Share This Page

Drug Price Trends for FEXOFENADINE HCL

✉ Email this page to a colleague

Average Pharmacy Cost for FEXOFENADINE HCL

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| FEXOFENADINE HCL 60 MG TABLET | 69230-0201-05 | 0.17675 | EACH | 2025-11-19 |

| FEXOFENADINE HCL 180 MG TABLET | 00904-6711-46 | 0.27283 | EACH | 2025-11-19 |

| FEXOFENADINE HCL 180 MG TABLET | 00904-7050-40 | 0.27283 | EACH | 2025-11-19 |

| FEXOFENADINE HCL 180 MG TABLET | 00904-7486-02 | 0.27283 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Fexofenadine HCl

Introduction

Fexofenadine hydrochloride (HCl) is a second-generation antihistamine extensively prescribed for allergic rhinitis, chronic idiopathic urticaria, and hay fever. Its high safety profile, minimal sedative effects, and widespread consumer acceptance underpin its significant market presence. This article provides a comprehensive market analysis and price projection for Fexofenadine HCl, considering current trends, patent landscapes, manufacturing dynamics, regulatory impacts, and competitive positioning.

Market Overview

Global Market Size and Growth Dynamics

The global antihistamine market was valued at approximately USD 4.2 billion in 2022 and is expected to grow at a Compound Annual Growth Rate (CAGR) of around 3.5% through 2030 [1]. Fexofenadine HCl is a prominent segment within this, driven by increasing prevalence of allergic conditions, especially in urbanization hotspots across North America, Europe, and Asia-Pacific.

In 2022, Fexofenadine HCl accounted for approximately 25% of the total antihistamine market, estimated at USD 1.05 billion [2]. Its lean profile—low sedative effects and minimal drug interactions—has bolstered its preference over first-generation alternatives like diphenhydramine and chlorpheniramine.

Market Drivers

- Growing allergic disease prevalence: Increased urban pollution, climate change, and changing lifestyles escalate allergic rhinitis and urticaria cases.

- Enhanced patient awareness: Improved healthcare access and patient education reinforce demand.

- Brand Consolidation and Generics: Patent expiration and entry of generics have intensified market competition and affordability.

- Regulatory support: Approval of over-the-counter (OTC) formulations in key markets promotes accessibility and volume sales.

Market Challenges

- Price erosion: The influx of generics depresses pricing.

- Patent expiries: Lost exclusivity limits premium pricing opportunities.

- Market saturation in mature regions: Growth primarily driven by emerging markets.

Patent and Regulatory Landscape

Patents and Exclusivity

Pfizer’s patent protection on Allegra (fexofenadine) expired in the U.S. in 2012, leading to widespread generic competition [3]. Yet, some formulations still benefit from secondary patents or formulation patents, which can extend market exclusivity in specific regions.

Regulatory Approvals

Regulatory bodies approve Fexofenadine HCl mainly for OTC and prescription uses. Key markets like the U.S. FDA, EMA, and China's NMPA have streamlined approval processes for generics, enabling rapid market entry.

Competitive Environment

Key Players

- Sanofi-Aventis: Original innovator with branded Allegra lines.

- Teva, Sandoz, Mylan: Major generics manufacturers offering cost-effective Fexofenadine HCl products.

- Regional players: Local manufacturers in Asia-Pacific and Latin America expanding access.

Market Segments

- Branded vs. Generic: Generics dominate large portions due to cost advantages.

- Formulation types: Oral tablets, dispersible tablets, and OTC formulations.

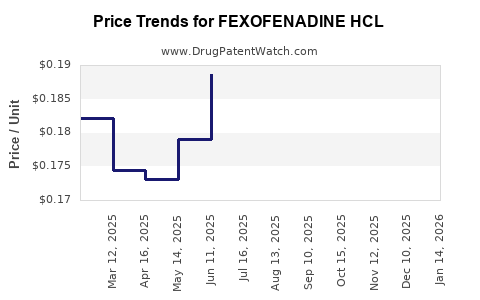

Price Trends and Projections

Current Pricing Landscape

Average retail prices vary significantly by region:

- United States: Generic Fexofenadine HCl 180 mg tablets range approximately USD 15–20 for a 30-day supply.

