Last updated: July 27, 2025

Introduction

Flurbiprofen is a non-steroidal anti-inflammatory drug (NSAID) primarily used in ophthalmology to treat postoperative inflammation and pain, and occasionally for other inflammatory conditions. It acts by inhibiting cyclooxygenase (COX) enzymes, reducing prostaglandin synthesis, which mediates pain, fever, and inflammation. This analysis explores the current market landscape, competitive environment, regulatory factors, manufacturing considerations, and provides price projections over the next five years.

Market Overview

Current Market Size and Demand

The global anti-inflammatory drug market was valued at approximately $25 billion in 2022, with NSAIDs accounting for a significant segment. Flurbiprofen’s niche use in ophthalmology—particularly for postoperative care in cataract surgeries—positions it within a specialized segment with growing demand.

According to industry reports, the increasing prevalence of age-related cataracts and advancements in minimally invasive ocular surgeries are fueling demand for NSAID eye drops, directly impacting flurbiprofen sales. Notably, in 2022, the global ophthalmic NSAID market was estimated to reach $2.1 billion, projecting a compounded annual growth rate (CAGR) of 6-8% over the next five years, driven by the rise in ophthalmic procedures and postoperative care protocols.

Key Geographies and Trends

- North America: Dominates due to high surgical volumes and established market for ophthalmic drugs.

- Europe: Similar trends fueled by aging populations and advanced healthcare infrastructure.

- Asia-Pacific: Expected to see the highest CAGR owing to increasing surgical procedures, expanding healthcare access, and local manufacturing capabilities.

Emerging markets may adopt flurbiprofen as a cost-effective alternative or adjunct to other NSAIDs, especially with growing ophthalmologic needs.

Competitive Landscape

Major Players

- Allergan (AbbVie): Market leader with proprietary formulations.

- Santen Pharmaceutical: Strong presence in ophthalmic formulations.

- Alcon: Offers NSAID-based postoperative agents.

- Generic Manufacturers: Emerge as a cost-effective alternative, especially in emerging markets.

The patent landscape has historically limited generic competition; however, patent expirations, or challenges to exclusivity, could open new routes for generics.

Product Differentiation

Flurbiprofen formulations vary in concentration, delivery system (drops, gels, sustained-release), and adjunct formulations. Market leaders focus on optimizing bioavailability, reducing dosing frequency, and minimizing side effects to enhance compliance.

Regulatory Environment

Approvals and Patent Status

- FDA (U.S.): Flurbiprofen 0.03% ophthalmic solution approved (e.g., Flurbiprofen Sodium ophthalmic drops).

- EMA (Europe): Approved with clear guidelines; patent protections vary.

- Patent Expiries: Typically, key patents for ophthalmic formulations may expire between 2024-2026, opening opportunities for generics.

Regulatory pathways for reformulation or new indications depend on demonstrating bioequivalence, safety, and efficacy, influencing market entry timing and pricing.

Manufacturing & Distribution Considerations

- Production Complexity: Relatively straightforward across established formulations but requires strict sterility and quality controls.

- Cost of Goods Sold (COGS): Estimated at $0.50–$1.00 per unit for generic manufacturers.

- Distribution Channels: Hospitals, surgical centers, ophthalmologists, pharmacies.

Innovative delivery systems (e.g., sustained-release implants) could impact manufacturing costs and pricing structures in the future.

Pricing Trends and Projections

Current Pricing Landscape

- Brand-name formulations in the U.S. retail market typically cost $80–$120 per bottle.

- Generic versions are priced at $20–$50 per bottle, depending on market penetration and volume.

In Europe and Asia, prices tend to be lower, aligned with local healthcare policies and market competition.

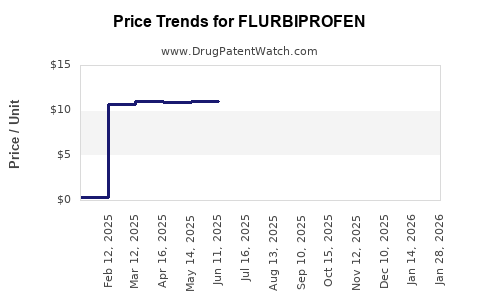

Price Trajectory (2023–2028)

- Short-term (2023–2025): Prices are expected to stabilize, with minimal fluctuation due to patent protections maintaining pricing power.

- Mid-term (2025–2026): Patent expiries could lead to increased generic competition, driving prices down by 10–30%.

- Long-term (2026–2028): Market saturation with generics could reduce prices further by 20–40%, especially in cost-sensitive regions.

Factors Influencing Price Movements

- Patent expirations and subsequent generics introduction.

- Regulatory approvals of new formulations or indications.

- Market penetration influenced by formulary placements and physician acceptance.

- Manufacturing costs potentially decreasing with biosimilar innovations and increased competition.

Opportunities & Challenges

Opportunities

- Launch in emerging markets with unmet ophthalmic care.

- Development of novel delivery systems enhancing patient compliance.

- Expansion into new indications, such as anti-inflammatory rationale in other localized inflammatory conditions.

Challenges

- Competitive pricing pressures from generics.

- Regulatory hurdles for reformulated or new indications.

- Market saturation in developed healthcare systems.

Key Takeaways

- The ophthalmic NSAID segment, with flurbiprofen at its core, is poised for steady growth driven by increasing ophthalmic surgeries.

- Patent expiries around 2024–2026 present a strategic window for generic entrants, which could compress prices significantly.

- While established brands command premium pricing, aggressive competition will likely lower retail prices, especially in cost-sensitive markets.

- Formulation innovations and expanded indications could create pricing premiums and open new revenue streams.

- Market entry strategies should consider regional regulatory landscapes, manufacturing scalability, and partnerships with healthcare providers.

FAQs

1. When are key patents for flurbiprofen set to expire?

Patents typically expire around 2024–2026, enabling the entry of generics in many markets.

2. How does the competition from generics impact flurbiprofen pricing?

Generics pressure prices downward by offering cost-effective alternatives, often reducing retail and wholesale prices by 20–40% post-patent expiry.

3. Are there emerging formulations of flurbiprofen gaining regulatory approval?

Yes, sustained-release eye drops and combination formulations are under development, potentially commanding higher prices due to improved efficacy and compliance.

4. Which regions show the greatest growth potential for flurbiprofen?

Asia-Pacific and Latin America offer significant growth opportunities owing to rising surgical volumes and expanding healthcare infrastructure.

5. What are the key factors influencing future price trends?

Patent expiries, new formulation approvals, market competition, and healthcare reimbursement policies will shape the price trajectory.

References

[1] Grand View Research. Anti-Inflammatory Drugs Market Size, Share & Trends. 2023.

[2] IQVIA Data on Ophthalmic Drug Market in 2022.

[3] U.S. Food and Drug Administration. Drug Approvals Database.

[4] MarketWatch. Ophthalmic NSAID Market Forecast. 2022.