Last updated: July 27, 2025

Introduction

FOSAMAX PLUS D, a combination medication manufactured by Merck, merges alendronate sodium—a bisphosphonate used to treat and prevent osteoporosis—with vitamin D3. Its unique formulation addresses both bone density decline and vitamin D deficiency, positioning it as a key therapy for postmenopausal women and at-risk populations. Given the aging global demographic and rising osteoporosis prevalence, understanding its market landscape and future pricing trajectory is essential for manufacturers, healthcare providers, and investors. This analysis combines current market dynamics, regulatory trends, competitive positioning, and pricing trends to provide a comprehensive outlook on FOSAMAX PLUS D.

Market Overview

Epidemiology and Demand Drivers

Osteoporosis affects over 200 million women worldwide, with postmenopausal women constituting the primary demographic. The World Health Organization estimates that approximately 1 in 3 women over 50 years old will experience osteoporotic fractures [1]. The increasing aging population globally—projected to reach 1.5 billion individuals aged 65+ by 2050—ensures sustained demand for osteoporosis therapies.

Further compounding demand are heightened awareness and improved diagnostic protocols. The decline in fracture-related morbidity has propelled physicians toward early intervention, favoring combination therapies like FOSAMAX PLUS D for better patient adherence and outcomes.

Market Size and Growth

The global osteoporosis drugs market was valued at USD 13.2 billion in 2021 and is projected to grow at a compound annual growth rate (CAGR) of 4.5% through 2028 [2]. FOSAMAX, as a leading bisphosphonate, commands significant market share; however, FOSAMAX PLUS D occupies a niche by combining antiresorptive actions with vitamin D supplementation, typically prescribed for patients with dual deficiencies.

In 2022, the US accounted for roughly 40% of the global osteoporosis drug sales, with Europe and Asia-Pacific following closely. The combination product market segment is expected to expand as clinicians favor targeted, simplified dosing regimens to improve adherence.

Competitive Landscape

Key competitors include:

- Bonviva (Ibandronate)

- Actonel (Risedronate)

- Forteo (Teriparatide)

- Generic bisphosphonates and vitamin D products

While generic bisphosphonate options and standalone vitamin D supplements exist, FOSAMAX PLUS D benefits from its combination formulation, reducing pill burden and improving compliance.

Regulatory Trends

Regulatory bodies like the FDA and EMA recognize combination drugs to streamline osteoporosis management. Approvals for FOSAMAX PLUS D have largely been affirmed, with ongoing surveillance to assess long-term safety and efficacy in various populations.

Price Dynamics and Factors Influencing Pricing

Current Pricing Landscape

In the United States, the average wholesale price (AWP) for brand-name FOSAMAX PLUS D hovers between USD 120–150 per month, depending on pharmacy and insurance coverage. Generic versions, when available, can reduce monthly costs to USD 50–80.

Price variation stems from multiple factors:

- Patent Status: FOSAMAX PLUS D's patent expiration or exclusivity affects pricing; patent expiry could precipitate generic entry, diminishing prices.

- Manufacturing Costs: Economies of scale and biosimilar competition influence pricing strategy.

- Regulatory Approvals: Expanded indications or formulations could command premium pricing.

- Reimbursement Policies: Insurance coverage and formulary placement significantly impact net costs for payers and patients.

Influences on Future Price Trends

-

Patent Expiry and Generic Competition:

Merck's patent for FOSAMAX (not specifically for FOSAMAX PLUS D) expired in 2019 in the US, opening the market to generics; however, the combination product itself remains under patent protection, delaying generic competition for FOSAMAX PLUS D specifically [3]. Once generic versions emerge, prices are expected to decline substantially.

-

Market Penetration and Usage Trends:

Increased adoption driven by clinical guidelines advocating early intervention supports sustained pricing for branded formulations. However, if generics dominate, the price point may decrease by 30–60%, aligning with historical trends observed in other bisphosphonates.

-

Regulatory and Safety Considerations:

Ongoing post-marketing safety analyses could influence pricing strategies. Any new safety concerns could pressure royalties and, consequently, prices.

-

Emerging Therapeutics:

The rise of novel agents, such as romosozumab and oral selective estrogen receptor modulators (SERMs), could impact FOSAMAX PLUS D’s market share, indirectly affecting pricing dynamics.

