Share This Page

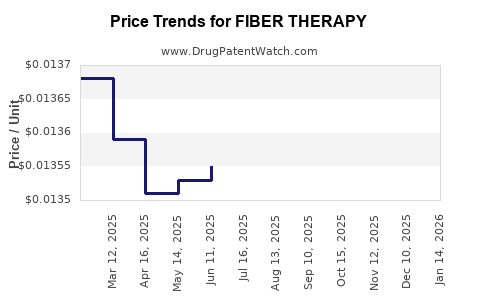

Drug Price Trends for FIBER THERAPY

✉ Email this page to a colleague

Average Pharmacy Cost for FIBER THERAPY

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| FIBER THERAPY POWDER | 00904-5675-16 | 0.01301 | GM | 2025-12-17 |

| FIBER THERAPY POWDER | 00904-5675-16 | 0.01325 | GM | 2025-11-19 |

| FIBER THERAPY POWDER | 00904-5675-16 | 0.01344 | GM | 2025-10-22 |

| FIBER THERAPY POWDER | 00904-5675-16 | 0.01355 | GM | 2025-09-17 |

| FIBER THERAPY POWDER | 00904-5675-16 | 0.01349 | GM | 2025-08-20 |

| FIBER THERAPY POWDER | 00904-5675-16 | 0.01355 | GM | 2025-07-23 |

| FIBER THERAPY POWDER | 00904-5675-16 | 0.01355 | GM | 2025-06-18 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for FIBER THERAPY

Introduction

Fiber therapy, primarily used to manage gastrointestinal conditions such as chronic constipation, irritable bowel syndrome (IBS), and to promote overall digestive health, has gained significant traction in recent years. As consumers increasingly seek non-pharmacological, dietary-based solutions, fiber-based therapies present a growing market opportunity. This analysis explores key market drivers, competitive landscape, pricing dynamics, and future projections to inform stakeholders seeking strategic insights into fiber therapy's commercial potential.

Market Overview

Definition and Scope

Fiber therapy encompasses dietary fiber supplements—such as powders, capsules, and functional foods—and medical-grade fiber products used to modulate bowel movements and improve gut health. The global fiber supplement market, a primary indicator of fiber therapy adoption, was valued at approximately USD 3.0 billion in 2022 and projects continuous growth driven by aging populations and rising awareness of gut health.

Market Drivers

-

Increasing Prevalence of Digestive Disorders: Rising incidence of constipation, IBS, and other gastrointestinal issues has elevated demand for fiber supplements, with North America and Europe leading adoption rates [1].

-

Consumer Preference for Natural and Dietary Solutions: A shift toward health-conscious choices favors high-fiber diets, fueling demand for over-the-counter (OTC) fiber products.

-

Aging Population: Older adults are more prone to digestion-related health issues, driving sales of fiber therapy products [2].

-

Regulatory Support and Healthcare Awareness: Initiatives promoting gut health as part of overall wellness support market expansion.

Market Constraints

-

Regulatory Challenges: Variations in classification and health claims approval can restrict product marketing strategies.

-

Consumer Perceptions: Concerns about fiber supplement side effects, such as bloating or gas, can hinder adoption.

-

Competitive Landscape: Presence of numerous established brands and private labels intensifies price competition.

Market Segmentation

By Product Type

-

Dietary Fiber Supplements: Powders, capsules, chewables, and functional foods.

-

Medical-Grade Fiber Products: Used in clinical settings for patients with severe constipation or preoperative bowel preparation.

By Distribution Channel

-

OTC Retail (Pharmacies and Supermarkets)

-

Online Retail Platforms

-

Healthcare Facilities

By Geographic Region

-

North America: Largest market share due to high consumer awareness and healthcare infrastructure.

-

Europe: Growing adoption driven by preventive health initiatives.

-

Asia-Pacific: Rapidly expanding market owing to increasing urbanization and health literacy.

Competitive Landscape

Major players include:

-

Benefiber (Novartis): Known for clear, tasteless fiber supplements.

-

Metamucil (Procter & Gamble): A market leader with a broad product portfolio.

-

Phillips (Pfizer): Focused on clinical-grade fiber therapies.

-

Private Label Manufacturers: Offering cost-effective alternatives in retail outlets.

