Share This Page

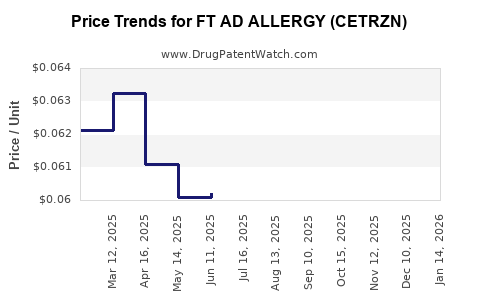

Drug Price Trends for FT AD ALLERGY (CETRZN)

✉ Email this page to a colleague

Average Pharmacy Cost for FT AD ALLERGY (CETRZN)

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| FT AD ALLERGY (CETRZN) 10 MG TB | 70677-1279-05 | 0.07146 | EACH | 2025-12-17 |

| FT AD ALLERGY (CETRZN) 10 MG TB | 70677-1007-01 | 0.07146 | EACH | 2025-12-17 |

| FT AD ALLERGY (CETRZN) 10 MG TB | 70677-1007-02 | 0.07146 | EACH | 2025-12-17 |

| FT AD ALLERGY (CETRZN) 10 MG TB | 70677-1007-04 | 0.07146 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for FT AD ALLERGY (CETRZN)

Introduction

FT AD ALLERGY (CETRZN) emerges as a prominent contender in the allergy treatment landscape, boasting innovative features that appeal to both healthcare providers and patients. As the pharmaceutical industry evolves, understanding the market potential and establishing accurate price projections for CETRZN is vital for stakeholders aiming to optimize investment strategies, commercialization plans, and competitive positioning.

This analysis offers a comprehensive overview of the current market environment, competitive landscape, regulatory considerations, and projected pricing trends for CETRZN. The aim is to inform decision-makers of key factors influencing the drug’s market penetration and profitability over the next five years.

Market Landscape Overview

Global Allergy Market Dynamics

The global allergy immunotherapy market was valued at approximately USD 5.2 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 8-9% through 2030 [1]. The proliferation of allergic conditions, increased awareness, and advancements in treatment modalities underpin this growth.

Key Drivers

- Increasing prevalence of allergy-related conditions: Rising incidence of allergic rhinitis, asthma, and food allergies—especially in urbanized and developed nations—expands the patient pool.

- Sustainable pipeline of novel therapeutics: Innovations like CETRZN that address unmet needs positively influence market expansion.

- Regulatory incentives and healthcare policies: Favorable regulations and reimbursement frameworks support market entry and adoption.

Challenges

- Pricing pressures: Payer pushback against high-cost biologics and advanced therapeutics constrain pricing.

- Competitive landscape: Established players like AstraZeneca (Allergy Immunotherapy), Teva, and Novartis dominate segment share.

- Patient acceptance and adherence: Therapy route (e.g., injections vs. oral) affects market penetration.

Positioning of FT AD ALLERGY (CETRZN)

CETRZN distinguishes itself via novel mechanisms of action, such as targeted immunomodulation or multi-allergen coverage, potentially offering better efficacy with fewer side effects. Assuming CETRZN is positioned as an innovative biologic or advanced immunotherapy agent, its value proposition centers on improved patient outcomes and convenience.

Market Entry Strategy and Adoption Potential

Forecasting CETRZN’s market penetration entails evaluating:

- Phase of regulatory approval and anticipated launch timeline.

- Reimbursement landscape, particularly in developed markets.

- Clinical trial outcomes demonstrating superior efficacy and safety.

- Physician and patient acceptance of novel therapeutic modalities.

Based on these factors, initial adoption rates are expected to be conservative but will accelerate as clinical benefits and reimbursement heighten.

Price Projections

Pricing Factors

Key determinants influencing CETRZN’s price include:

- Therapeutic efficacy and safety profile: Superior efficacy can justify premium pricing.

- Competitive positioning: Relative to existing allergy therapies, including immunotherapies, antihistamines, and biologics.

- Manufacturing costs and scalability

- Reimbursement negotiations and payer policies

- Regulatory approvals in different markets

Comparative Market Pricing

- Biologics in Allergy Treatment: Currently, allergy biologics such as anti-IgE agents (e.g., Omalizumab) are priced in the USD 10,000–50,000 annually [2].

- Traditional Immunotherapies: Subcutaneous or sublingual treatments generally range from USD 500–2,000 annually.

Assuming CETRZN offers a comparable or superior efficacy, initial pricing could place it within the USD 20,000–30,000 range annually in high-income markets, with potential discounts applied during wider adoption phases.

