Share This Page

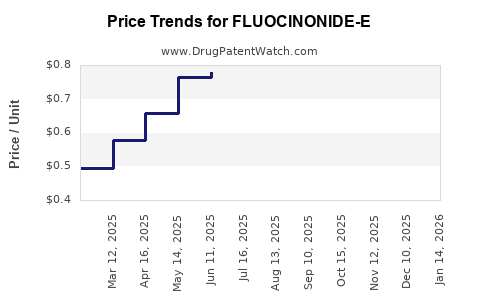

Drug Price Trends for FLUOCINONIDE-E

✉ Email this page to a colleague

Average Pharmacy Cost for FLUOCINONIDE-E

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| FLUOCINONIDE-E 0.05% CREAM | 00713-0664-15 | 1.50508 | GM | 2025-12-17 |

| FLUOCINONIDE-E 0.05% CREAM | 00713-0664-31 | 0.78191 | GM | 2025-12-17 |

| FLUOCINONIDE-E 0.05% CREAM | 00093-0263-92 | 0.59243 | GM | 2025-12-17 |

| FLUOCINONIDE-E 0.05% CREAM | 00713-0664-60 | 0.59243 | GM | 2025-12-17 |

| FLUOCINONIDE-E 0.05% CREAM | 00093-0263-15 | 1.50508 | GM | 2025-12-17 |

| FLUOCINONIDE-E 0.05% CREAM | 51672-1254-03 | 0.59243 | GM | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Fluocinnonide-E: A Comprehensive Overview

Introduction

Fluocinnonide-E, a topical corticosteroid formulation, has garnered attention in dermatological therapeutics due to its potent anti-inflammatory and antipruritic properties. As a newer entrant within the corticosteroid market segment, understanding its market landscape and pricing trajectory is critical for stakeholders, including pharmaceutical companies, investors, and healthcare providers. This analysis offers a detailed assessment of the current market environment, competitive positioning, regulatory considerations, pricing strategies, and future projections for Fluocinnonide-E.

Product Profile and Therapeutic Context

Fluocinnonide-E is a high-potency topical corticosteroid used predominantly to manage inflammatory skin conditions such as eczema, psoriasis, and dermatitis. Its formulation aims for enhanced skin penetration, resulting in improved efficacy. The drug’s topical application ensures localized relief while minimizing systemic exposure, aligning with current medical preferences for targeted skin therapies.

The global corticosteroid market was valued at approximately USD 4.1 billion in 2022, with a consistent compound annual growth rate (CAGR) of about 3.5% projected through 2030 [1]. The growth is driven by rising prevalence of chronic skin conditions, increasing awareness, and expanding dermatology treatment options.

Market Landscape and Competitive Dynamics

Current Market Players

Fluocinnonide-E faces competition from established corticosteroid brands such as Clobetasol Propionate, Betamethasone Dipropionate, and Mometasone Furoate. These products benefit from extensive clinical validation, broad patent protections, and established distribution networks. As a newer innovation, Fluocinnonide-E’s market penetration is initially limited but expected to grow as clinical evidence and physician familiarity expand.

Regulatory Environment

Regulatory approval processes influence market entry and pricing dynamics. In the U.S., the Food and Drug Administration (FDA) classifies topical corticosteroids under Over-the-Counter (OTC) or prescription segments, depending on potency. Fluocinnonide-E, categorically high potency, requires a New Drug Application (NDA) approval pathway. In Europe, the European Medicines Agency (EMA) and national agencies regulate approval and reimbursement policies.

Regulatory approval timelines directly impact the market launch window and subsequent pricing strategies. An expedited approval could accelerate adoption and influence price stabilization patterns.

Market Penetration Strategies

Commercial success hinges on aggressive dermatology-focused marketing, physician education regarding unique benefits, and strategic positioning in current corticosteroid formulations. Partnerships with dermatology clinics and hospitals will facilitate sustained growth.

Price Analysis and Projections

Current Pricing Landscape

Given its potency and formulary positioning, Fluocinnonide-E’s initial price point is estimated to be slightly above the average for prescription topical corticosteroids. In the United States, high-potency corticosteroids like Clobetasol Propionate are priced around USD 150–200 per tube (30g), depending on manufacturer and branding. New entrants often price slightly higher initially to recoup R&D investments and establish product value.

Pricing Strategies

- Premium Pricing: Positioned as a cutting-edge, efficacious corticosteroid with a novel delivery mechanism, Fluocinnonide-E may command a premium—potentially USD 200–250 per 30g tube initially.

