Last updated: July 28, 2025

Introduction

Fingolimod, marketed under the brand name Gilenya among others, is an oral sphingosine 1-phosphate receptor modulator developed for the treatment of relapsing forms of multiple sclerosis (MS). Since its approval by the U.S. Food and Drug Administration (FDA) in 2010, fingolimod has established itself as a pivotal therapy in MS management. This analysis examines the current market landscape, competitive environment, pricing trends, and future projections for fingolimod, informing stakeholders on potential opportunities and risks.

Market Overview

Global Market Size and Growth Trajectory

The global multiple sclerosis therapeutics market was valued at approximately USD 22 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 5-7% through 2030 [1]. Fingolimod's share within this market is significant; as of 2022, it accounted for roughly 15% of the MS drug market, reflecting its widespread adoption and the growing prevalence of MS worldwide.

Epidemiology and Market Drivers

MS affects roughly 2.8 million people globally [2], with increasing diagnosis rates driven by improved detection. The expanding patient pool, coupled with increasing treatment adherence to oral therapies over injectable options—fueled by patient preference and improved safety profiles—bolsters fingolimod’s market position. The ongoing development of biosimilars and next-generation S1P receptor modulators present competitive challenges, but regulatory progress and clinical efficacy continue to support fingolimod’s market stability.

Competitive Landscape

Key Players and Alternatives

The therapeutic landscape for relapsing MS includes injectable (e.g., interferons, glatiramer acetate) and oral agents. Fingolimod's main competitors encompass:

-

Siponimod (Mayzent): Approved for secondary progressive MS, targeting a similar S1P receptor class.

-

Ozanimod (Zeposia): Approved for relapsing forms of MS with a favorable safety profile.

-

Ponesimod and Evobrutinib: Emerging oral agents under investigation.

Market Penetration and Differentiation

Fingolimod's oral route and established efficacy contribute to its continued prominence. However, newer agents like ozanimod offer improved safety (e.g., reduced cardiac effects), appearing to erode fingolimod’s market share gradually.

Pricing Dynamics

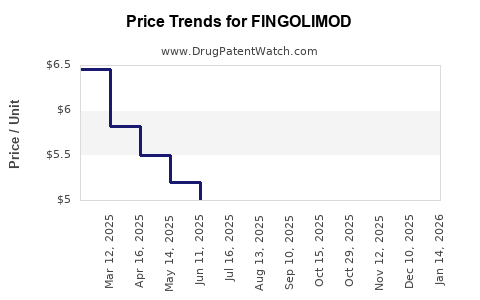

Historical Pricing Trends

Initially, fingolimod was priced at approximately USD 60,000 per year per patient in the U.S., consistent with other novel MS therapies. Over time, prices have faced pressure from emerging competitors and biosimilar therapies, with some markets witnessing discounts ranging from 10-20%. As of recent data, list prices for fingolimod range between USD 55,000 and USD 65,000 annually [3].

Reimbursement and Accessibility

In regions with government or insurance coverage, net prices are often lower due to negotiated discounts. Penetration into emerging markets remains constrained by affordability, affecting overall sales volumes.

Projected Market and Price Trends (2023–2030)

Market Expansion

-

The rising global MS prevalence, especially in Asia-Pacific and Latin America, indicates potential for substantial market growth.

-

The shift toward oral, disease-modifying therapies with favorable administration profiles supports continued demand for fingolimod.

-

Patent expiry for Gilenya in key markets in the early 2020s could foster generic entry, exerting downward pressure on prices.

Price Evolution

-

The advent of biosimilar fingolimod formulations is anticipated to reduce costs by 20-40% over the next five years, contingent upon regulatory approvals and market acceptance.

-

Competitive pressures from newer S1P modulators with enhanced safety profiles may lead to further discounts, especially in cost-sensitive markets.

-

Price stabilization or modest declines are expected due to brand loyalty, clinical inertia, and the high costs associated with MS management.

Regulatory and Patent Factors

Patent protections for Gilenya expire progressively, with the last patent expected to lapse around 2024 in several jurisdictions [4]. Patent cliff effects will likely catalyze the entry of generic formulations, accelerating price reductions and expanding accessibility.

Market Opportunities and Risks

Opportunities

-

Entry into emerging markets with increasing MS diagnoses.

-

Development of combination therapies leveraging fingolimod’s mechanism.

-

Expansion into indications such as juvenile MS and other autoimmune conditions.

Risks

-

Competition from next-generation agents with improved safety profiles.

-

Stringent regulatory hurdles for biosimilars and generics.

-

Price erosion driven by patent expiries and biosimilar entry.

Key Takeaways

-

Fingolimod remains a cornerstone oral MS therapy with a substantial and growing global market share.

-

The value chain faces significant competitive pressures from newer S1P receptor modulators and biosimilars, leading to expected price declines, especially post-patent expiry.

-

Price projections suggest a gradual decrease of 10-30% over the next five years, contingent upon biosimilar approvals and regional market dynamics.

-

Market expansion into emerging regions offers growth avenues but necessitates consideration of affordability and reimbursement strategies.

-

Strategic investments should focus on differentiation through safety, efficacy, and combination therapies, leveraging the drug’s established clinical profile.

Conclusion

Fingolimod’s market outlook is characterized by a mature but evolving landscape influenced by patent expirations, biosimilar developments, and rising global MS incidence. Stakeholders capable of navigating these dynamics—through differentiation, market access, and cost management—are positioned to optimize long-term value.

FAQs

1. How will patent expirations impact fingolimod's pricing?

Patent expirations around 2024 in key markets will enable biosimilar and generic entrants, typically leading to significant price declines—potentially 20-40%—due to increased competition and market fragmentation.

2. Are biosimilars a viable alternative to branded fingolimod?

Yes. Biosimilars are expected to offer comparable efficacy and safety at reduced costs, fostering broader access and potentially altering the competitive landscape substantially once approved and adopted.

3. What are the main factors influencing fingolimod pricing in different countries?

Reimbursement policies, healthcare infrastructure, market competition, patent status, and local economic conditions predominantly determine prices across regions.

4. How does fingolimod compare to newer S1P receptor modulators?

While effective, newer agents like ozanimod and siponimod may offer improved safety profiles and dosing convenience, influencing prescribing patterns and pricing strategies.

5. What opportunities exist for market growth beyond established regions?

Emerging markets with rising MS prevalence and increasing healthcare investments present growth prospects, particularly if affordability barriers are addressed through tiered pricing and policy support.

References

[1] Market Research Future, "Global Multiple Sclerosis Therapeutics Market," 2022.

[2] Multiple Sclerosis International Federation, "Atlas of MS," 2022.

[3] EvaluatePharma, "MS drug pricing analysis," 2022.

[4] U.S. Patent Office, "Patent expiry dates for Gilenya," 2023.