Share This Page

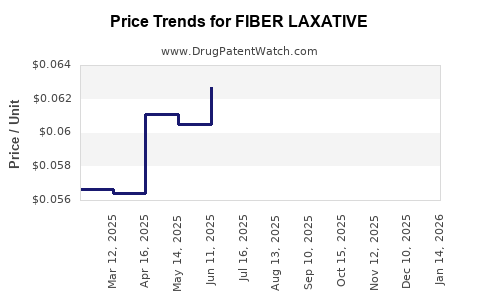

Drug Price Trends for FIBER LAXATIVE

✉ Email this page to a colleague

Average Pharmacy Cost for FIBER LAXATIVE

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| FIBER LAXATIVE 625 MG CAPLET | 70000-0067-01 | 0.05980 | EACH | 2025-12-17 |

| FIBER LAXATIVE 625 MG CAPLET | 70000-0067-01 | 0.05872 | EACH | 2025-11-19 |

| FIBER LAXATIVE 625 MG CAPLET | 70000-0067-01 | 0.05596 | EACH | 2025-10-22 |

| FIBER LAXATIVE 625 MG CAPLET | 70000-0067-01 | 0.05700 | EACH | 2025-09-17 |

| FIBER LAXATIVE 625 MG CAPLET | 70000-0067-01 | 0.05841 | EACH | 2025-08-20 |

| FIBER LAXATIVE 625 MG CAPLET | 70000-0067-01 | 0.05966 | EACH | 2025-07-23 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Fiber Laxative

Introduction

Fiber laxatives occupy a significant segment within the over-the-counter (OTC) gastrointestinal health market, driven by escalating consumer awareness around digestive health, rising prevalence of functional constipation, and a growing aging population. This analysis offers a comprehensive review of the current market landscape, key drivers, competitive dynamics, regulatory influences, and future price projections for fiber laxatives.

Market Overview

The global fiber laxative market was valued at approximately USD 1.2 billion in 2022, with projections reaching USD 1.9 billion by 2030, reflecting a compound annual growth rate (CAGR) of 6.1% (2023-2030)[1]. The market's steady expansion stems from increased consumer focus on digestive wellness, and the shift toward natural, OTC remedies.

Fiber laxatives are primarily classified into methylcellulose, psyllium husk, methylcellulose, and inulin-based products. Key players include Johnson & Johnson, Bayer, and Scott & Ferguson, alongside numerous regional brands.

Market Drivers

1. Rising Incidence of Digestive Disorders

Functional constipation affects an estimated 14% of the global population, with higher incidence in older adults and women[2]. This demographic trend boosts demand for fiber-based solutions that are perceived as safe and effective.

2. Growing Preference for Natural and Dietary Supplements

Consumers increasingly prefer natural remedies, favoring soluble fiber supplements over stimulant laxatives. The perception of fiber laxatives as gentle and non-addictive enhances their market appeal.

3. Increased Healthcare Accessibility and Self-care Trends

Advances in healthcare access and heightened health awareness promote self-medication, especially in developed nations. OTC fiber laxatives become convenient options for gastrointestinal health management.

4. Product Innovation and Differentiation

Innovations such as sugar-free formulations, flavored powders, and combined probiotic-fiber products expand consumer options and stimulate market growth.

Regulatory and Market Challenges

1. Regulatory Variations

Regulatory landscapes influence market evolution. For instance, the U.S. FDA classifies certain fiber products as dietary fibers, affecting labeling and marketing protocols. Regulatory scrutiny over health claims can impact product positioning and pricing.

2. Competition from Prescription and Other OTC Laxatives

The coexistence of stimulant and osmotic laxatives creates competitive pressures. The perception of fiber laxatives as safe adjuncts or alternatives influences market shares.

3. Price Sensitivity and Reimbursement Policies

In regions where healthcare policies encourage OTC product use, price sensitivity remains high, impacting manufacturers' pricing strategies.

Competitive Landscape

Leading players such as Johnson & Johnson's Metamucil, Bayer's Dulcolax, and various regional brands dominate the market. Differentiation primarily relies on formulation innovation, branding, and distribution networks.

