Last updated: July 28, 2025

Introduction

Fluoxetine, a selective serotonin reuptake inhibitor (SSRI), is predominantly prescribed for depression, obsessive-compulsive disorder (OCD), bulimia nervosa, and panic disorder. Introduced in the late 1980s, it remains one of the most prescribed antidepressants globally owing to its efficacy and safety profile. As the pharmaceutical landscape evolves, understanding the current market dynamics and future price trajectories for Fluoxetine becomes critical for stakeholders including manufacturers, healthcare providers, payers, and investors.

Market Overview

Global Market Size and Growth Trends

The global antidepressant market, valued at approximately USD 15 billion in 2022, exhibits steady growth driven by rising mental health awareness, expanding patient populations, and increasing adoption of SSRIs like Fluoxetine. The antidepressant segment is projected to grow at a compound annual growth rate (CAGR) of around 3-4% through 2028 [1].

Fluoxetine's market share remains significant, particularly in mature markets such as North America and Europe, where it was one of the first SSRIs to gain widespread acceptance. Developing markets, including Asia-Pacific, are witnessing increased access due to expanding healthcare infrastructure and evolving prescribing practices.

Key Players and Market Penetration

Major pharmaceutical companies such as Eli Lilly (the original manufacturer), Teva Pharmaceuticals, and Mylan manufacture generic versions of Fluoxetine, which constitute a substantial portion of the market. Patent expirations in the early 2000s led to a surge in generic formulations, substantially reducing prices but expanding availability.

The presence of generics has driven down prices substantially but stabilized the market as demand remains high, especially in countries with limited access to newer antidepressants.

Regulatory and Patent Landscape

The original patent for Fluoxetine expired in the early 2000s, opening the market for generics worldwide. Newer formulations or combination products have not significantly altered its dominant position, although patent protections for specific formulations or delivery methods, if any, could influence regional pricing strategies.

Regulatory agencies like the FDA and EMA continue to oversee manufacturing standards, but no recent significant patent litigations or regulatory hurdles have impacted Fluoxetine's market stability.

Pricing Dynamics

Current Pricing Regimen

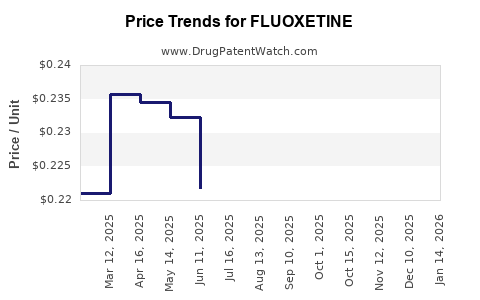

The cost of branded Fluoxetine varies across regions but generally ranges between USD 10-30 per month for branded formulations. The widespread availability of generics has driven retail prices down to below USD 0.50 per tablet in many markets, making Fluoxetine one of the most affordable antidepressants globally.

In the United States, the average wholesale price (AWP) for generic Fluoxetine hovers around USD 0.25 per pill [2], with cash prices often lower due to discounts and pharmacy benefit manager negotiations.

Impact of Generic Competition

Generic competition has led to significant price erosion post-patent expiry. The market's flexibility has meant prices have remained relatively stable at low levels, although regional variations exist due to differential regulatory policies and market sizes.

Pricing Trends and Drivers

- Market Penetration and Accessibility: Increased access in low-to-middle-income countries (LMICs) boosts volume sales, positively influencing overall revenue despite low unit prices.

- Manufacturing Costs: Stable manufacturing costs for generic APIs sustain low prices.

- Pharmacovigilance and Safety: No recent safety alerts specific to Fluoxetine influence pricing until and unless new adverse effects are detected.

- Emerging Biosimilars/Alternatives: Although Biosimilars are not relevant for small-molecule drugs like Fluoxetine, newer antidepressant classes or formulations could impact market share and prices.

- Healthcare Policy and Reimbursement: Push for cost-effective treatments promotes use of low-cost generics, further suppressing prices.

Market Opportunities and Challenges

Opportunities:

- Expansion into LMICs with limited mental health resources.

- Formulation innovations—such as extended-release or combination formulations—could command premium pricing.

- Increased utilization driven by the rising prevalence of depression, which affected an estimated 264 million worldwide in 2020 [3].

Challenges:

- Competition from newer antidepressants with favorable side effect profiles.

- Stigma surrounding mental health inhibiting prescription and adherence.

- Insurer restrictions favoring generics or newer side-effect profiles.

Price Projections (2023-2028)

Given the mature status of Fluoxetine’s market and the dominance of generics, significant upward price movement is unlikely. Forecasts suggest:

- Stable Low Pricing: The average retail price is expected to remain around USD 0.20-0.50 per tablet due to persistent generic competition.

- Minor Fluctuations: Regional economic factors, healthcare reforms, and supply chain dynamics may cause slight variations.

- Potential Premiumization: Limited if reformulations with extended-release or combination drugs enter the market, potentially commanding higher prices.

Summary: Over the next five years, Fluoxetine prices are predicted to remain low globally, with marginal fluctuations influenced by regional policies and healthcare market dynamics.

Conclusion

Fluoxetine continues to be a cornerstone in mental health pharmacotherapy due to its well-established safety profile, broad indications, and extensive generic market penetration. While the global demand persists, the pricing landscape remains subdued, with limited scope for significant increases absent formulation innovations or favorable regulatory changes.

Stakeholders should focus on regional expansion strategies, access improvement, and monitoring potential innovations that might disrupt market dynamics. The steady, low-price environment ensures continued affordability, but caps profit margins for manufacturers seeking higher margins.

Key Takeaways

- Market Size: The global Fluoxetine market remains substantial, with a CAGR of roughly 3-4%, driven by rising mental health awareness and expanding access.

- Pricing Stability: Prices are driven down by generics, with current retail costs averaging USD 0.20-0.50 per tablet.

- Competitive Landscape: Widespread generic manufacturing keeps prices low; few recent patent protections or exclusive formulations influence pricing.

- Future Projections: Prices are likely to remain stable with minimal upward trend, barring formulation innovations or regional policy changes.

- Investment Implication: Market saturation and low prices limit arbitrage opportunities but point toward stable, low-cost medication access.

FAQs

1. Will Fluoxetine prices increase with new formulations?

While new formulations like extended-release versions could command premium prices, the market for such innovations remains limited, and current trends favor low-cost generics.

2. How do regional policies affect Fluoxetine's pricing?

In regions with strict price controls and reimbursement schemes, prices remain low, whereas markets with minimal regulation might see slightly higher costs, though overall levels stay modest.

3. Are there competitive risks from new antidepressants?

Yes. Newer medications with improved tolerability or efficacy profiles could shift prescribing patterns, but Fluoxetine’s established reputation ensures continued relevance.

4. What role do patent protections play currently?

Since patent expirations in the early 2000s, multiple manufacturers produce generic Fluoxetine, maintaining a competitive, low-price environment.

5. Is there potential for market growth through new geographic markets?

Yes. Expanding access in LMICs offers growth opportunities, primarily through increased volume rather than price increases.

References

[1] Fortune Business Insights, “Antidepressant Market Size, Share & Industry Analysis, 2022-2028,” 2022.

[2] Micromedex, “Generic Drug Pricing Data,” 2023.

[3] World Health Organization, “Depression and Other Common Mental Disorders: global health estimates,” 2020.