opportunities, potentially influencing pricing strategies and product positioning.

Conclusion

FT ADULT TUSSIN remains a cornerstone in OTC cold remedy markets, with outlooks favoring steady, moderate price increases aligned with inflation and market dynamics. Stakeholders should monitor regulatory developments, consumer trends favoring natural products, and technological shifts facilitating online sales to optimize pricing and market penetration strategies.

FAQs

1. What factors influence the pricing of FT ADULT TUSSIN?

Pricing is affected by raw material costs, manufacturing expenses, distribution logistics, competitive pressures, regulatory compliance, and retailer markdowns.

2. How does regulatory oversight impact FT ADULT TUSSIN's market?

Regulatory agencies like the FDA influence formulations, labeling, and safety standards, prompting reformulations or labeling changes that can impact manufacturing costs and pricing.

3. What are the key competitors to FT ADULT TUSSIN?

Major competitors include Mucinex, Robitussin, and store-brand products from retail pharmacies. Competition hinges on price, efficacy, brand loyalty, and formulations.

4. How might emerging consumer preferences affect FT ADULT TUSSIN prices?

Growing demand for natural, organic, and non-synthetic formulations could lead to premium pricing for new variants while traditional products face pricing pressures.

5. What is the outlook for FT ADULT TUSSIN's global market?

Emerging markets offer growth opportunities driven by unmet demand. Localization and pricing strategies will be critical to capturing market share internationally.

Sources:

- [MarketWatch, OTC Cough and Cold Market Size & Trends, 2022]

- [FDA, Safety Regulations for OTC Medications, 2022]

More… ↓