Emerging startups are innovating with prebiotic combinations and fiber-enriched functional foods, diversifying the landscape.

Pricing Dynamics

Current Pricing Benchmarks

-

Powdered Fiber Supplements: Typically priced at USD 10-15 for a 300g container; a month’s supply is approximately USD 15-25.

-

Capsules: Range from USD 8-20 per bottle (30-60 capsules).

-

Functional Foods: Priced at USD 2-5 per serving, with daily consumption recommended.

Factors Influencing Price Points

-

Product Formulation: Specialized fibers with added prebiotics or probiotics command premium pricing.

-

Brand Positioning: Established brands maintain higher prices through perceived quality and trust.

-

Distribution Channel: Online sales often offer lower prices due to reduced overheads, while retail outlets might price higher.

-

Regulatory and Certification Costs: Organic, non-GMO, or clinically validated claims can elevate product costs, reflected in retail pricing.

Price Trends and Forecasts

Analysts predict a compound annual growth rate (CAGR) of approximately 5-7% for fiber supplement prices through 2030, driven by innovation and premiumization trends. The introduction of personalized fiber formulations tailored to specific gut health needs could further elevate pricing structures.

Future Market Projections

Market Growth

The fibrous supplement segment is expected to reach USD 4.5-5.0 billion by 2030, with a CAGR of 6.2% (2023–2030). Asia-Pacific is anticipated to exhibit the highest growth rates, potentially tripling market size by 2030 due to increasing health awareness and urbanization.

Price Evolution

-

Premium Products: Expect continued premiumization, with fiber therapies incorporating prebiotics, probiotics, and targeted formulations priced 20-30% higher than basic counterparts.

-

Economies of Scale: Increased manufacturing and distribution efficiencies may moderate price increases, making fundamental fiber products more accessible.

-

Innovative Delivery Platforms: Novel forms, such as ready-to-drink beverages or fiber-enriched functional snacks, could command premium prices.

Regulatory Impact

Stricter health claim approvals and quality standards may influence pricing by increasing product development costs but could also foster consumer trust and willingness to pay higher prices for validated benefits.

Regulatory and Market Considerations

-

Ingredient Safety and Claims: Compliance with FDA, EFSA, and other authorities influence product labeling and marketing strategies, affecting pricing.

-

Intellectual Property: Proprietary formulations or patent protections may enable premium pricing for innovative fibers.

-

Market Entry Barriers: High R&D costs and regulatory hurdles can limit new entrants, affecting price competition.

Key Challenges and Opportunities

-

Challenges: Price sensitivity among consumers, regulatory complexity, and market saturation.

-

Opportunities: Development of personalized fiber solutions, integration with digital health platforms, and expansion into emerging markets.

Key Takeaways

-

The fiber therapy market is poised for steady growth, driven by increasing awareness of gut health and preventive care trends.

-

Pricing strategies will evolve with product innovation, consumer preferences, and regulatory landscapes, with premium offerings expected to command higher prices.

-

Asia-Pacific presents significant expansion opportunities owing to demographic shifts and rising health literacy.

-

Industry players should focus on product differentiation through clinical validation, delivery innovations, and targeted formulations.

-

Regulatory compliance remains critical for sustained growth, especially in emerging markets with evolving standards.

FAQs

1. What are the primary factors influencing fiber therapy pricing?

Product formulation complexity, brand positioning, distribution channels, regulatory compliance, and added health benefits drive pricing dynamic shifts.

2. How does consumer perception impact fiber therapy market growth?

Perceptions around effectiveness, side effects, and natural ingredients influence adoption, potentially restraining or accelerating market expansion.

3. Which geographic region offers the highest growth potential for fiber therapy products?

Asia-Pacific is projected to see the fastest growth due to rising urbanization, increased health awareness, and expanding middle-class populations.

4. What innovations could impact future pricing models for fiber therapy?

Personalized formulations, fiber-enriched functional foods, and digital health integrations are likely to enable premium pricing.

5. How do regulatory standards affect the development of fiber therapy products?

Strict regulations on health claims and ingredient safety influence product development costs and marketing strategies, affecting retail pricing.

References

[1] MarketWatch. "Global Fiber Supplements Market Size, Share & Industry Analysis," 2022.

[2] Grand View Research. "Digestive Health Market Forecast," 2023.

More… ↓