Share This Page

Drug Price Trends for FEMARA

✉ Email this page to a colleague

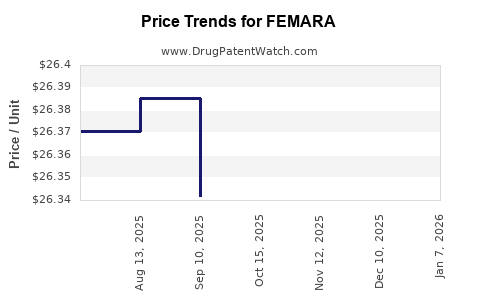

Average Pharmacy Cost for FEMARA

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| FEMARA 2.5 MG TABLET | 00078-0249-15 | 26.35648 | EACH | 2025-11-19 |

| FEMARA 2.5 MG TABLET | 00078-0249-15 | 26.35648 | EACH | 2025-10-22 |

| FEMARA 2.5 MG TABLET | 00078-0249-15 | 26.34171 | EACH | 2025-09-17 |

| FEMARA 2.5 MG TABLET | 00078-0249-15 | 26.38553 | EACH | 2025-08-20 |

| FEMARA 2.5 MG TABLET | 00078-0249-15 | 26.37067 | EACH | 2025-07-23 |

| FEMARA 2.5 MG TABLET | 00078-0249-15 | 26.28232 | EACH | 2025-01-14 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for FEMARA (Letrozole)

Introduction

FEMARA (letrozole) is a highly prescribed aromatase inhibitor primarily used in the treatment of hormone receptor-positive breast cancer in postmenopausal women. Since its approval by the U.S. Food and Drug Administration (FDA) in 1998, FEMARA has become a cornerstone in hormone therapy, with expanding indications and brand recognition. This analysis explores current market dynamics, competitive positioning, and future price trajectories, offering insights crucial for pharmaceutical stakeholders and investors.

Market Overview and Dynamics

1. Market Segmentation and Demand Drivers

FEMARA's primary market is postmenopausal women with estrogen receptor-positive (ER+) breast cancer, representing a substantial segment within oncology therapeutics. Epidemiologically, breast cancer remains the most diagnosed cancer worldwide, with an estimated 2.3 million new cases globally in 2020 [1]. The aging population and increased screening have amplified the demand for targeted hormonal therapies.

In addition to oncology, FEMARA is utilized off-label for fertility enhancement, particularly in ovarian stimulation protocols, albeit to a lesser extent.

2. Key Market Players and Competition

FEMARA is marketed exclusively by Novartis. Nonetheless, its competitive landscape includes other aromatase inhibitors such as anastrozole (Arimidex) and exemestane (Aromasin). Generic versions of letrozole entered the market post-patent expiry in multiple jurisdictions, significantly impacting pricing and market share dynamics.

3. Patent and Regulatory Landscape

Novartis held primary patents until their expiration in major markets like the U.S. and Europe by 2010–2015, enabling generic manufacturing. Despite patent cliff effects, Novartis maintains a robust brand presence in certain regions through marketing and formulated delivery advantages. Ongoing patent litigations and exclusivity periods influence market entry timelines for generics and biosimilars.

Price Trends and Projections

1. Historical Pricing Trajectory

Prior to patent expiry, FEMARA commanded premium pricing, typical of second-generation aromatase inhibitors. Post-patent, generic competition caused a precipitous decline in prices. For instance, the average retail price of a 20 mg tablet declined by approximately 60–70% over five years following market entry of generics in the U.S. [2].

2. Current Pricing Landscape

In 2023, branded FEMARA averages around $4.50–$7.00 per 2.5 mg tablet in retail pharmacies in the U.S., significantly higher than generics priced between $0.15–$0.25 per tablet. Market data suggest that generic prices stabilize after initial dips, with minor fluctuations driven by supply chain factors and regional reimbursement policies.

