Share This Page

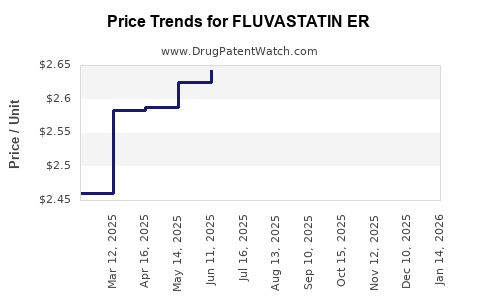

Drug Price Trends for FLUVASTATIN ER

✉ Email this page to a colleague

Average Pharmacy Cost for FLUVASTATIN ER

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| FLUVASTATIN ER 80 MG TABLET | 00527-2580-37 | 2.52847 | EACH | 2025-12-17 |

| FLUVASTATIN ER 80 MG TABLET | 00781-8017-01 | 2.52847 | EACH | 2025-12-17 |

| FLUVASTATIN ER 80 MG TABLET | 00527-2580-32 | 2.52847 | EACH | 2025-12-17 |

| FLUVASTATIN ER 80 MG TABLET | 00781-8017-31 | 2.52847 | EACH | 2025-12-17 |

| FLUVASTATIN ER 80 MG TABLET | 00093-7446-01 | 2.52847 | EACH | 2025-12-17 |

| FLUVASTATIN ER 80 MG TABLET | 00093-7446-56 | 2.52847 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Fluvastatin ER

Introduction

Fluvastatin ER, an extended-release formulation of fluvastatin, belongs to the statin class of lipid-lowering agents primarily used to reduce low-density lipoprotein (LDL) cholesterol and cardiovascular risk. With cardiovascular disease (CVD) remaining a leading global cause of mortality, the demand for effective statins sustains continuous growth. This report provides a comprehensive market analysis, including current market positioning, competitive landscape, regulatory environment, and future price projections for Fluvastatin ER.

Market Overview

Pharmacological Profile and Therapeutic Use

Fluvastatin ER offers a controlled-release mechanism, allowing for improved patient compliance and steady plasma concentrations, translating into optimized lipid management. It is indicated for primary and secondary prevention of atherosclerotic cardiovascular disease, with approval in multiple jurisdictions, including the U.S. and EU.

Market Penetration and Adoption

While generic versions of fluvastatin dominate the statin market, the prolonged-release formulation faces unique opportunities because of its potential for once-daily dosing, enhanced adherence, and reduced side effects. Currently, Fluvastatin ER occupies a niche, used mainly in patients with intolerance to other statins or requiring tailored lipid management.

Key Market Drivers

- Rising prevalence of dyslipidemia and CVD globally.

- Increasing awareness of cardiovascular risk management.

- Physician preference for statins with favorable safety profiles.

- Patent exclusivity and potential for branding in emerging markets.

Market Challenges

- Competition from established statins (atorvastatin, rosuvastatin).

- Pricing pressures in mature markets.

- Limited awareness of Fluvastatin ER versus generic options.

Competitive Landscape

Major Players

- Novartis: As the innovator behind original fluvastatin formulations, with ongoing efforts to promote Fluvastatin ER.

- Generic Manufacturers: A significant share of market volume is held by generics, exerting downward pressure on price points.

- Emerging Market Players: Introduce cost-effective formulations, expanding snapshot opportunities.

Market Differentiators

- Extended-release technology aimed at improving adherence.

- Potential for fewer side effects due to steady drug levels.

- Integration into combination therapies for lipid management.

Regulatory Environment

Major markets such as the U.S. (FDA) and EU (EMA) have approved Fluvastatin ER, maintaining strict safety and efficacy standards. Regulatory incentives, such as orphan drug status or patent protections, vary and influence pricing strategies.

Current Price Landscape

Pricing of Fluvastatin ER

The price of Fluvastatin ER varies by region, formulation strength, and manufacturer. In the U.S., branded Fluvastatin ER (e.g., Novartis's efforts) typically retails approximately $200–$300 per month for a typical prescription, whereas generic fluvastatin (immediate-release) costs significantly less – often under $20.

