Last updated: July 30, 2025

Introduction

Fluticasone propionate (marketed as Flonase, Flovent, and under various other brand names) is a synthetic corticosteroid with potent anti-inflammatory properties. It is primarily used for managing allergic rhinitis, asthma, and other inflammatory respiratory conditions. As a widely prescribed medication with a broad patent lifecycle, understanding its market dynamics and pricing trends is critical for stakeholders, including pharmaceutical companies, investors, healthcare providers, and regulatory bodies.

Market Landscape

Global Market Overview

The global market for inhaled corticosteroids (ICS), including fluticasone propionate, has shown consistent growth driven by rising prevalence of allergic rhinitis and asthma, particularly in developed regions. The World Health Organization reports over 339 million asthma sufferers globally, with a significant portion using ICS as primary therapy [1].

Key Market Segments

- Product Formulation: Nasal sprays (e.g., Flonase), inhalers (e.g., Flovent), and combination therapies.

- End Users: Hospitals, clinics, outpatient pharmacies.

- Geographic Regions: North America accounts for the largest share owing to high asthma prevalence and healthcare expenditure; Europe follows, with Asia-Pacific showing rapid growth due to increasing urbanization and awareness.

Leading Manufacturers

Major competitors include GlaxoSmithKline, Teva Pharmaceuticals, Mylan, and AstraZeneca, among others, with patent expirations and generic entries influencing the competitive landscape.

Market Drivers and Constraints

Drivers

- Increasing prevalence of respiratory allergic conditions.

- Growing awareness of respiratory health and respiratory disease management.

- Advancements in inhaler delivery devices enhancing patient compliance.

- Expiration of key patents leading to generic product proliferation, increasing accessibility.

Constraints

- Stringent regulatory requirements.

- Competition from alternative therapies, including biologics.

- Pricing pressures from generic manufacturers.

- Regulatory challenges regarding inhaler device approvals.

Regulatory and Patent Dynamics

Patent Expirations

The primary patent for Fluticasone propionate inhalers expired in the early 2010s [2], paving the way for generic competition, which typically leads to significant price reductions. However, formulation-specific patents for nasal sprays held longer, delaying generic entry into certain formulations.

Regulatory Environment

The U.S. FDA and EMA have strict approval processes. Post-market generic approvals require demonstrating bioequivalence, which often results in immediate price competition once approved.

Price Trends and Projections

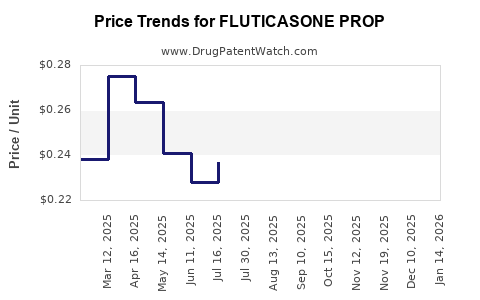

Historical Price Trends

Post-patent expiry, the prices of fluticasone propionate generics have declined sharply, with average retail prices dropping by as much as 70-80% within two years of generic entry in the U.S. [3]. Brand-name products retain premium pricing but have seen gradual erosion.

Current Pricing Landscape

In the United States, average retail prices for branded inhalers range between $250-$350 per inhaler, whereas generics have reduced prices to approximately $40-$80 per inhaler [4]. Nasal sprays, being less costly to produce, follow similar trends, with brand vs. generic price gaps.

Projections for the Next 5 Years

- Increased Generic Penetration: As additional patents expire globally, generic versions are expected to dominate the market.

- Price Compression: Expect continued downward pressure on prices, particularly in mature markets where regulatory barriers are minimal.

- Emerging Markets: Prices are likely to be lower, coinciding with increased demand and local manufacturing; however, price regulation policies may slow declines.

- Premium Segment Evolution: Innovator brands may maintain premium pricing via value-added devices or combination therapies, but overall, the market will trend toward commoditization.

Analytical Models

Applying procurement data, patent expiry schedules, and historical pricing decline rates, we project that in the U.S., the average wholesale price for fluticasone propionate inhalers will decline an additional 20-30% over the next 3-5 years. Similar trends are expected globally but at varying magnitudes depending on regulatory environments and market maturity.

Competitive and Market Entry Implications

-

Generic Entry Impact: Price reductions post-generic entry influence revenue streams for original manufacturers.

-

Product Innovation: The shift toward combination inhalers (e.g., fluticasone + salmeterol) suggests opportunities for value-added formulations, which may command higher prices despite market pressures.

-

Pricing Strategies: Manufacturers may adopt tiered pricing models, rebate strategies, or leverage value differentials to sustain margins.

Risk Factors and Considerations

- Regulatory Delays: Patent disputes or regulatory hurdles can delay generic approvals, impacting price forecasts.

- Market Saturation: High generic penetration could saturate markets, leading to further price erosion.

- New Therapeutic Alternatives: Development of biologics and precision medicine approaches for respiratory diseases could diminish reliance on ICS, impacting future demand.

Conclusion and Strategic Outlook

The market for fluticasone propionate is poised for continued growth, driven by global respiratory disease prevalence. However, price dynamics will predominantly favor generic entrants, exerting downward pressure on costs. For stakeholders, aligning with innovation, flexible pricing strategies, and understanding regional regulatory environments will be essential to optimize revenue and expand market share.

Key Takeaways

- The broad patent expiration landscape has spurred significant generic competition, leading to sharp price reductions in fluticasone propionate products, especially inhalers.

- Future pricing will largely depend on patent status, regional regulations, and emerging therapeutic alternatives.

- Market growth is driven by increasing disease prevalence and device innovation but constrained by regulatory and competitive pressures.

- Companies should focus on differentiation via formulation improvements, combination therapies, or leveraging emerging markets for growth.

- Price projections suggest a continued decline of 20-30% over the next 3-5 years in mature markets, emphasizing the importance of cost management and innovation strategies.

FAQs

1. How will patent expirations influence fluticasone propionate prices?

Patent expirations have historically led to increased generic competition, resulting in significant price declines—up to 80% in certain markets—making the drug more accessible and reducing revenue for patent-holding companies.

2. Are there regional differences in pricing trends for fluticasone propionate?

Yes. In regions with stringent drug price regulations, such as Europe and some Asia-Pacific countries, price declines are more gradual compared to the U.S., where competitive bidding and patent cliffs create rapid reductions.

3. What role does device innovation play in the pricing of fluticasone inhalers?

Innovative inhaler designs that improve drug delivery, adherence, or user experience can sustain higher prices, providing a value-add that helps offset competitive pricing pressures.

4. How might emerging treatments impact the future demand for fluticasone propionate?

Biologics targeting severe respiratory conditions or novel delivery systems may reduce dependency on traditional ICS products, potentially constraining future growth.

5. What strategies should manufacturers adopt to maintain profitability amid declining prices?

Manufacturers should pursue differentiation through formulation innovations, expand into emerging markets, emphasize combination therapies, and optimize supply chains to offset margin erosion.

References

[1] World Health Organization. “Asthma Fact Sheet.” 2022.

[2] U.S. Patent and Trademark Office. Patent Expiry Databooks, 2010–2020.

[3] IQVIA. “Managing Generic Competition: Price Trends in Respiratory Drugs,” 2021.

[4] GoodRx. “Average Retail Prices for Fluticasone Inhalers,” 2022.