- Europe: Prices hover around EUR 10–15 per month.

- Asia-Pacific: Prices are markedly lower, often below USD 5 for comparable courses.

In the U.S., the entry of multiple generics has driven prices down by approximately 60% since patent expiry [4].

Price Evolution Forecast (2023-2030)

- Near-term (2023-2025): Prices are expected to stabilize at current generics levels, with minor fluctuations due to market maturation and consolidation.

- Mid-term (2025-2027): Intensified competition and potential biosimilar entries could further depress prices by an estimated 10–15%.

- Long-term (2028-2030): Emerging markets' growth and potential formulation innovations might support slight price increases or stabilization, with prices remaining 50-70% below early patent-protected levels.

The potential for substitution by new antihistamine modalities (e.g., biologics, vaccines) remains limited but could influence pricing dynamics marginally over the next decade.

Market Opportunities and Risks

Opportunities

- Emerging markets: Rapid urbanization and increasing allergic conditions present significant growth potential.

- OTC expansion: Broadening OTC availability facilitates increased consumer access.

- Formulation innovations: Development of long-acting, formulation-based delivery methods may command premium pricing.

Risks

- Patent challenges and litigation: Potential patent disputes could restrict market access or lead to delayed product launches.

- Regulatory uncertainties: Changes in OTC regulation or safety assessments could impact availability.

- Competitive pressure: Rapid generic proliferation may erode margins and limit pricing power.

Key Market Trends

- Increased OTC penetration: Facilitating wider consumer access and boosting volume sales.

- Price erosion: Driven by multiple generic entrants, especially in mature markets.

- Regional disparities: Higher prices maintained in regions with restricted generic entry or strong brand loyalty.

- Formulation diversification: Innovative delivery systems (e.g., dissolvable tablets) fostering new market segments.

Conclusion and Recommendations

Fexofenadine HCl's market remains primarily driven by generic competition, which has significantly lowered prices, especially in mature markets like the U.S. and Europe. Price stability is expected over the next several years, with minor downward pressures due to competitive parity. Emerging markets offer substantial growth prospects owing to increasing allergy prevalence and expanding healthcare infrastructure.

For pharmaceutical companies aiming to capitalize on this landscape, focusing on formulations tailored for emerging markets, OTC expansion strategies, and potential patent protections can optimize market share and profit margins. Meanwhile, affordability and accessibility remain central, given the commoditized nature of the drug.

Key Takeaways

- The global Fexofenadine HCl market is valued at over USD 1 billion, with steady growth driven by allergy prevalence.

- Patent expiries have led to intense generic competition, resulting in significant price erosion.

- Prices in mature markets are projected to stabilize or decline modestly through 2030, while emerging markets present promising growth opportunities.

- Formulation innovations and OTC expansion are strategic avenues to enhance market share.

- Market dynamics necessitate proactive IP management and strategic regional focus to sustain profitability.

FAQs

1. What factors predominantly influence the pricing of Fexofenadine HCl?

Price fluctuations are primarily driven by patent statuses, the number of generic competitors, regional regulations, and formulation innovations.

2. How does patent expiration impact Fexofenadine HCl's market?

Patent expiry opens the market for generics, escalating competition, and resulting in significant price reductions, especially in developed markets.

3. Which regions present the most growth opportunities for Fexofenadine HCl?

Emerging markets across Asia-Pacific, Latin America, and parts of Africa offer substantial growth owing to increasing allergic disease prevalence and expanding healthcare access.

4. Are there any upcoming formulations that could influence the price or market share of Fexofenadine HCl?

Long-acting formulations, dissolvable tablets, and OTC variants could diversify the product portfolio and potentially sustain or increase prices in certain segments.

5. What is the outlook for branded versus generic Fexofenadine HCl?

Generics will continue to dominate due to cost advantages, but branded versions may retain niche segments through differentiation and formulation technologies.

References

[1] MarketResearch.com, "Global Antihistamines Market Outlook," 2022.

[2] IQVIA, "Pharmaceutical Market Data," 2022.

[3] U.S. Patent Office, "Patent Status of Allegra," 2012.

[4] GoodRx, "Fexofenadine Prices and Trends," 2022.

More… ↓