In Europe and emerging markets, prices tend to be lower, influenced by local healthcare policies and patent statuses. For instance, in the EU, brand prices average around €150–€200 per month, while generics are available at much lower prices.

Impact of Generics

The generic market drastically reduces prices, challenging the profitability of branded formulations like Fluvastatin ER. Nonetheless, differentiation through pharmacokinetics and adherence benefits sustains a premium for the extended-release version.

Market Projections

Market Growth Forecast (2023-2030)

Based on epidemiological data, the global statins market is projected to expand at a CAGR of approximately 4–6%, driven by increasing CVD burden and expanding treatment guidelines.

Fluvastatin ER’s market share is expected to grow modestly, predicted to reach around 10–15% of the overall fluvastatin market by 2030. Key factors include:

- Rising adoption in developed markets due to adherence advantages.

- Expansion into new geographic regions, particularly in Asia-Pacific and Latin America.

- Potential pipeline development combining Fluvastatin ER with novel delivery systems or companion drugs.

Price Trajectory

Considering market dynamics:

- Short-term (2023–2025): Prices are likely to remain stable, with possible slight reductions due to increased competition and healthcare cost containment measures.

- Mid to Long-term (2026–2030): Prices may decline by 10–20%, primarily driven by patent expiration, introduction of generics, and increased market penetration.

Influencing Factors

- Patent Status: If Novartis or other patent holders maintain exclusivity, price premiums will persist.

- Healthcare Policies: Price controls in certain regions could suppress prices further.

- Technological Innovations: Enhanced delivery systems might command higher prices initially.

Implications for Stakeholders

- Manufacturers: Should innovate to sustain premium pricing through differentiation, particularly emphasizing adherence benefits and safety profiles.

- Healthcare Providers: May favor Fluvastatin ER for patients needing simplified regimens; pricing sensitivity could influence prescribing.

- Patients: Cost considerations will drive adherence; lower-cost generics will dominate unless premium features demonstrate clear clinical advantages.

Conclusion

Fluvastatin ER occupies a niche characterized by its pharmacokinetic advantages and potential adherence benefits. While competition from generics and other statins limits its market share, expanding cardiovascular risk management and technological differentiation support its incremental growth. Price projections suggest modest declines over the next decade, predicated on patent status, competition, and regional healthcare policies.

Key Takeaways

- Fluvastatin ER has niche market appeal driven by its extended-release formulation and adherence benefits.

- The global statins market is expanding, but Fluvastatin ER's share will remain limited compared to generic and more established statins.

- Prices are currently high for branded formulations but are expected to decline gradually due to patent expiries and generics.

- Regional disparities influence pricing, with developed markets maintaining higher premiums.

- Differentiation through safety and adherence advantages is crucial for sustaining premium pricing.

FAQs

-

What factors influence the pricing of Fluvastatin ER globally?

Pricing is affected by patent protections, manufacturing costs, regional healthcare policies, competition from generics, and perceived clinical benefits. -

How does Fluvastatin ER compare to other statins in terms of market share?

It holds a smaller niche compared to dominant statins like atorvastatin and rosuvastatin, primarily due to later market entry and limited awareness. -

What is the impact of patent expiration on Fluvastatin ER prices?

Patent expirations will likely lead to increased generic competition, significantly reducing prices and market exclusivity. -

Are there opportunities for premium pricing of Fluvastatin ER?

Yes, where clinical benefits such as improved adherence or reduced side effects are demonstrated, especially in populations with statin intolerance. -

What strategies can manufacturers adopt to sustain profitability?

Emphasize clinical differentiation, pursue new delivery technologies, expand geographic reach, and foster brand loyalty among prescribers.

Sources:

[1] MarketsandMarkets. Statins Market Analysis, 2022.

[2] Deloitte. The Future of Cardiovascular Drugs, 2023.

[3] FDA. Approved Lipid-Lowering Agents, 2023.

[4] IQVIA. Global Prescription Drug Prices and Trends, 2022.

More… ↓