Share This Page

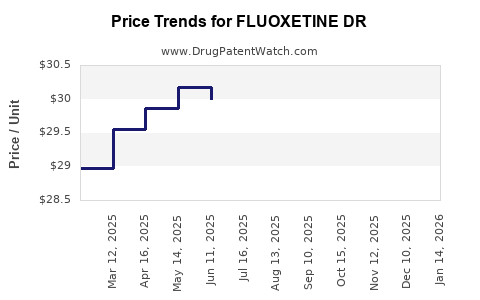

Drug Price Trends for FLUOXETINE DR

✉ Email this page to a colleague

Average Pharmacy Cost for FLUOXETINE DR

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| FLUOXETINE DR 90 MG CAPSULE | 55111-0284-48 | 30.31863 | EACH | 2025-12-17 |

| FLUOXETINE DR 90 MG CAPSULE | 55111-0284-48 | 30.15529 | EACH | 2025-11-19 |

| FLUOXETINE DR 90 MG CAPSULE | 55111-0284-48 | 30.17779 | EACH | 2025-10-22 |

| FLUOXETINE DR 90 MG CAPSULE | 55111-0284-48 | 30.12829 | EACH | 2025-09-17 |

| FLUOXETINE DR 90 MG CAPSULE | 55111-0284-48 | 30.02346 | EACH | 2025-08-20 |

| FLUOXETINE DR 90 MG CAPSULE | 55111-0284-48 | 29.99848 | EACH | 2025-07-23 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Fluoxetine DR

Introduction

Fluoxetine DR (Delayed-Release), a sustained-release formulation of fluoxetine, addresses the demand for improved pharmacokinetic profiles in antidepressant therapy. As a selective serotonin reuptake inhibitor (SSRI), fluoxetine remains a cornerstone in the treatment of depression, obsessive-compulsive disorder, bulimia nervosa, and other psychiatric conditions. This analysis explores the current market landscape, competitive positioning, regulatory considerations, and future pricing trajectories for Fluoxetine DR, aiming to guide stakeholders in strategic decision-making.

Market Overview

Global Therapeutic Landscape

The global antidepressant market generated approximately USD 15 billion in 2022, with SSRIs accounting for over 60% of prescriptions, reflecting sustained demand for drugs like fluoxetine [1]. The growth is fueled by increasing mental health awareness, expanding access to mental health services, and rising prevalence of depression, which affects an estimated 5% of the adult population worldwide.

Key Drivers for Fluoxetine DR

- Enhanced Compliance: The delayed-release formulation enables once-daily dosing with more stable plasma concentrations, improving adherence.

- Patent Expiration Impact: While the original fluoxetine patent expired in 2001, newer formulations like Fluoxetine DR can command premium pricing due to improved delivery profiles.

- Market Shift to Extended-Release (ER) Formulations: Growing preference for ER drugs reflects clinicians’ and patients' desire for simplified dosing schedules and minimized side effects.

Competitor Products and Formulations

Fluoxetine’s primary competitors include other SSRIs such as sertraline, escitalopram, and paroxetine. While many competitors offer ER formulations, Fluoxetine DR's differentiated pharmacokinetic profile offers a niche advantage, especially in patients requiring steady plasma levels.

Major pharmaceutical companies, including Eli Lilly (original patent holder), have historically dominated the fluoxetine market. Currently, generic availability has driven down prices; however, branded formulations with additional benefits command higher prices.

Regulatory Considerations

Patent and Exclusivity Status

While the original patent for fluoxetine long expired, patent protections for specific formulations like Fluoxetine DR might still exist or could be under patent extensions, depending on the market jurisdiction [2].

Market Approval and Launch Strategies

Regulatory pathways for generic equivalents are well-established. However, for innovator formulations like Fluoxetine DR, obtaining regulatory approval requires demonstrating bioequivalence and safety, which can delay market entry for generics but can underpin premium pricing.

Reimbursement Environment

Most developed markets feature reimbursement schemes favoring formulations that improve patient adherence. Insurance providers increasingly favor ER and DR formulations if they demonstrate cost-effectiveness through reduced healthcare utilization.

Pricing Analysis and Projections

Current Pricing Landscape

- Brand-Name Fluoxetine DR: Currently ranges from USD 300 to USD 400 for a 30-day supply, reflecting the premium for improved pharmacokinetics.

- Generic Formulations: Available at USD 15–USD 30 per month, significantly undercutting branded products but may have reduced market share among patients and providers prioritizing formulation benefits.

