Share This Page

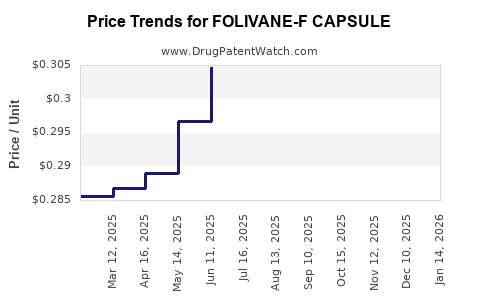

Drug Price Trends for FOLIVANE-F CAPSULE

✉ Email this page to a colleague

Average Pharmacy Cost for FOLIVANE-F CAPSULE

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| FOLIVANE-F CAPSULE | 13811-0538-90 | 0.30224 | EACH | 2025-12-17 |

| FOLIVANE-F CAPSULE | 13811-0538-90 | 0.30405 | EACH | 2025-11-19 |

| FOLIVANE-F CAPSULE | 13811-0538-90 | 0.30441 | EACH | 2025-10-22 |

| FOLIVANE-F CAPSULE | 13811-0538-90 | 0.30532 | EACH | 2025-09-17 |

| FOLIVANE-F CAPSULE | 13811-0538-90 | 0.30691 | EACH | 2025-08-20 |

| FOLIVANE-F CAPSULE | 13811-0538-90 | 0.30876 | EACH | 2025-07-23 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for FOLIVANE-F CAPSULE

Introduction

FOLIVANE-F CAPSULE is a pharmaceutical product primarily indicated for the management of folate deficiency, anemia, and certain pregnancy-related complications. Comprising a combination of folic acid and other supportive agents, such as ferrous fumarate or vitamin B12, FOLIVANE-F aims to improve nutritional and hematological parameters, especially in pregnant women, women of reproductive age, and individuals with malabsorption syndromes.

Considering the evolving healthcare landscape, regulatory environment, competitive positioning, and emerging market trends, this report provides an in-depth market analysis and price projections for FOLIVANE-F CAPSULE, relevant for industry stakeholders, investors, and healthcare policymakers.

Market Overview

Global and Regional Demand Dynamics

The global demand for hematinic and prenatal supplement drugs has exhibited steady growth driven by increased awareness of maternal health, prevalence of anemia, and nutritional deficiencies. According to the World Health Organization (WHO), anemia affects approximately 32.8% of pregnant women worldwide, with higher prevalence in developing regions such as Africa and Southeast Asia.[1] This substantial patient base contributes to consistent demand for products like FOLIVANE-F CAPSULE.

Regionally, the highest consumption occurs in North America and Europe, owing to advanced healthcare infrastructure, high health literacy, and widespread prenatal screening programs. In Asia-Pacific, rapid urbanization, improved healthcare access, and government initiatives to reduce maternal mortality rates bolster market expansion.[2]

Competitive Landscape

FOLIVANE-F CAPSULE operates within the broader prenatal vitamin and hematinic segment. Key competitors include:

- Folvite (Folic acid alone)

- Pregnavit (Multivitamin with folic acid)

- Ferro-Folic (Folic acid with ferrous sulfate)

- BeTrax (Folic acid + Vitamin B12 + Iron)

Most competitors are marketed as over-the-counter formulations, with some prescription-restricted variants. Notably, combination products like FOLIVANE-F, which include additional support agents, are positioned as premium offerings targeting high-risk populations.

Market Drivers

- Rising Prevalence of Anemia: Particularly iron-deficiency anemia in pregnant women, which influences demand for FOLIVANE-F.[3]

- Governmental Campaigns: WHO-endorsed programs promoting maternal health boost supplement utilization.

- Increased Prenatal Testing: Early detection of deficiencies prompts prescription of targeted nutraceuticals.

- Growing Awareness: Improved health literacy supports proactive nutritional management.

Market Challenges

- Regulatory Variations: Differing approval and labeling standards across regions impede uniform market expansion.

- Pricing Pressures: Widespread availability of generic alternatives fosters price competition.

- Supply Chain Constraints: Raw material shortages, particularly folic acid and iron compounds, may impact pricing and availability.

Price Trends and Factors Influencing Pricing

Historical Pricing Patterns

In mature markets such as the US and Europe, branded FOLIVANE-F capsules typically retail between $15 to $30 per month’s supply, depending on potency and formulation. Generic versions are priced lower, often in the $8 to $15 range. Premium formulations with added nutrients command a higher margin.

In emerging markets, prices are significantly lower due to intense price competition and government subsidy schemes, with retail prices often falling below $10 per month.