Emerging entrants focus on organic, gluten-free, and non-GMO ingredients to meet consumer demand for cleaner labels. E-commerce platforms increasingly facilitate direct-to-consumer sales, impacting traditional pricing models.

Price Trends and Future Projections

Current Pricing Dynamics

Average retail prices for fiber laxatives vary by formulation and region.

- Powders (e.g., Metamucil): USD 10-20 per container (approximately 20-40 servings).

- Capsules/Tablets: USD 8-15 for pack sizes around 30-60 servings.

- Organic/Natural Brands: Priced at 20-30% higher than mainstream brands, given premium ingredients.

Price sensitivity influences consumer loyalty and product switching behaviors.

Factors Influencing Future Price Projections

-

Market Growth and Consumer Demand: Sustained growth will enable manufacturers to leverage economies of scale, potentially lowering prices. Conversely, premium organic niches may maintain higher price points to uphold brand positioning.

-

Regulatory Changes: Stricter labeling or health claim regulations could increase compliance costs, exerting upward pressure on prices.

-

Raw Material Costs: Fluctuations in sourcing ingredients like psyllium husk and inulin impact production costs, thereby affecting retail prices.

-

Innovation and Differentiation: Introduction of novel formulations or delivery systems (e.g., effervescent powders) allows premium pricing strategies.

-

E-commerce Penetration: Competitive online markets often foster price wars, potentially reducing retail prices but simultaneously creating opportunities for premium offerings.

Projected Price Trends (2023-2030)

Based on current trajectories and industry insights, the retail price for standard fiber laxatives is anticipated to increase marginally at a CAGR of approximately 3-4%, reaching:

- Powders: USD 11-25 per container

- Capsules/Tablets: USD 9-17 for similar pack sizes

- Organic/Niche Products: USD 25-40, sustaining premium positioning

The increased adoption of premium and specialized fiber products underscores a bifurcated market where mainstream affordability persists alongside high-end offerings.

Future Market and Price Outlook

The fiber laxative segment is poised for steady expansion, influenced by demographic shifts and health trends. Manufacturers should anticipate subtle upward pricing trends, with potential discounts in highly competitive online channels. Premiumization in organic and functional formulations will likely sustain higher price points, contributing to overall revenue growth.

Key Takeaways

- The global fiber laxative market is projected to grow at a CAGR of over 6% through 2030, driven by rising digestive health awareness and demographic shifts.

- Price points vary regionally and by formulation but are expected to rise modestly, driven by innovation, raw material costs, and regulatory considerations.

- Market segmentation into mainstream and premium organic/natural products creates dual pricing trajectories, with premium segments maintaining higher margins.

- Competitive pressures from e-commerce and new entrants emphasize the importance of innovation and brand differentiation.

- Regulatory environments influence pricing strategies, with stricter regulations potentially increasing compliance costs and retail prices.

FAQs

1. What are the primary ingredients used in fiber laxatives?

Common ingredients include psyllium husk, methylcellulose, inulin, and wheat dextrin, each offering soluble fiber benefits that promote regular bowel movements.

2. How does consumer perception influence fiber laxative pricing?

Consumers perceive fiber laxatives as safe, natural, and effective, enabling manufacturers to command moderate premium prices, especially for organic or specialty formulations.

3. What regulatory factors impact the fiber laxative market?

Regulations around health claims, labeling standards, and classification as dietary supplements versus drugs affect product positioning and pricing strategies.

4. What is the outlook for online sales of fiber laxatives?

E-commerce channels are expanding rapidly, often offering lower prices and exclusive formulations, thereby exerting downward pressure on retail prices but opening new revenue streams.

5. How will raw material costs influence future prices?

Fluctuations in the cost of sourcing key fiber ingredients like psyllium and inulin will directly impact manufacturing expenses, ultimately influencing retail pricing.

References

[1] MarketWatch, “Global Fiber Laxative Market Size & Forecast,” 2023.

[2] WHO, “Digestive Disorders Prevalence,” 2022.

More… ↓