3. Future Price Projections

Price dynamics are likely to follow a gradual decline trajectory over the next five years, driven by increasing generic penetration, increased competition from biosimilars, and payer pressure. Nevertheless, brand-name FEMARA may retain premium status in certain markets due to brand loyalty and formulary restrictions, with estimates showing a stabilizing price around $3.00–$4.50 per tablet in North America and Europe by 2028.

Factors Impacting Future Market and Pricing

1. Regulatory and Patent Landscape

Patent expirations in key markets such as the U.S. (2018–2020) and Europe (2017) facilitated generic proliferation. Future patent litigations or secondary patents could temporarily restrain generic entry, preserving higher prices.

2. Market Penetration of Generics and Biosimilars

The entry of more affordable generics and biosimilars significantly pressures brand pricing. As more manufacturers gain approval, price competition will intensify, particularly in high-volume markets.

3. Pricing and Reimbursement Policies

Government health agencies and insurance payers exert downward pressure through formulary management, prior authorization, and negotiated discounts, which influence the actual prices paid by end-users.

4. Innovations and Line Extensions

Although FEMARA remains primarily a straightforward aromatase inhibitor, future formulations or combination therapies could sustain higher prices if they demonstrate superior efficacy or tolerability, although these are unlikely in the immediate term.

5. Market Growth and Demographics

The rising incidence of breast cancer, combined with higher screening rates, indicates sustained increased demand. Moreover, expanded indications, such as off-label uses or new combination regimens, could bolster volume and influence prices.

Strategic Implications for Stakeholders

Pharmaceutical Companies:

- Entry timing for generic or biosimilar versions remains critical; early market entry could secure significant share before price erosion.

- Licensing or patent extensions might delay generic entry, maintaining higher prices temporarily.

Investors and Analysts:

- Anticipate continued price declines; focus on market share trends and regulatory developments to refine projections.

- Diversification into combination therapies or expanding indications could retain premium pricing potential.

Healthcare Providers and Payers:

- Cost containment strategies influence prescribing patterns; favoring generics is likely to decrease healthcare expenditures.

Conclusion and Outlook

FEMARA has undergone a significant generics-driven price decline over the past decade. Moving forward, prices are projected to stabilize at a lower but sustainable level, with slight fluctuations depending on regional policies, patent status, and competition. The oncology landscape's evolving dynamics will influence both volume and pricing, necessitating continuous market surveillance.

Key Takeaways

- Patent expiration catalyzed a sharp decline in FEMARA pricing, which has stabilized amidst increasing generic competition.

- Future price decreases are expected but will plateau around $3–$4.50 per tablet in developed markets by 2028.

- Generics and biosimilars will dominate the market share, compelling brand-preserving strategies for Novartis and other stakeholders.

- Regulatory and patent climates are pivotal: patent extensions or legal barriers could temporarily sustain higher prices.

- Market growth driven by increasing breast cancer incidence offers volume opportunities, even as price pressure remains.

FAQs

1. What are the main factors influencing FEMARA's pricing today?

Market competition, patent status, regional reimbursement policies, and the proliferation of generics primarily drive current prices.

2. How does FEMARA compare to other aromatase inhibitors in pricing and market share?

While FEMARA initially commanded higher prices, generic versions of letrozole now lead in market share due to affordability, often surpassing branded options.

3. What is the outlook for FEMARA’s price in the next five years?

Prices are expected to stabilize at approximately $3–$4.50 per tablet in developed markets, with marginal fluctuations driven by regional dynamics.

4. Are there new formulations or indications that could impact FEMARA's pricing?

While current development focuses on combination therapies and expanding indications, no significant reformulations are anticipated in the immediate future.

5. How important is regional regulation in shaping FEMARA’s market and pricing landscape?

Extremely significant; regulations influence patent protections, generic approvals, pricing negotiations, and reimbursement policies, directly affecting market access and profitability.

References

[1] World Health Organization. "Cancer Fact Sheets." 2020.

[2] GoodRx. "Letrozole Prices and Trends," 2022.

More… ↓