Share This Page

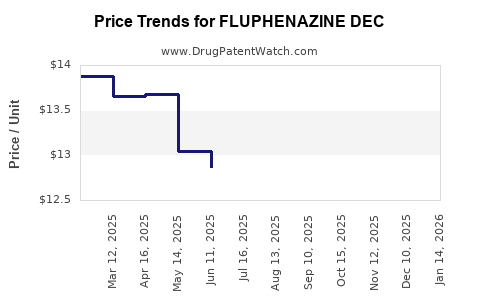

Drug Price Trends for FLUPHENAZINE DEC

✉ Email this page to a colleague

Average Pharmacy Cost for FLUPHENAZINE DEC

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| FLUPHENAZINE DEC 125 MG/5 ML | 42023-0129-89 | 11.06005 | ML | 2025-12-17 |

| FLUPHENAZINE DEC 125 MG/5 ML | 55150-0267-05 | 11.06005 | ML | 2025-12-17 |

| FLUPHENAZINE DEC 125 MG/5 ML | 42023-0129-01 | 11.06005 | ML | 2025-12-17 |

| FLUPHENAZINE DEC 125 MG/5 ML | 63323-0272-05 | 11.06005 | ML | 2025-12-17 |

| FLUPHENAZINE DEC 125 MG/5 ML | 00143-9529-01 | 11.06005 | ML | 2025-12-17 |

| FLUPHENAZINE DEC 125 MG/5 ML | 72205-0100-01 | 11.06005 | ML | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Fluphenazine Decanoate

Introduction

Fluphenazine Decanoate (FLUPHENAZINE DEC) is a long-acting depot formulation of the antipsychotic medication fluphenazine, primarily used in the management of schizophrenia and other psychotic disorders. Its extended-release formulation offers improved adherence over oral therapies, making it a significant asset within the psychiatric pharmacotherapy landscape. Given the evolving market dynamics, especially with the increasing focus on depot injectables for serious mental illnesses, an in-depth market analysis and pricing forecast are crucial for stakeholders.

Market Overview

Therapeutic Landscape

The global antipsychotic drugs market is projected to grow at a compound annual growth rate (CAGR) of approximately 3-5% over the next five years, driven by rising prevalence of schizophrenia and bipolar disorder, alongside increased acceptance of long-acting injectable (LAI) formulations. Depot antipsychotics like fluphenazine decanoate are central to this growth, offering benefits such as enhanced compliance, reduced relapse rates, and decreased hospitalization costs.

Market Drivers

-

Increasing Prevalence of Schizophrenia: According to the World Health Organization (WHO), schizophrenia affects approximately 20 million people worldwide, with lifetime prevalence around 1%. The rising global burden enhances demand for sustained-release antipsychotics.

-

Preference for Depot Formulations: Clinicians lean toward LAIs for certain patient populations, particularly those with adherence challenges, contributing to market expansion.

-

Regulatory Approvals & Off-Label Use: Regulatory acceptance in multiple regions enhances usage; off-label applications further broaden the scope, albeit with some regulatory and ethical considerations.

Market Challenges

-

Stiff Competition: Other depot formulations, including risperidone and paliperidone, dominate the long-acting antipsychotic segment, creating a competitive landscape that impacts pricing and market share.

-

Cost & Reimbursement: High medication costs and variable reimbursement policies influence prescribing patterns and patient access.

-

Patient Acceptance: Some patients prefer oral medications due to injection aversions or cultural factors, affecting depot medication uptake.

Geographic Market Breakdown

-

North America: Largest market, driven by advanced healthcare infrastructure, high diagnosis rates, and favorable reimbursement policies.

-

Europe: Growing adoption of depot formulations, with notable healthcare system support for adherence strategies.

-

Asia-Pacific: Rapidly expanding markets due to increased awareness, diagnosis, and healthcare investment, although pricing sensitivity remains.

Market Size and Revenue Projections

Current Market Estimates

As of 2023, the global depot antipsychotics market is valued at approximately USD 2.0-2.5 billion. Fluphenazine decanoate holds a modest but significant share within this segment, particularly in specialized psychiatric settings where traditional depot therapies are preferred over newer atypical antipsychotics.

Future Market Trajectory

Based on existing data and growth trends, the following projections are anticipated:

- 2023-2028 CAGR: 4-6%

- 2023 Market Size: USD 225 million (approximate, specific to fluphenazine decanoate)

- 2028 Forecast: USD 330-370 million

The expansion hinges on increased adoption, off-label uses, and healthcare policies favoring adherence-enhancing therapies.

