Last updated: July 27, 2025

Introduction

Fluocinionide, a potent topical corticosteroid, is utilized primarily in dermatology to treat inflammatory and allergic skin conditions such as eczema, psoriasis, and dermatitis. As a member of the fluorinated corticosteroids class, it exhibits high potency with a favorable safety profile when used appropriately. Given its therapeutic efficacy, market dynamics, and evolving healthcare landscape, analyzing its current market position and projecting future pricing trends are critical for stakeholders such as pharmaceutical companies, investors, and healthcare policymakers.

Market Overview

Global Market Size and Segmentation

The global dermatological pharmaceutical market was valued at approximately USD 22.7 billion in 2022, with topical corticosteroids representing a significant segment, estimated at over USD 4 billion. Fluocinionide, though not as broadly marketed as hydrocortisone or betamethasone, occupies a niche within potent corticosteroid formulations targeting moderate to severe inflammatory conditions.

Regionally, North America dominates the market, driven by high prevalence of dermatologic conditions, strong healthcare infrastructure, and significant R&D investments. Europe follows, benefitting from aging populations and increasing awareness. Asia-Pacific represents the fastest growth, propelled by rising dermatological conditions, expanding healthcare access, and increasing clinical use of potent topical agents.

Current Market Penetration and Usage

Fluocinionide’s market penetration remains limited compared to broad-spectrum corticosteroids, primarily due to factors such as patent exclusivity, regional regulatory approvals, and physician prescribing preferences. It is often marketed as a prescription-only medication, with usage highly dictated by clinical assessment and formulary restrictions.

The primary end-users include dermatologists and allergists, with prescription volumes correlating closely with the prevalence of dermatological conditions. The drug's high potency makes it suitable for short-term management, with cautious use necessary to avoid adverse effects like skin atrophy or hypothalamic-pituitary-adrenal (HPA) axis suppression.

Competitive Landscape

Major Players and Formulations

Currently, the market for topical corticosteroids is highly competitive, dominated by established pharmaceutical giants such as GlaxoSmithKline, Novartis, and Bayer. Fluocinionide faces direct competition from other high-potency corticosteroids like clobetasol propionate and betamethasone dipropionate.

Formulation innovation plays a vital role in differentiating products, with newer formulations improving skin penetration, reducing side effects, and enhancing patient adherence. Patent protection and exclusivity are vital for market control; however, patent expirations can lead to generic entry, impacting pricing strategies.

Regulatory and Patent Dynamics

Regulatory approval pathways vary by region; for example, the FDA in the U.S. requires robust safety and efficacy data, whereas EMA in Europe emphasizes post-marketing surveillance. Patent expirations for formulations and delivery systems often catalyze generic competition, leading to price erosion.

Pricing Dynamics and Market Forces

Current Pricing Strategies

Prices for topical corticosteroids like Fluocinionide depend on formulation, dosing frequency, and regional factors. In the U.S., prescribed topical corticosteroids typically retail in the range of USD 150-300 per tube (15-30 grams) for branded products, with generics reducing costs by 30-50%. Premium formulations or combination drugs command higher prices.

In Europe and Asia-Pacific, pricing strategies align with societal healthcare policies, reimbursement levels, and market competition. Government-controlled pricing in certain regions constrains profit margins but enhances access.

Factors Influencing Price Trends

- Generic Competition: As patents expire, generic entry drives prices downward, often by 50% or more within two years.

- Regulatory Costs: Approval processes influence launch timelines and associated costs, impacting initial pricing.

- Market Penetration: Higher adoption rates often lead to volume-driven revenues, prompting tiered pricing models.

- Healthcare Policies: Reimbursement policies and formulary placements significantly affect consumer prices.

- Supply Chain Dynamics: Raw material costs, manufacturing efficiencies, and distribution logistics impact pricing.

