Share This Page

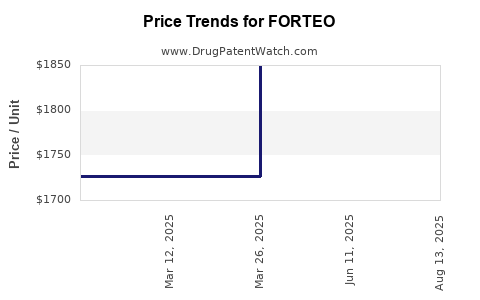

Drug Price Trends for FORTEO

✉ Email this page to a colleague

Average Pharmacy Cost for FORTEO

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| FORTEO 560 MCG/2.24 ML PEN INJ | 00002-9678-01 | 1848.10003 | ML | 2025-10-08 |

| FORTEO 560 MCG/2.24 ML PEN INJ | 00002-8400-01 | 1848.10003 | ML | 2025-08-20 |

| FORTEO 560 MCG/2.24 ML PEN INJ | 00002-8400-01 | 1852.67510 | ML | 2025-06-18 |

| FORTEO 560 MCG/2.24 ML PEN INJ | 00002-8400-01 | 1849.57766 | ML | 2025-04-02 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for FORTEO (Teriparatide)

Introduction

FORTEO (teriparatide) is a recombinant form of parathyroid hormone used predominantly for the treatment of osteoporosis in postmenopausal women, men with osteoporosis, and patients at high risk of fractures. Since its FDA approval in 2002, FORTEO has maintained a significant market share within the osteoporotic treatment landscape, known for its anabolic effects that stimulate new bone formation. This article provides a comprehensive market analysis and price projection for FORTEO, integrating current market trends, competitive dynamics, regulatory considerations, and anticipated economic factors affecting its valuation.

Market Overview

Global Osteoporosis Drug Market

The osteoporosis therapeutics market is projected to reach USD 13.9 billion by 2027, expanding at a CAGR of approximately 3.8% (2020-2027) [1]. Increasing aging populations worldwide, particularly in North America, Europe, and Asia-Pacific, are primary drivers of this growth. The rising prevalence of osteoporosis correlates with increased fracture risk, elevating demand for effective therapies like FORTEO.

Therapeutic Class and Market share

Existing osteoporosis treatments span antiresorptives such as bisphosphonates (e.g., Alendronate, Risedronate) and newer agents like Sclerostin inhibitors (e.g., Romosozumab). Among anabolic agents, teriparatide remains a key player, owing to its unique mechanism of stimulating osteoblastic activity.

According to IQVIA data, FORTEO held approximately 35% of the anabolic osteoporosis treatment market in 2022, with the remainder split among newer entrants and off-label alternatives [2].

Regulatory and Market Dynamics

The market landscape has evolved with regulatory approvals of alternative agents. In 2019, a generic form of teriparatide received FDA approval, potentially impacting FORTEO’s market share through price competition. Additionally, the development of biosimilars is imminent, impacting pricing strategies.

Furthermore, expanded indications—such as treatment of glucocorticoid-induced osteoporosis—augment the potential user base.

Economic and Pricing Factors

Current Pricing Landscape

As of 2023, the average wholesale price (AWP) for a 28-day supply of FORTEO stands at approximately $2,800 – $3,200 in the United States. This pricing reflects the brand's premium position due to its clinical efficacy and relatively limited competition within anabolic therapies.

The high cost remains a barrier for some patients, often mitigated by insurance coverage and assistance programs. The U.S. pharmaceutical pricing system's complexity significantly influences patient access and reimbursement dynamics.

Reimbursement and Market Access

Coverage policies typically favor long-term antiresorptive agents over anabolic therapies due to cost considerations. Consequently, reimbursement strategies and prior authorization processes affect market penetration and revenue.

Particularly, the evolution toward value-based care and payor incentives for cost-effective treatment optimization will shape future pricing and access.

Market Growth Drivers

- Demographic Shifts: The global elderly demographic is expanding, with projections indicating that individuals aged 65+ will constitute over 16% of the world population by 2025 [3], intensifying osteoporosis incidence and demand.

- Therapeutic Advances: Extended treatment windows and expanded labels for FORTEO, along with improved injection devices, enhance patient adherence.