- Value-based Pricing: Pricing could be aligned with its clinical advantages over existing options, emphasizing improved patient outcomes or fewer side effects.

- Tiered Discounts: For institutional buyers, formulary inclusion, and insurance reimbursement negotiations, discounts will be necessary, influencing net prices.

Projected Price Changes (2023–2030)

| Year | Estimated Price per 30g Tube | Rationale |

|---|---|---|

| 2023 | USD 220–250 | Launch phase with initial premium positioning |

| 2025 | USD 200–220 | Market sedates as competition ramps up; price stabilization |

| 2027 | USD 180–200 | Increased competition and generic entry potential |

| 2030 | USD 150–180 | Ubiquity in formulary lists and broader access |

Note: These projections assume steady regulatory approval, positive clinical outcomes, and coverage expansion.

Factors Influencing Price Trajectory

- Patent Exclusivity and Generics: Patent expiry or challenges could lead to significant price reductions, fostering generic competition.

- Reimbursement Policies: Favorable insurance reimbursement policies will facilitate broader access, potentially stabilizing or reducing net pricing.

- Market Adoption: Physician and patient acceptance directly impact demand, influencing economies of scale and pricing power.

- Clinical Efficacy and Safety Profile: Superior efficacy or safety profiles can justify premium pricing.

Regulatory and Economic Risks

Uncertainties arise from potential delays in regulatory approvals, assessments of safety/effectiveness, and reimbursement hurdles. Political or economic shifts, such as healthcare reforms, can alter pricing and market access.

Future Outlook and Market Potential

The promising growth of topical corticosteroids, coupled with a robust pipeline of innovative formulations like Fluocinnonide-E, suggests a dynamic market landscape. If clinical trials demonstrate superior efficacy and safety, Fluocinnonide-E could secure a premium position, especially within niche dermatology segments.

By 2030, the market for high-potency topical corticosteroids is projected to grow at a CAGR of approximately 3%–4%, reaching an estimated USD 5.0–5.5 billion globally [1]. Fluocinnonide-E aims to capture a segment of this expanding market, primarily through strategic partnerships, differentiated clinical benefits, and cost-effective production.

Key Takeaways

- Market Positioning: Fluocinnonide-E must leverage its potency and formulation advantages to secure a strong position amidst established corticosteroids.

- Pricing Strategy: Initial premium pricing aligned with clinical efficacy and safety profiles is advisable, with gradual adjustments as market dynamics evolve.

- Regulatory Navigation: Efficient approval processes and proactive engagement with regulatory bodies are crucial to minimize delays and optimize market entry.

- Competitive Landscape: Anticipate increased competition from generics; early patent defenses and development of value-added features will be pivotal.

- Market Expansion Opportunities: Emerging markets with high dermatological disease prevalence present significant growth potential, contingent on appropriate affordability and access policies.

Conclusion

Fluocinnonide-E occupies a promising niche within the topical corticosteroid market landscape. Its success will depend on strategic regulatory navigation, effective market differentiation, and adaptive pricing models responsive to competitive and economic shifts. Continuous monitoring of clinical trial data, regulatory developments, and payer policies will be vital for stakeholders seeking to optimize investment and commercialization strategies.

FAQs

1. What differentiates Fluocinnonide-E from existing topical corticosteroids?

Fluocinnonide-E is formulated for enhanced skin penetration, offering potentially superior anti-inflammatory effects with a favorable safety profile, making it suitable for severe dermatological conditions.

2. How does patent protection influence the pricing of Fluocinnonide-E?

Patent exclusivity allows for premium pricing and market safeguarding. Once patents expire, generic competitors typically enter, leading to significant price reductions.

3. What regulatory challenges could impact Fluocinnonide-E’s market debut?

Delays in approval due to safety or efficacy concerns, or regulatory changes in classification, can postpone commercialization, affecting initial pricing and market share.

4. Which markets offer the highest growth opportunities for Fluocinnonide-E?

Emerging markets in Asia-Pacific and Latin America, where dermatological treatments are in growing demand and regulatory pathways are evolving, present substantial opportunities.

5. How can pricing be optimized post-launch for sustained market success?

A combination of value-based pricing, flexible discounting strategies, and demonstrating superior clinical outcomes will enhance market penetration and profitability.

Sources:

[1] Market Research Future. "Topical Corticosteroids Market - Forecast to 2030." 2022.

More… ↓