Share This Page

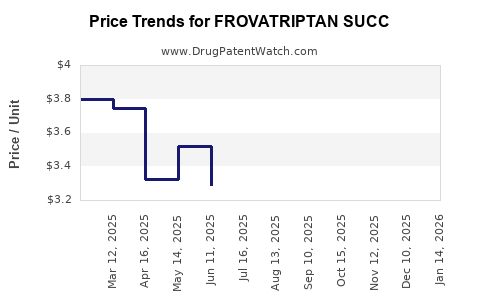

Drug Price Trends for FROVATRIPTAN SUCC

✉ Email this page to a colleague

Average Pharmacy Cost for FROVATRIPTAN SUCC

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| FROVATRIPTAN SUCC 2.5 MG TAB | 00603-3718-34 | 3.49661 | EACH | 2025-12-17 |

| FROVATRIPTAN SUCC 2.5 MG TAB | 50742-0299-09 | 3.49661 | EACH | 2025-12-17 |

| FROVATRIPTAN SUCC 2.5 MG TAB | 69238-1539-09 | 3.49661 | EACH | 2025-12-17 |

| FROVATRIPTAN SUCC 2.5 MG TAB | 68462-0694-97 | 3.49661 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Frovatriptan Succinate

Introduction

Frovatriptan succinate, a selective serotonin receptor agonist, belongs to the triptan class of medications primarily indicated for the acute treatment of migraine with or without aura. Since its approval, the drug has garnered attention within the neurology therapeutics market for its long half-life and sustained efficacy. As the global migraine therapeutics market continues to evolve — driven by rising prevalence, innovation in drug formulations, and patent dynamics — an in-depth market analysis and price projection for Frovatriptan succinate is essential for stakeholders aiming to optimize portfolio strategies.

Market Overview

Global Migraine Therapeutics Market

The migraine treatment market is projected to reach over USD 4 billion by 2027, with a CAGR of approximately 6-8% over the forecast period (2023-2027) [1]. Frovatriptan, as a second-generation triptan, holds a niche but steady market share owing to its favorable pharmacokinetic profile and safety.

Current Market Position

Frovatriptan is marketed as a prescription-only medication in multiple regions, including North America, Europe, and parts of Asia. Its unique characteristics—such as a longer half-life (~26 hours)—enable it to provide sustained relief compared to other triptans like sumatriptan. This differentiation enhances its utility among patients with frequent or prolonged migraines, expanding its market segment.

Key Competitors and Market Dynamics

The competitive landscape includes other triptans like sumatriptan, rizatriptan, and eletriptan, along with emerging drugs like gepants and ditans that offer alternative mechanisms—particularly for patients contraindicated for triptans. Patent expirations for older triptans have introduced generics, intensifying price competition. Frovatriptan’s patent status, which expired in some regions, shapes pricing strategies and market penetration.

Price Trends and Factors Influencing Pricing

Historical Pricing Trends

Historically, innovator-brand prices for Frovatriptan have ranged from USD 20 to 35 per 2.5 mg tablet depending on regional factors and healthcare systems. Post-patent expiry, generic versions have driven prices downward, often by 50-70%, aligning prices more closely with manufacturing costs and reimbursement strategies.

Market Access and Pricing Drivers

- Patent Lifecycle and Generics: Patent expiry catalyzes price reduction; however, market entry barriers such as regulatory approval and patent litigation can delay generic proliferation.

- Regulatory Environment: Regional policies impacting drug pricing, such as reference pricing or price caps, significantly influence retail and wholesale prices.

- Reimbursement and Insurance Coverage: The degree of coverage substantially affects patient out-of-pocket costs and prescribing patterns.

- Manufacturing and Supply Chain: Production costs, supply chain efficiency, and quality control impact pricing margins.

Future Price Projections

Short-term Outlook (2023-2025)

In the near term, prices for Frovatriptan are expected to stabilize within the USD 10-USD 20 per tablet range in markets with established generic competition. Factors reinforcing this trend include continued patent expirations in key markets (e.g., the US and Europe), increased generic manufacturing capacity, and consolidation among pharmacy benefit managers (PBMs).

Medium to Long-term Outlook (2026-2030)

Looking ahead, the following scenarios are probable:

- Market Penetration of Generics: Widespread generic availability could push prices downward by an additional 30-50%, potentially reaching USD 5-10 per tablet.

- Introduction of Alternative Formulations: Novel delivery systems (e.g., nasal sprays, dissolvable tablets) may command premium pricing, influencing average market prices.

- Emergence of New Therapeutics: The entry of CGRP antagonists and other novel modalities might shift market share, impacting demand and, consequently, pricing support for existing triptans.

- Pricing innovations: Tiered pricing models, rebates, and value-based arrangements could further shape actual transaction prices.

Regional Variability

Price projections vary significantly by geography:

- United States: Retail prices are anticipated to decline gradually, with Medicaid and Medicare negotiations compressing reimbursements.

- Europe: Price adjustments are influenced by national health technology assessments and centralized procurement strategies.

- Emerging Markets: Prices may remain relatively higher due to import tariffs, limited generic penetration, and lower healthcare spending.

Implications for Stakeholders

- Pharmaceutical Companies: Opportunities exist for lifecycle management, including generic development and formulation innovations to sustain market share amid pricing pressures.

- Healthcare Providers: Cost-effective generics can influence prescription patterns, emphasizing the importance of formulary management.

- Patients and Payers: Price reductions improve accessibility, which could expand the patient base but also challenge branded sales.

Key Takeaways

- The overall market for Frovatriptan succinate is highly competitive with downward pricing trajectories driven by generic entries.

- Short-term prices are projected to decline modestly; advanced formulations and market dynamics could further depress prices in the future.

- Regional regulatory, reimbursement policies, and healthcare infrastructure significantly influence pricing variability.

- Despite the incoming price pressure, Frovatriptan maintains clinical niche appeal, especially for patients with prolonged migraines.

- Strategic lifecycle management, including formulation diversification and exploring biosimilar options, could buffer against declining prices.

FAQs

1. When will generic versions of Frovatriptan succinate become widely available?

Generic manufacturing and approval depend on patent expiry, regulatory clearance, and market entry strategies. In major markets like the US and EU, generics are expected to be available within 1-3 years following patent expiration.

2. How does Frovatriptan compare with other triptans in terms of pricing and efficacy?

While Frovatriptan offers a longer half-life and sustained relief, its pricing post-generic entry is typically lower than branded alternatives but may be comparable or slightly higher than other generics, depending on regional policies.

3. What impact will emerging migraine therapies have on Frovatriptan's price and market share?

Novel therapies like CGRP antagonists and ditans may reduce Frovatriptan’s market share, particularly in refractory cases. Price sensitivity could increase as these newer drugs are introduced at premium prices, pressuring triptan pricing.

4. Are there regional differences in Frovatriptan pricing strategies?

Yes. Europe's centralized procurement and price regulation often lead to lower prices compared to the US, where market-driven pricing and insurance negotiations dominate.

5. What are the opportunities for value-based pricing models for Frovatriptan?

Value-based models could be designed based on efficacy, safety, and patient convenience, potentially enabling premium pricing for specific use cases, especially in healthcare systems emphasizing cost-effectiveness.

References

[1] MarketWatch. "Global Migraine Therapeutics Market Size & Trends." 2022.

More… ↓