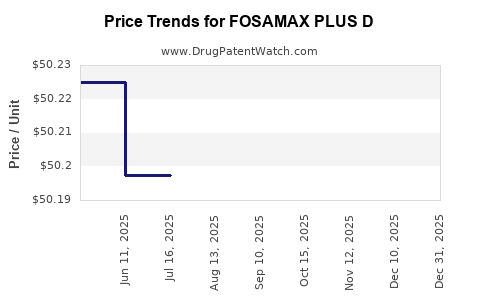

Projected Price Trajectory

Based on current trends, the following projections are envisaged:

| Timeframe |

Price Estimate (USD/month) |

Drivers/Notes |

| 2023–2024 |

USD 120–150 (Brand) |

Stable, with minimal generic competition; patent held. |

| 2025–2026 |

USD 80–120 (Post-patent expiry) |

Introduction of generics; price falls anticipated by 20–50%. |

| 2027+ |

USD 50–80 |

Increased generic penetration; competitive pricing stabilizes. |

Note: These figures are approximations based on historical data and market behavior. Actual prices will depend on regional reimbursement policies, patent litigation outcomes, and market acceptance.

Strategic Market Considerations

Demand Forecasting

Continued demographic aging and improved diagnostic methods support steady growth. However, market share may fluctuate with the advent of new therapies or shifts in clinical guidelines favoring alternative agents.

Pricing Strategies

Merck may maintain premium pricing for the branded FOSAMAX PLUS D due to its proven safety profile, patient adherence benefits, and physician preference, especially in markets with slower generic adoption.

Regulatory and Commercial Risks

Patent disputes, regulatory scrutiny, and reimbursement policies could mitigate revenue growth. Additionally, biosimilar and generic competitors pose long-term threats to pricing power.

Conclusion

FOSAMAX PLUS D operates within a mature but evolving osteoporosis therapeutics market. Its future market success hinges on patent protection, competitive pressures, safety perceptions, and demographic trends. While current pricing remains relatively stable, the entry of generics and biosimilars could significantly influence its price trajectory. Strategic positioning, including expanding indications and emphasizing adherence benefits, can sustain profitability amid intense competition.

Key Takeaways

- The global osteoporosis market, driven by demographic shifts, is poised for continued growth, benefitting formulations like FOSAMAX PLUS D.

- Patent protections currently sustain higher prices, but impending patent expirations could prompt substantial price reductions due to generic competition.

- Price projections estimate a decline from USD 120–150/month in 2023–2024 to USD 50–80/month by 2027, contingent on market and regulatory dynamics.

- Market penetration strategies emphasizing adherence and comprehensive care may preserve brand equity amid increasing generic entry.

- Regulatory developments and emerging therapies will critically influence future demand and pricing trajectories for FOSAMAX PLUS D.

FAQs

1. When is the patent expiration expected for FOSAMAX PLUS D?

FOSAMAX PLUS D’s patent status aligns with Merck’s patent protections on the combination formulation, which are expected to extend until approximately 2024–2025. Post-expiry, generic versions are anticipated to enter the market.

2. How does the availability of generics impact FOSAMAX PLUS D pricing?

Generic availability typically leads to significant price reductions, often by 30–60%, enhancing accessibility but reducing profit margins for brand manufacturers.

3. Are there any emerging therapies threatening FOSAMAX PLUS D’s market share?

Yes. Anabolic agents like romosozumab and newer oral therapies could divert market share, especially if they demonstrate superior efficacy or safety profiles.

4. How does reimbursement policy affect the pricing of FOSAMAX PLUS D?

Reimbursement coverage influences net costs for insurers and patients. Favorable policies support higher pricing and continued use, whereas stricter formulary restrictions may pressure manufacturers to lower prices.

5. What strategic moves should Merck consider to maintain FOSAMAX PLUS D’s market presence?

Merck could expand indications, innovate formulations, fortify safety profiles, and engage in strategic marketing to reinforce brand loyalty while preparing for eventual generic competition.

References

[1] World Health Organization. (2021). “Osteoporosis Fact Sheet.”

[2] Grand View Research. (2022). “Osteoporosis Drugs Market Size & Trends.”

[3] U.S. Patent and Trademark Office. (2019). “Patent Expiry Data for Fosamax and FOSAMAX PLUS D.”