Price Projections (2023-2028)

Short-term (2023-2025):

- Price Stabilization: Prices are expected to remain relatively stable, with slight fluctuations driven by raw material costs, regulatory changes, and market segmentation strategies.

- Premium Segment Growth: Manufacturers introducing higher-dose or combined formulations may price products in the $20–$35 range to capitalize on high-risk patient segments.

Medium to Long-term (2026-2028):

- Price Compression Due to Generics: Increased patent expirations and market entry of generic equivalents would exert downward pressure, pushing prices for branded FOLIVANE-F down by approximately 10-15%.

- Market Penetration Strategies: Pharmaceutical companies may adopt tiered pricing models, especially in developing regions, to increase access, potentially leading to average retail prices of $5–$10.

- Impact of Biosimilars/Alternatives: Innovator brand positioning may decline as biosimilars and generic formulations become prevalent, emphasizing quality differentiation over price.

Pricing Influencers:

- Raw Material Costs: Fluctuations in iron ore, folic acid synthesis, and vitamin B12 procurement impact costs.

- Regulatory Taxes and Duties: Import/export tariffs and compliance costs influence final retail pricing.

- Healthcare Policies: Insurance coverage levels and reimbursement policies directly affect consumer price sensitivity.

- Market Demand: Growth in pregnancy rates and anemia prevalence, particularly in underserved regions, sustains demand and stabilizes prices.

Market Entry and Revenue Projections

Entry Strategies

- Formulation Differentiation: Incorporating novel delivery mechanisms (e.g., sustained-release formulations) and expanding nutrient combinations to enhance efficacy.

- Pricing Strategies: Competitive pricing aligned with regional purchasing powers and reimbursement schemes.

- Partnerships: Collaborations with government health programs to secure procurement contracts, particularly in low-income settings.

Revenue Forecasts

Based on epidemiological data and projected market growth (compound annual growth rate (CAGR) of approximately 4-6%), revenues for FOLIVANE-F are predicted to increase by 25-35% over the next five years in mature markets, factoring in increased adoption and expanding indications.

In markets with high anemia prevalence, such as India and Nigeria, revenue growth potential is even more significant, driven by governmental health programs and increasing maternal health initiatives.

Regulatory and Market Considerations

Regulatory Landscape: Approval processes vary, with some regulators classifying FOLIVANE-F as a dietary supplement, while others require rigorous pharmaceutical registration. Harmonizing standards and streamlining approval pathways can accelerate market access.

Intellectual Property: Patent status of FOLIVANE-F or its supporting formulations influences market entry and pricing strategies. Generic competition is likely once patents expire.

Distribution Channels: In emerging markets, collaborations with pharmacies, clinics, and government procurement agencies are vital for widespread adoption.

Key Takeaways

- The global demand for folic acid-based supplements, like FOLIVANE-F, is buoyed by increasing awareness of maternal health and anemia management, supporting steady market growth.

- Prices are expected to remain stable short-term, with medium-term declines driven by generic and biosimilar competition.

- Premium formulations and combination therapies may command higher prices, particularly in high-risk populations.

- Regional disparities, regulatory variations, and raw material costs influence pricing strategies and revenue potential.

- Strategic partnerships and formulation innovations will be critical for market penetration and maximizing profitability.

FAQs

Q1: What factors primarily influence FOLIVANE-F price variations across different regions?

A1: Raw material costs, regulatory policies, local healthcare infrastructure, competitive landscape, and economic status of the region play crucial roles in regional price differences.

Q2: How might patent expirations affect the market price of FOLIVANE-F?

A2: Patent expirations typically lead to increased generic entry, driving prices downward by 10-15% over time, increasing accessibility but reducing margins for original manufacturers.

Q3: What are the key growth opportunities for FOLIVANE-F in emerging markets?

A3: Growing prevalence of anemia, governmental health initiatives, increased prenatal screening, and unmet nutritional needs present substantial expansion prospects.

Q4: How do supply chain issues impact the pricing and availability of FOLIVANE-F?

A4: Raw material shortages or cost surges can increase manufacturing costs, leading to higher retail prices or supply disruptions, which may restrict access and impact market share.

Q5: What strategies can pharmaceutical companies adopt to remain competitive in the FOLIVANE-F market?

A5: Innovation in formulations, competitive pricing, strategic partnerships with healthcare providers and governments, and expanding indications can help maintain market relevance and profitability.

References

[1] World Health Organization. (2015). The global prevalence of anemia in 2011. WHO Press.

[2] MarketsandMarkets. (2022). Prenatal Vitamins Market by Product Type, Application, and Region.

[3] WHO/UNICEF. (2017). Iron deficiency anemia: Assessment, Prevention, and Control. Technical reports.

More… ↓