Share This Page

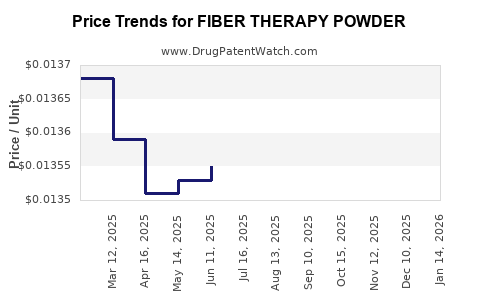

Drug Price Trends for FIBER THERAPY POWDER

✉ Email this page to a colleague

Average Pharmacy Cost for FIBER THERAPY POWDER

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| FIBER THERAPY POWDER | 00904-5675-16 | 0.01301 | GM | 2025-12-17 |

| FIBER THERAPY POWDER | 00904-5675-16 | 0.01325 | GM | 2025-11-19 |

| FIBER THERAPY POWDER | 00904-5675-16 | 0.01344 | GM | 2025-10-22 |

| FIBER THERAPY POWDER | 00904-5675-16 | 0.01355 | GM | 2025-09-17 |

| FIBER THERAPY POWDER | 00904-5675-16 | 0.01349 | GM | 2025-08-20 |

| FIBER THERAPY POWDER | 00904-5675-16 | 0.01355 | GM | 2025-07-23 |

| FIBER THERAPY POWDER | 00904-5675-16 | 0.01355 | GM | 2025-06-18 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for FIBER THERAPY POWDER

Introduction

FIBER THERAPY POWDER has surged in popularity within the dietary supplement and gastrointestinal health sectors, driven by increasing consumer awareness of digestive health and wellness. As a dietary supplement, it positions itself amid a competitive landscape favoring natural and fiber-based products, with anticipated growth fueled by consumer health trends and expanding global markets. This analysis explores current market dynamics, competitive landscape, regulatory factors, and future pricing trends to inform stakeholders' strategic decisions.

Market Overview

Global Market Size and Growth Drivers

The global fiber supplement market was valued at approximately $2.2 billion in 2022 and is projected to grow at a CAGR of 5.8% through 2030 [1]. The rising consumer focus on digestive health, weight management, and metabolic wellness underpins this expansion. FIBER THERAPY POWDER, as a concentrated fiber supplement, benefits from these trends, especially within North America, Europe, and emerging Asian markets.

Consumer Demographics and Preferences

The core consumers include health-conscious adults aged 25-50, with a significant segment comprising individuals seeking preventive health solutions. The shift towards plant-based and organic ingredients enhances product appeal. Moreover, consumers favor convenience, which positions powdered form as a preferred delivery format over pills or liquids.

Distribution Channels

Sales predominantly occur through pharmacies, health food stores, e-commerce platforms, and direct-to-consumer brands. E-commerce’s share has increased notably post-pandemic, accounting for approximately 35-40% of total sales [2].

Competitive Landscape

Major Players

Key competitors include:

- Benecol: Known for functional fiber formulations.

- Metamucil (Cargill): A dominant player with a broad product portfolio.

- Now Foods: Offers affordable, no-frills fiber powders.

- Jarrow Formulas & Garden of Life: Focus on organic, plant-based fibers.

Product Differentiation Factors

Innovation centers on:

- Ingredient sourcing: Organic, non-GMO fibers like psyllium husk, acacia, or chia.

- Formulation: Combining fibers with probiotics, prebiotics, or flavorings.

- Labeling: Clean-label, allergen-free, and vegan certifications.

Patent Landscape

While specific patents for fiber powders are limited, innovations in extraction methods, functional formulations, and sustained-release delivery may be patentable, providing competitive advantages and barriers.

Regulatory Environment

In regions such as the U.S., FIBER THERAPY POWDER falls under dietary supplement regulations enforced by the FDA, requiring compliance with labeling, manufacturing practices, and claims substantiation. The European Union’s Novel Food regulation impacts ingredients derived from new sources, necessitating pre-market authorization.

Pricing Dynamics

Current Price Range

Wholesale and retail prices fluctuate based on ingredient quality, branding, and distribution channels:

- Wholesale price: $4 - $8 per kilogram.

- Retail price: $15 - $30 per 300g to 500g container.

Premium organic or specialty formulations command higher margins, often exceeding $25 per 500g.

Factors Influencing Price

- Raw material costs: Sourced from regions exporting high-quality fibers (e.g., psyllium from India).

- Manufacturing costs: GMP-certified facilities, quality assurance.

- Brand positioning: Premium brands leverage higher pricing through product differentiation.

- Regulatory compliance costs: Certification, testing, and claims substantiation.

Price Projections

Short-term Outlook (2023-2025)

Prices are expected to remain stable, influenced by raw material availability and manufacturing costs. Minor inflationary pressures may lead to 2-3% increases annually, especially for organic ingredients due to supply constraints and higher cultivation costs.

Medium to Long-term Outlook (2026-2030)

- Market expansion: Growing demand in emerging markets and through e-commerce will boost sales volume.

- Ingredient innovation: Introduction of novel fiber sources or synergistic blends could command premium pricing, pushing retail prices above $35 per 500g by 2030.

- Regulatory developments: Stricter standards may raise manufacturing costs, translating into higher consumer prices.

Scenario Analysis

- Optimistic scenario: Innovation and market expansion lead to increased premiums. Expect retail prices to average $30-35 per 500g by 2030.

- Conservative scenario: Supply chain disruptions or regulatory hurdles restrict price growth, maintaining prices at $20-$25 per 500g.

Strategic Recommendations

- Harness innovation in fiber sourcing and formulation to command premium pricing.

- Focus on organic, clean-label certifications to differentiate in competitive markets.

- Strengthen e-commerce presence to capitalize on direct-to-consumer sales growth.

- Monitor regulatory changes closely to anticipate compliance costs and related pricing impacts.

Key Takeaways

- The global fiber supplement market is poised for steady growth, driven by rising health consciousness.

- FIBER THERAPY POWDER's pricing will remain relatively stable short-term but may increase due to innovation and demand.

- Premium formulations and organic certifications can justify higher retail prices.

- E-commerce expansion and regulatory compliance are critical drivers of strategic pricing decisions.

- Supply chain and ingredient sourcing stability are vital for maintaining cost-effective pricing strategies.

FAQs

1. What are the primary factors influencing the price of FIBER THERAPY POWDER?

Raw material costs, manufacturing expenses, branding, regulatory compliance, and distribution channels primarily influence pricing. Premium ingredients and certifications elevate retail prices.

2. How does consumer demand impact future pricing of fiber powders?

Growing health awareness and preference for natural, organic products enable brands to command higher prices for premium formulations, especially as markets mature and innovation accelerates.

3. What regulatory challenges could affect the pricing of FIBER THERAPY POWDER?

Regulations on ingredient sourcing, health claims, and manufacturing practices may increase compliance costs, potentially raising retail prices.

4. Are there geographic differences in pricing and market potential?

Yes. Developed markets like North America and Europe have higher retail prices due to established demand and regulatory standards, whereas emerging markets tend to have lower prices but growing sales potential.

5. What role will innovation play in the future pricing of fiber supplements?

Innovation in ingredient sourcing, formulation, and delivery methods can create premium offerings, allowing for higher pricing coalescing with consumer expectations for enhanced functionality.

Sources:

[1] ResearchAndMarkets, "Global Fiber Supplement Market," 2022.

[2] Statista, "E-commerce sales share in dietary supplements," 2022.

More… ↓