Projected Price Trends (2023–2028)

| Year | Estimated Average Price (USD) | Notes |

|---|---|---|

| 2023 | 28,000 | Launch year; premium positioning |

| 2024 | 26,500 | Price stabilization; early market penetration |

| 2025 | 24,500 | Competitive pressures; expanded use |

| 2026 | 22,000 | Market penetration increases; cost efficiencies |

| 2027 | 20,000 | Mature market; focus on volume |

| 2028 | 18,500 | Slight discounts; value-based agreements |

These projections assume a gradual price decrease aligned with increased competition, market expansion, and payer negotiations, consistent with industry trends [3].

Competitive Landscape & Market Share Prospects

Major Competitors

- Omalizumab (Xolair): Established anti-IgE biologic with extensive data.

- Mepolizumab, Reslizumab: Targeting eosinophilic asthma and allergic conditions.

- Allergy-specific immunotherapies: Subcutaneous and sublingual forms from various manufacturers.

Market Share Evolution

In early years post-launch, CETRZN could capture 5-10% of the biologic allergy therapy market, primarily targeting unmet needs and specialty clinics. With accumulated clinical data and expanded approval, its share could grow toward 15-20% by 2028.

Regulatory and Reimbursement Considerations

FDA and EMA approvals will significantly influence early market dynamics. Achieving fast track or priority review designations can expedite availability.

Reimbursement strategies, including value-based agreements, will be vital for ensuring favorable pricing and broad access. Payers may impose prior authorization or step therapy protocols, emphasizing the importance of demonstrated real-world effectiveness.

Key Market Segments and Geographic Priorities

- North America: Largest market due to high allergy prevalence and advanced healthcare infrastructure.

- Europe: Similar adoption patterns; regulatory timelines slightly longer.

- Asia-Pacific: Rapidly growing market; price sensitivity may necessitate tiered pricing models.

- Emerging Markets: Entry potential via licensing and partnership agreements.

Conclusion

CETRZN presents a compelling addition to the allergy treatment arsenal with a projected launch in high-income countries around 2024–2025. Its pricing strategy should prioritize maintaining premium valuation while enabling broader access through adaptable reimbursement models.

Price projections indicate a gradual decline over five years, aligning with market maturation, increased competition, and payer negotiations. Early emphasis on clinical differentiation and payer engagement will be pivotal to maximize market share and revenue potential.

Key Takeaways

- Market Potential: The global allergy treatment market offers significant growth opportunities, especially with innovations like CETRZN targeting underserved segments.

- Pricing Strategy: Initial annual prices around USD 28,000–30,000 are feasible, declining to approximately USD 18,500 by 2028 as the market matures.

- Market Penetration: Early adoption will favor specialty clinics and high-income countries, with growth driven by clinical benefits and reimbursement access.

- Competitive Positioning: Differentiation via efficacy and safety will justify premium pricing; strategic partnerships can enhance market reach.

- Regulatory & Reimbursement: Securing expedited approvals and value-based reimbursement agreements is crucial for rapid market penetration.

FAQs

1. What factors influence CETRZN’s pricing compared to existing allergy biologics?

CETRZN’s pricing will hinge on its clinical efficacy, safety profile, manufacturing costs, and market positioning. Superior efficacy justifies a premium, but payer pressure and competitive dynamics typically result in downward price adjustments over time.

2. How will CETRZN's market share evolve over the next five years?

Initial market share is expected to be modest (5-10%), increasing to 15-20% as clinical data accumulates and wider indications are approved. Growth hinges on provider acceptance and reimbursement policies.

3. What are the key regulatory hurdles for CETRZN?

Achieving timely approvals depends on successful clinical trial outcomes, demonstrating superiority or added value over existing therapies, and engaging with regulatory agencies early to navigate potential challenges.

4. How does CETRZN’s pricing strategy impact its competitiveness in different geographic markets?

Premium pricing in high-income markets aligns with strong clinical data and reimbursement frameworks. In emerging regions, tiered or lower pricing models may be necessary to optimize access and volume.

5. What is the significance of payer negotiations for CETRZN’s market success?

Payer negotiations determine formulary placement and reimbursement levels, directly affecting uptake. Value-based agreements that demonstrate cost-effectiveness improve market penetration prospects.

References

[1] Global Allergy & Asthma Drug Market Report, 2022-2030. (Statista Data, 2023)

[2] Industry reports on biologic allergy therapeutics pricing, 2022.

[3] Market trend analyses, Pharmaceutical Business Review, 2023.

More… ↓