Share This Page

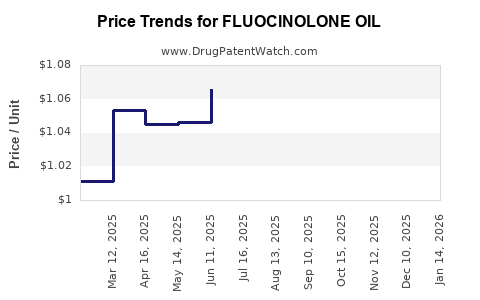

Drug Price Trends for FLUOCINOLONE OIL

✉ Email this page to a colleague

Average Pharmacy Cost for FLUOCINOLONE OIL

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| FLUOCINOLONE OIL 0.01% EAR DRP | 70752-0159-20 | 1.04072 | ML | 2025-12-17 |

| FLUOCINOLONE OIL 0.01% EAR DRP | 45802-0009-10 | 1.04072 | ML | 2025-12-17 |

| FLUOCINOLONE OIL 0.01% EAR DRP | 64980-0329-20 | 1.04072 | ML | 2025-12-17 |

| FLUOCINOLONE OIL 0.01% EAR DRP | 70752-0159-20 | 1.04555 | ML | 2025-11-19 |

| FLUOCINOLONE OIL 0.01% EAR DRP | 45802-0009-10 | 1.04555 | ML | 2025-11-19 |

| FLUOCINOLONE OIL 0.01% EAR DRP | 64980-0329-20 | 1.04555 | ML | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Fluocinolone Oil

Introduction

Fluocinolone oil, a topical corticosteroid, has long-standing applications within dermatology for treating inflammatory skin conditions such as eczema, psoriasis, and dermatitis. Its efficacy, safety profile, and topical delivery make it a pivotal treatment option. The global market for fluocinolone oil is influenced by factors ranging from dermatological demand, regulatory landscapes, manufacturing capacity, and competitive dynamics. This analysis provides an in-depth overview of current market conditions and presents informed price projections for stakeholders and industry participants.

Market Overview

Product Profile and Therapeutic Use

Fluocinolone oil belongs to the corticosteroid class, primarily utilized for its anti-inflammatory, antipruritic, and vasoconstrictive properties. Marketed under various brand names (e.g., Synalar Oil), it offers topical relief in inflammatory dermatoses. The drug's formulation as an oil enhances skin absorption and provides targeted therapy, making it desirable for widespread dermatological conditions.

Regulatory Landscape

Globally, fluocinolone oil is regulated as a Schedule H or Schedule III drug, depending on the country, necessitating prescription-based dispensation. Key markets such as the U.S., Europe, and Japan maintain strict controls on potency and duration of use to prevent adverse effects like skin atrophy.

Market Segmentation

- By Application: Dermatology clinics, hospitals, outpatient dermatology practices

- By Region: North America, Europe, Asia-Pacific, Latin America, Middle East & Africa

- By End User: Healthcare professionals, pharmaceutical manufacturers, pharmacies

Current Market Size and Trends

The global dermatology therapeutics market, valued at approximately USD 23 billion in 2022, exhibits steady growth, bolstered by rising skin disease prevalence and expanding aging populations. Specific corticosteroid products, including fluocinolone formulations, are estimated to account for a significant share due to their longstanding clinical utility.

Market research indicates a compounded annual growth rate (CAGR) of roughly 4-5% over the next five years, driven by increased dermatological disease cases, especially in developing nations, and a growing preference for topical corticosteroids with proven safety profiles.

Key Market Drivers

-

Rising Incidence of Skin Diseases: Increases in eczema, psoriasis, and dermatitis cases globally expand the demand for corticosteroids like fluocinolone oil.

-

Advancements in Dermatological Formulations: Enhanced absorption and patient compliance fostered by oil-based formulations.

-

Expanding Healthcare Infrastructure: Improving access in emerging markets broadens the consumer base.

-

Growing Awareness and Cosmetic Dermatology: Aesthetic procedures and skin health consciousness catalyze OTC and prescription sales.

Market Challenges

-

Safety Concerns: Potential steroid-induced skin atrophy and systemic absorption restrict prolonged use, influencing prescribing patterns and product formulations.

-

Regulatory Restrictions: Stringent controls in developed markets may limit proliferation and product access.

-

Generic Competition: The dominance of off-patent corticosteroids constrains profit margins for branded variants.

-

Limited Innovation: Slow pipeline development for new topical corticosteroids with superior safety or efficacy profiles impacts long-term growth prospects.