- Clinical Evidence: Long-term studies demonstrate the efficacy of FORTEO in reducing vertebral and non-vertebral fractures, reinforcing its position as a preferred anabolic therapy.

Market Challenges

- Generic and Biosimilar Entry: The impending availability of biosimilars may drive down prices, impacting revenue streams.

- Safety Concerns and Regulatory Restrictions: Black box warnings regarding osteosarcoma risk and dose limitations influence prescribing patterns.

- High Cost and Reimbursement Barriers: These factors restrict access for some segments, potentially reducing total addressable market size.

Price Projection Outlook

Short-Term (2023-2025)

In the near term, FORTEO’s price is expected to stabilize, with minor fluctuations driven by inflation, raw material costs, and policy changes. Pricing may slightly decline (approximately 2-4%) due to the entry of biosimilars and increased competition.

Medium to Long-Term (2026-2030)

As biosimilars gain market share, a downward pressure on price is anticipated—potentially 25–35% reduction from current levels. However, premium positioning due to clinical efficacy and brand loyalty may cushion the extent of price erosion.

Additionally, value-based pricing and outcomes-based reimbursement models could result in tiered pricing frameworks, rewarding demonstrable benefits and adherence.

Scenario Analysis

- Optimistic Scenario: Continued expansion of indications and high patient adherence sustain revenues, with only modest price erosion (~15-20%) over five years.

- Conservative Scenario: Accelerated biosimilar penetration and aggressive price competition reduce prices by up to 40%, severely impacting revenues.

Competitive Landscape

Other anabolic agents such as abaloparatide (Tymlos) offer alternative therapeutic options, influencing price and market share dynamics. The development pipeline includes novel agents with improved safety and efficacy profiles, which may challenge FORTEO's dominance.

Strategic Recommendations

To sustain market share and optimize pricing, manufacturers should focus on:

- Demonstrating long-term cost-effectiveness and clinical benefits.

- Enhancing patient adherence through innovations in administration devices.

- Navigating regulatory pathways to expand indications.

- Developing comprehensive reimbursement strategies aligned with value-based healthcare models.

Key Takeaways

- The global osteoporosis therapeutics market is expanding, with FORTEO occupying a strategic niche as an anabolic agent.

- Current pricing remains premium due to clinical efficacy, but impending biosimilar entry is poised to exert downward pressure.

- Price projections indicate a potential 25-35% decline over the next five years, accelerated by biosimilar competition.

- Market growth is driven by demographic trends, clinical evidence, and expanding indications, although economic and safety considerations pose challenges.

- Manufacturers should adopt innovative pricing and market access strategies to sustain profitability amid evolving competitive dynamics.

FAQs

1. How does biosimilar entry impact FORTEO’s pricing?

The introduction of biosimilars typically triggers price reductions of 25-35% over several years, driven by increased competition and the demand for cost-effective alternatives. This shift may necessitate strategic adjustments in pricing and market positioning for FORTEO.

2. What factors influence the reimbursement of FORTEO?

Reimbursement depends on payer policies, cost-effectiveness evaluations, and clinical guidelines. High drug costs and safety profile considerations may require manufacturers to engage in value-based negotiations and patient assistance programs.

3. Are there ongoing developments to extend FORTEO’s market lifespan?

Yes. Expanding approval for additional indications, improving delivery systems to enhance adherence, and demonstrating long-term cost-effectiveness are key strategies to prolong market relevance.

4. How does the safety profile influence FORTEO’s market outlook?

Concerns related to osteosarcoma risk, although rare, lead to prescribing restrictions and dosage limits, which can constrain market growth. Ongoing safety monitoring and transparent communication are essential for maintaining confidence.

5. What is the potential market for FORTEO in emerging markets?

Emerging markets exhibit rising osteoporosis prevalence, creating growth opportunities. However, affordability, infrastructure, and healthcare access limitations may restrict immediate adoption, requiring tailored pricing and distribution strategies.

References

[1] Grand View Research. Osteoporosis Drugs Market Size, Share & Trends Analysis Report. 2021.

[2] IQVIA. Osteoporosis Therapeutics Market Insights, 2022.

[3] United Nations. World Population Ageing 2019.

More… ↓