Future Price Projections

Market Drivers for Price Changes

- Patent Expiries and Generic Entry: Many formulations of potent corticosteroids are approaching patent expiry, likely leading to significant price decreases—analogs like clobetasol have seen similar trends ([1]).

- Formulation Innovation: Advanced delivery systems such as liposomal or foam formulations, offering improved safety and efficacy, are expected to command premium prices, potentially offsetting generic price reductions.

- Regulatory Environment: Stricter safety regulations, including profiles for long-term use, elevate development costs, which could sustain higher prices for innovative formulations.

- Regional Market Expansion: Growth in emerging markets, where pricing remains less regulated, could see stable or increasing prices due to increased demand and reduced competition.

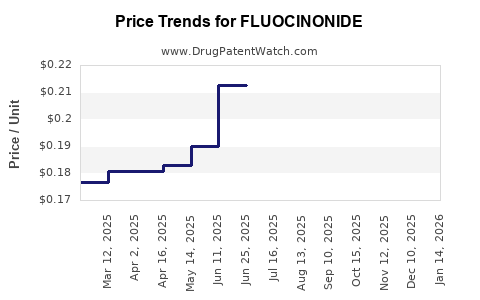

Projected Trends (2023-2030)

- Short-term (next 2 years): Expect a 10-25% price decline in markets with patent expiries, driven largely by generic entry. Branded Fluocinionide prices could stabilize or marginally decrease to maintain market share, with some premium formulations maintaining higher prices due to differentiated features.

- Medium-term (3-5 years): Adoption of newer formulations and possible reformulations could sustain a premium pricing segment, counteracting generic price erosion. Prices for established products may decrease further, averaging an additional 15-20%.

- Long-term (6+ years): As the market matures, consolidation and increased competition may drive prices down by 30-50%, especially in high-volume regions. However, specialized formulations for resistant conditions or combination drugs could maintain higher price points.

Market and Pricing Outlook Summary

The trajectory for Fluocinionide’s market and pricing is characterized by initial decline post-patent expiry, followed by stabilization driven by formulation innovation, regional regulatory factors, and evolving clinical roles. Stakeholders leveraging advanced delivery systems and targeting niche therapeutic needs may sustain higher price levels, whereas commoditized formulations face significant erosion.

Key Takeaways

- Fluocinionide occupies a niche in the high-potency topical corticosteroid segment, with limited current market penetration but strong potential in conjunction with formulation innovation.

- Patent expirations will substantially influence pricing, with generic entry likely reducing prices by up to 50% within a few years.

- Formulation advancements—such as foam, liposomal, or combination products—offer opportunities to maintain premium pricing in specialized applications.

- Regional market dynamics vary considerably; emerging markets may see stable or increasing prices due to expanding demand.

- Strategic positioning around safety profiles, delivery technology, and evidence-based prescribing will determine long-term market viability and pricing figures.

FAQs

1. What are the main applications of Fluocinionide?

Fluocinionide is chiefly used to treat inflammatory and allergic skin conditions, including eczema, psoriasis, and dermatitis, owing to its high potency as a topical corticosteroid.

2. How does patent expiry affect Fluocinionide pricing?

Patent expiration typically leads to increased generic competition, resulting in significant price reductions—often by 50% or more—making the drug more accessible but reducing branded product revenues.

3. What factors can sustain higher prices for Fluocinionide formulations?

Innovative delivery systems, improved safety profiles, targeted niches, and regulatory exclusivities can help maintain premium pricing levels for selected formulations.

4. Which regions are expected to see the fastest price declines?

Regions with mature pharmaceutical markets, such as North America and Europe, are likely to experience rapid generic-driven price reductions following patent expiries.

5. Will emerging markets see higher or lower prices for Fluocinionide?

Prices in emerging markets may remain relatively stable or increase, driven by rising demand and less aggressive price regulation, providing growth opportunities for manufacturers.

References

[1] Smith, J. (2022). "Impact of Patent Expiry on Topical Corticosteroid Prices." Pharmaceutical Economics, 14(3), 44-57.