Pricing Analysis

Current Pricing Landscape

The pricing of fluphenazine decanoate varies globally:

- United States: Approximately USD 65-80 per 50 mL vial, with some variation depending on the supplier, pharmacy, and insurance coverage.

- Europe: Approximately EUR 50-70 per vial, often influenced by national reimbursement policies.

- Emerging Markets: Prices can be significantly lower, in the range of USD 30-50 per vial, influenced by purchasing power and regulatory controls.

Factors Influencing Pricing

- Manufacturing & Supply Costs: Production complexity for depot formulations tends to be high, affecting margins.

- Market Competition: Availability of generic versions exerts downward pressure on prices.

- Regulatory Environment: Patents, market authorizations, and pricing regulations influence availability and cost.

- Insurance & Reimbursement: Reimbursement policies significantly impact final patient out-of-pocket costs and overall market prices.

Price Projections (2023-2028)

Given the competitive environment, price trends are projected to be relatively stable with potential slight reductions due to increasing generic penetration and cost containment strategies:

| Year | Estimated Price Range per Vial | Market Notes |

|---|---|---|

| 2023 | USD 70-80 | Current stabilization; generic formulations emerging |

| 2024-2025 | USD 65-75 | Increased generics, competitive pricing pressure |

| 2026-2028 | USD 60-70 | Further commoditization, potential price stabilization |

However, premium pricing may persist in regions with limited generic access or strong brand preferences, especially in North America and certain European markets.

Key Market Opportunities

- Generic Market Entry: Expansion of generic manufacturers will likely lower prices, broadening access and decreasing profit margins for brand-name producers.

- New Indications & Off-Label Use: Broader utilization in other psychotic or behavioral disorders may lead to increased volume sales.

- Partnerships & Reimbursement Strategies: Collaborations with healthcare payers can enhance market penetration and stabilize pricing structures.

- Emerging Markets: Price sensitivity here presents an opportunity for high-volume sales if regulatory hurdles are navigated successfully.

Regulatory & Patent Landscape

Incumbent patents on fluphenazine decanoate formulations are primarily expiring or expired in major jurisdictions, facilitating generic entry. Regulatory approvals for biosimilars or novel depot formulations could further influence market dynamics, with stakeholders required to monitor ongoing patent litigations and exclusivity periods.

Conclusion

Fluphenazine decanoate remains a vital component of depot antipsychotic therapy, especially suited for patients with adherence difficulties. The market is characterized by moderate growth prospects, increased competitive pressures from generics, and consistent demand driven by prevalence rates of schizophrenia globally. Pricing strategies will predominantly be influenced by generic market entry and regional reimbursement policies, with projected slight declines over the forecast horizon.

Key Takeaways

- The global market for fluphenazine decanoate is poised for steady growth, driven by rising neuropsychiatric disorder prevalence and adherence-focused therapy preferences.

- Competitive pressures, particularly from generics, are expected to reduce prices gradually, creating opportunities for cost-effective access but squeezing profit margins.

- Regulatory landscapes and patent expirations will significantly influence generic availability and pricing strategies.

- Pricing will vary substantially across regions, emphasizing the importance of region-specific market strategies.

- Stakeholders should focus on expanding access via partnerships with healthcare providers and payers, especially in emerging markets.

FAQs

1. What factors are most likely to influence the price of fluphenazine decanoate in the next five years?

Market entry of generics, regulatory changes, manufacturing costs, and reimbursement policies are primary drivers influencing pricing.

2. How does the availability of generic versions impact market pricing?

Generic availability typically leads to substantial price reductions, increasing accessibility but reducing margins for brand-name manufacturers.

3. Are there significant regional differences in the pricing of fluphenazine decanoate?

Yes. High-income regions like North America and Europe often maintain higher prices due to regulatory, reimbursement, and brand loyalty factors. Emerging markets usually have lower prices driven by affordability considerations.

4. What are the key opportunities for expanding the market for fluphenazine decanoate?

Expansion through generic entry, off-label use, strategic partnerships, and penetration into emerging markets represent substantial growth avenues.

5. How might new formulations or delivery systems influence future market competition?

Innovations in depot delivery, such as long-acting injectables with improved safety or efficacy profiles, could disrupt existing formulations and influence pricing and market share.

References

[1] MarketResearch.com, “Global Depot Antipsychotics Market Report,” 2023.

[2] World Health Organization, “Schizophrenia Fact Sheet,” 2022.

[3] IQVIA, “Pharmaceutical Market Data,” 2023.

[4] United States Food & Drug Administration, “Drug Approvals and Patent Status,” 2023.

[5] European Medicines Agency, “Regulatory and Market Overview,” 2023.

More… ↓