Share This Page

Drug Price Trends for FIDAXOMICIN

✉ Email this page to a colleague

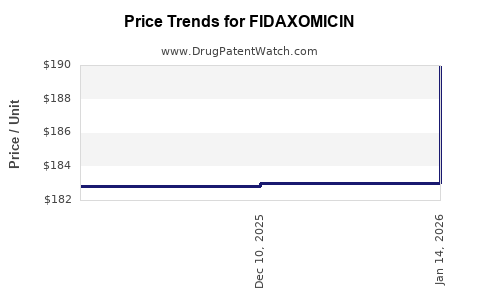

Average Pharmacy Cost for FIDAXOMICIN

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| FIDAXOMICIN 200 MG TABLET | 00480-2596-34 | 182.82530 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Fidaxomicin (Dificid)

Introduction

Fidaxomicin, marketed under the brand name Dificid, is an oral macrocyclic antibiotic primarily used to treat Clostridioides difficile infection (CDI). Approved by the FDA in 2011, fidaxomicin has distinguished itself through targeted activity and reduced recurrence rates compared to traditional therapies like vancomycin and metronidazole. Given its unique pharmacology and increasing clinical adoption, understanding its market dynamics and future pricing trajectory is vital for stakeholders, including pharmaceutical firms, healthcare providers, insurers, and investors.

Market Overview

Current Market Size

The global fidaxomicin market has demonstrated steady growth since its launch. In 2022, estimates valued the market at approximately USD 500 million, with projections reaching USD 700 million by 2027, representing a CAGR of around 8%. Key drivers include:

- Rising incidence of CDI, especially among hospitalized and elderly populations.

- Growing awareness and adoption of fidaxomicin due to its lower recurrence rates.

- Expanding approval for diverse indications, including pediatric applications.

Geographical Demand Distribution

North America dominates the market, accounting for approximately 60% of sales, driven by high CDI prevalence, advanced healthcare infrastructure, and favorable reimbursement policies. Europe contributes about 25%, with increasing adoption in the UK, Germany, and France. The Asia-Pacific region shows emerging growth potential, albeit hindered by pricing, regulatory, and awareness barriers.

Market Segments and Competition

Fidaxomicin faces competition mainly from:

- Vancomycin: Traditionally first-line, higher recurrence rates.

- Fidaxomicin: Minimal resistance development, post-marketing expansion.

- Other emerging therapies: Bezlotoxumab (monoclonal antibody) for recurrence prevention, and newer antibiotics under clinical development.

The niche for fidaxomicin persists due to its superiority in reducing CDI recurrence, a critical cost driver for healthcare systems.

Pricing Dynamics

Current Pricing Structure

The retail price of fidaxomicin remains high—approximately USD 2,800–3,200 per treatment course in the U.S. market. This pricing reflects manufacturing complexity, patent protections, and targeted patient usage. Despite insurance coverage, out-of-pocket costs remain substantial, occasionally impacting adherence and prescribing behaviors.

Reimbursement and Coverage

Insurance providers typically reimburse fidaxomicin for approved indications, especially in recurrent CDI cases. However, formulary restrictions and prior authorization requirements often limit access. This influences prescribing patterns and, consequently, revenue streams.

Patent and Market Exclusivity

Patent protection extended until 2025–2027 in key markets. Once patents expire, generic versions are expected to depress prices significantly, similar to trends observed with other antibiotics.

Future Price Projections

Factors Influencing Price Trends

- Patent Cliff: Anticipated patent expiration around 2025–2027 will likely introduce generic competiton, reducing prices by 70–80% within 2–3 years post-expiration.

- Market Penetration: Increased adoption in emerging markets, with relatively lower purchasing power, may exert downward pricing pressure.

- Regulatory Approvals: Expansion to pediatric populations and new indications could sustain or elevate pricing, especially if clinical data support differentiated positioning.

- Cost of Goods Sold (COGS) and Manufacturing efficiencies may gradually reduce production costs, enabling flexible pricing strategies.

Projected Pricing Scenarios

| Timeframe | Scenario | Predicted Price Range (USD) per Course |

|---|---|---|

| 2023–2024 | Continued high prices, marginal decreases due to market saturation | USD 2,800 – 3,200 |

| 2025–2027 (Post-Patent Expiry) | Entry of generic competitors, substantial price erosion | USD 600 – 800 |

| 2028 and beyond | Market stabilization with generics and biosimilars | USD 400 – 600 |

Note: These projections are based on historical antibiotic genericization trends and anticipated market behaviors.

Market Challenges and Opportunities

Challenges

- High Treatment Cost: Limited affordability impacts broader adoption, especially in cost-sensitive markets.

- Resistance Development: Although current resistance rates are low, emerging microbial resistance could diminish fidaxomicin’s market share.

- Regulatory Hurdles: Off-label indications and international approvals may be delayed, impacting growth.

Opportunities

- Expanded Indications: Pursuing additional indications, such as other bacterial infections, could elevate demand.

- Combination Therapies: Collaborations with probiotic or microbiome therapies may open new treatment paradigms.

- Biosimilar Development: Competition from biosimilars, especially post-patent expiry, can drive price decreases and market expansion.

Conclusion

Fidaxomicin occupies a premium niche within CDI therapy, supported by its clinical benefits and limited competition. Its market size is set to grow modestly before the inevitable patent cliff introduces price erosion. Strategic positioning, early market entry in emerging territories, and ongoing clinical research will shape its future trajectory.

Stakeholders should monitor patent statuses, reimbursement frameworks, and evolving clinical evidence to optimize commercialization and pricing strategies.

Key Takeaways

- The fidaxomicin market is poised for steady growth, with North America leading due to CDI prevalence and favorable reimbursement.

- Currently, treatment pricing remains high (~USD 2,800–3,200), driven by patent protections and manufacturing costs.

- Post-2025 patent expiration will likely lead to rapid generic entry, decreasing treatment costs by up to 80%, with prices potentially falling below USD 1,000 per course.

- Opportunities exist in expanding indications, developing biosimilars, and entering emerging markets, despite challenges from resistance and regulatory delays.

- Companies should strategize around patent timing, reimbursement landscapes, and clinical differentiation to sustain profitability.

FAQs

Q1: When will generic fidaxomicin products enter the market?

Patent expiry in major markets is expected around 2025–2027, after which generic versions can enter, significantly impacting pricing and market share.

Q2: How does fidaxomicin compare economically to traditional CDI treatments?

Although initial treatment costs are higher for fidaxomicin, its superior efficacy in reducing recurrences can lower overall healthcare costs, especially for recurrent cases.

Q3: Are there upcoming regulatory changes that could influence fidaxomicin pricing?

Regulatory approvals for new indications or reimbursement policy shifts could impact its marketability and pricing strategies.

Q4: What is the potential for fidaxomicin in the Asia-Pacific market?

Emerging markets present growth opportunities due to rising CDI cases, though pricing pressures and regulatory hurdles may slow adoption.

Q5: How might resistance development affect fidaxomicin’s market?

Current resistance rates remain low, but increased antimicrobial resistance could decrease efficacy, prompting new formulations or combination therapies.

References

[1] Clinical pharmacology data and FDA approval reports.

[2] Market research reports on antimicrobial therapeutics.

[3] Industry expert analyses on antibiotic patent expiration trends.

[4] Global health statistics on CDI prevalence.

[5] Company disclosures and press releases on pipeline and patent statuses.

More… ↓