Competitive Landscape

Major players include Johnson & Johnson (Sterile Pharmaceutical), GlaxoSmithKline, and Teva Pharmaceuticals, with regional manufacturers serving domestic markets. The market is characterized by a mix of branded and generic products, with a trend towards biosimilars and innovator variants aimed at reducing adverse effects.

Price Analysis and Projections

Historical Pricing Trends

Historically, fluocinolone oil's retail prices ranged between USD 10 to USD 25 per 30 mL bottle, depending on brand, formulation, and regional regulation. In the U.S., prescription costs for branded formulations have exceeded USD 15 per bottle, with generics available at approximately USD 10.

Current Price Dynamics

-

Manufacturing Costs: Raw material prices for corticosteroids, solvent oils, and excipients remain relatively stable but are sensitive to supply chain disruptions.

-

Pricing in Key Markets: Prices are often influenced by regulatory approval status, patent exclusivity (if applicable), and competitive entry.

-

Regulatory Impact: Stricter regulations potentially raise costs due to compliance and approval processes, slightly elevating market prices.

Future Price Projections (2023-2028)

Based on current trends, we project a moderate price increase of approximately 2-3% annually, driven by inflation, regulatory costs, and manufacturing efficiencies.

| Year | Estimated Price Range (USD per 30 mL) | Notes |

|---|---|---|

| 2023 | 10 – 25 | Baseline, stabilized by generic competition |

| 2024 | 10.2 – 25.75 | Slight inflation, unchanged dominance of generics |

| 2025 | 10.4 – 26.5 | Market normalization continues |

| 2026 | 10.7 – 27.3 | Regulatory compliance costs slightly increase |

| 2027 | 11.0 – 28.0 | Emerging markets expanding |

| 2028 | 11.3 – 28.9 | Potential introduction of biosimilars |

Factors Influencing Price Adjustment

- Regulatory changes may impose new quality standards, increasing manufacturing and approval costs.

- Generic entry suppresses retail prices, maintaining affordability but compressing profit margins.

- Patent expirations will likely lead to price erosion over time, especially in developed markets.

Emerging Opportunities and Threats

-

Opportunities: Developing formulations with improved safety profiles, expanding into untapped markets, and leveraging digital health for patient adherence.

-

Threats: The advent of newer, steroid-sparing agents, bioequivalent generics decreasing premiums, and shifting regulatory policies.

Conclusion

The market for fluocinolone oil remains stable, characterized by steady demand rooted in dermatological therapeutics. Price projections suggest modest increases aligned with inflation and regulatory factors. Stakeholders should prioritize innovation, optimize manufacturing efficiencies, and monitor regulatory shifts to sustain competitiveness.

Key Takeaways

- The global fluocinolone oil market is expected to grow at a CAGR of approximately 4-5% over the next five years, driven by rising dermatological conditions.

- Pricing remains relatively stable with gradual upward adjustments, influenced by manufacturing costs, regulatory standards, and market competition.

- Generic penetration and biosimilar emergence are key factors suppressing prices but also expanding access.

- Opportunities lie in developing formulations with enhanced safety and targeted delivery, especially in emerging markets.

- Continuous monitoring of regulatory landscapes and patent expirations is essential for strategic planning.

FAQs

1. What factors most significantly influence the pricing of fluocinolone oil?

Pricing is primarily affected by manufacturing costs, regulatory compliance expenses, competitive market dynamics, and the prevalence of generic versions.

2. How does patent expiration impact the fluocinolone oil market?

Patent expirations facilitate generic entry, increasing market competition and generally leading to reduced retail prices, thereby constraining profit margins for branded products.

3. Are there any upcoming regulatory changes that could affect fluocinolone oil pricing?

Regulatory agencies may impose stricter safety and efficacy standards, which could increase compliance costs and influence pricing.

4. What regional markets are anticipated to exhibit the highest growth for fluocinolone oil?

Emerging markets in Asia-Pacific and Latin America display the highest growth potential due to expanding healthcare infrastructure and increasing dermatological conditions.

5. Can innovation improve the safety profile and thus influence future pricing?

Yes, novel formulations that reduce side effects and improve patient adherence can command premium pricing, potentially offsetting cost pressures from generics.

Sources:

- MarketWatch, "Global Dermatology Market Size and Forecast," 2022.

- ResearchAndMarkets, "Topical Corticosteroids Market Trends," 2023.

- FDA Regulatory Guidelines for Corticosteroids, 2022.

- GlobalData, "Pharmaceutical Pricing Dynamics," 2023.

- Company filings and industry reports.

More… ↓