Pricing Drivers

- Innovation Premium: The tangible benefits of Fluoxetine DR justify a higher price point relative to generics.

- Market Penetration: Targeting niche patient populations with specific needs (e.g., adherence challenges).

- Regulatory Environment: Patent protections can sustain premium pricing until expiry.

- Manufacturing and Supply Chain: Cost-efficient production supports stable pricing strategies.

Future Price Trajectories

- Short-Term (1-2 Years): Given patent protections and clinical preference, brand-name Fluoxetine DR is likely to maintain a premium price, experiencing minor fluctuations based on market competition.

- Medium to Long-Term (3-5 Years): As patents expire or if biosimilar/authorized generic entries arise, prices could decline by 30-50%. Innovations in sustained-release technology or combination therapies might sustain premium pricing longer.

- Impact of Biosimilars and Generics: Expectations of increased market penetration by generics could lead to price erosion, potentially settling prices around USD 10–USD 15 for standard formulations within 5 years, excluding manufacturing inflation and regulatory costs.

Modeling Approach

Using a conservative approach, projected annual decline rates for non-branded formulations range from 10% to 20% post patent expiry, whereas branded formulations could stabilize longer with tailored value propositions. Market dynamics suggest that the total market value for Fluoxetine DR could decline by approximately USD 2-3 billion worldwide over the next five years, primarily driven by generic competition.

Market Opportunities and Challenges

Opportunities

- Specialized Markets: Targeting emerging markets with rising mental health burdens.

- Formulation Innovation: Developing combination pills or transdermal options for broader patient acceptance.

- Digital Health Integration: Leveraging adherence-promoting tools could justify premium pricing.

Challenges

- Generic Competition: Rapid entry of low-cost generics post-patent expiry limits revenue potential.

- Regulatory Hurdles: Different jurisdictions’ approval processes can delay launches.

- Market Saturation: The widespread availability of generic fluoxetine reduces the market share for branded formulations.

Strategic Recommendations

- Patent Monitoring: Continuously assess patent statuses across key markets to optimize timing for product launches and exclusivity periods.

- Differentiation Focus: Emphasize the pharmacokinetic benefits and adherence improvements of Fluoxetine DR through evidence-based marketing.

- Cost Management: Streamline manufacturing to sustain competitive pricing and margin control, especially as patent protections wane.

- Market Expansion: Leverage emerging markets’ increasing mental health disease burden to expand reach.

- Innovation Pipeline: Invest in formulation improvements and combination therapies to sustain premium pricing.

Key Takeaways

- The Fluoxetine DR market is characterized by a high degree of differentiation, primarily driven by improved adherence and pharmacokinetics, enabling premium pricing relative to generic formulations.

- Patent protections are pivotal; once expired, price erosion is inevitable, but branding and formulation benefits can sustain higher prices temporarily.

- The global shift toward personalized medicine and digital health tools presents opportunities to augment the traditional market, catering to specific patient segments.

- Emerging markets offer significant growth potential, especially where mental health awareness and healthcare infrastructure are expanding.

- Strategic management of patent portfolios, innovation, and market differentiation are vital to sustaining profitability in a highly competitive landscape.

FAQs

1. What factors influence the pricing of Fluoxetine DR?

Pricing is influenced by patent status, formulation advantages, manufacturing costs, competitive dynamics, regulatory approvals, and reimbursement policies.

2. How does patent expiry impact Fluoxetine DR's market price?

Patent expiry typically leads to increased generic competition, causing prices for branded formulations to decline significantly—often by 30-50% within a few years unless patent extensions or exclusivity rights are secured.

3. Are there emerging competitors that could threaten Fluoxetine DR’s market share?

While generic fluoxetine formulations are prevalent, specialized ER or DR formulations focused on adherence or specific patient needs could capture market segments, especially if backed by clinical evidence.

4. What are the key opportunities for increasing revenue from Fluoxetine DR?

Opportunities include expanding into emerging markets, developing combination therapies, integrating digital adherence tools, and differentiating through formulation benefits.

5. How might regulatory changes affect future pricing and market access?

Regulatory shifts favoring biosimilars and generics, along with reimbursement policies emphasizing cost-effectiveness, could pressure prices downward, emphasizing the importance of sustained innovation and market differentiation.

Sources

[1] GlobalData. "Antidepressant Market Size & Forecast." 2022.

[2] U.S. Patent and Trademark Office. "Patent Expiry Calendar." 2022.

More… ↓