Share This Page

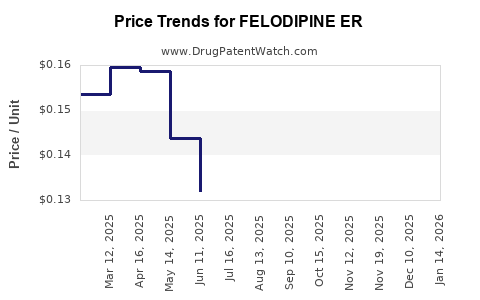

Drug Price Trends for FELODIPINE ER

✉ Email this page to a colleague

Average Pharmacy Cost for FELODIPINE ER

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| FELODIPINE ER 10 MG TABLET | 57237-0110-01 | 0.15801 | EACH | 2025-12-17 |

| FELODIPINE ER 10 MG TABLET | 13668-0134-05 | 0.15801 | EACH | 2025-12-17 |

| FELODIPINE ER 10 MG TABLET | 23155-0050-01 | 0.15801 | EACH | 2025-12-17 |

| FELODIPINE ER 10 MG TABLET | 00603-3583-21 | 0.15801 | EACH | 2025-12-17 |

| FELODIPINE ER 10 MG TABLET | 13668-0134-10 | 0.15801 | EACH | 2025-12-17 |

| FELODIPINE ER 10 MG TABLET | 00603-3583-28 | 0.15801 | EACH | 2025-12-17 |

| FELODIPINE ER 10 MG TABLET | 13668-0134-01 | 0.15801 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for FELODIPINE ER

Introduction

Feledipine ER (Extended Release), a dihydropyridine calcium channel blocker, primarily treats hypertension and angina pectoris. Its market dynamics are shaped by factors such as cardiovascular disease prevalence, competitive landscape, patent status, regulatory environment, and manufacturing costs. An in-depth analysis of these components informs strategic planning, investment decisions, and pricing forecasts.

Market Overview

Global and Regional Demand

The global antihypertensive drugs market is projected to reach USD 27 billion by 2028, growing at a CAGR of approximately 3.5% [1]. Feledipine ER, as a generic or brand offering, constitutes a significant segment within calcium channel blockers (CCBs), which account for roughly 17% of the antihypertensive therapy market [2].

Regionally, North America dominates due to high hypertension prevalence (over 45% among adults) and advanced healthcare infrastructure. Europe is also a substantial market, with rising awareness and treatment adherence. Emerging markets in Asia-Pacific display expanding demand, driven by increased urbanization, lifestyle changes, and healthcare investments.

Competitive Landscape

Feledipine ER faces competition from:

- Brand-name formulations: Such as Plendil (Fleodipine), Amlodipine ER, and other CCBs.

- Generics: Numerous manufacturers produce generic Feledipine ER, intensifying price competition.

Key players include Pfizer, Sanofi, and generic manufacturing giants like Mylan, Teva, and Sandoz.

The patent expiry of branded formulations has led to an influx of generics, intensifying price competition and driving affordability. The molecule's patent status in major markets significantly influences pricing strategies.

Market Drivers and Barriers

Drivers

- Rising Hypertension Prevalence: Aging populations and lifestyle risk factors elevate demand.

- Patient Preference for ER Formulations: Once-daily dosing improves adherence.

- Affordable Generics: Entry of generics reduces costs and improves access.

- Government Campaigns and Treatment Guidelines: Favor early and consistent treatment.

Barriers

- Price Competition: Oversaturation of generics suppresses margins.

- Regulatory Challenges: Marketing approvals and post-marketing surveillance constraints.

- Physician Preference: Some clinicians prefer established or alternative therapies based on efficacy and side effect profiles.

Pricing Landscape

Current Price Benchmarks

In the United States, the average wholesale price (AWP) for branded Feledipine ER ranges from USD 150–200/month. Generics are substantially cheaper, averaging USD 20–50/month, depending on the supplier and formulation.

In European countries, prices vary from EUR 15–40 for generics, influenced by national reimbursement policies. Asia-Pacific markets report even lower prices due to cost-of-living differences and regulatory pressures favoring affordability.

Pricing Strategies

Pharmaceutical companies often employ tiered pricing—higher margins for branded drugs in markets with fewer competitors and aggressive pricing for generics. Price reductions are common post-patent expiration. The presence of multiple generics (market saturation) causes downward pressure, often leading to $1–2 per pill in certain regions.

Future Price Projections

Factors Influencing Future Pricing

- Patent Expiration Timeline: Anticipated patent cliff in 2025-2027 in key markets.

- Market Penetration of Generics: Increased generic competition pushes prices lower.

- Regulatory Changes: Price controls in countries like India and European nations will influence sticker prices.

- Manufacturing and Supply Chain Costs: Advances in synthesis and bulk procurement reduce unit costs.

Forecasted Pricing Trends (Next 5 Years)

| Region | Estimated Price Range (USD/month) | Prognosis |

|---|---|---|

| North America | $15 – $30 (generic) | Continued decline due to generic saturation |

| Europe | €10 – €25 | Slight decrease expected as new generics enter |

| Asia-Pacific | $5 – $15 | Stable to declining, driven by market expansion |

In advanced markets, branded Feledipine ER could retain a premium price (~USD 150–200/month), while generic equivalents will dominated by competitive pricing, likely settling at USD 10–30/month in mature markets.

Market Opportunities and Risks

Opportunities:

- Developing Market Entry: Affordability can facilitate access in emerging markets.

- Combination Therapies: Positioning Feledipine ER in multi-drug regimens.

- Biosimilars and Specialty Formulations: Innovations can command premium prices.

Risks:

- Generic Encroachment: Significant downward price pressure.

- Regulatory Hurdles: Delays in approval or reimbursement restrictions.

- Market Saturation: Limited growth prospects as most markets mature.

Regulatory and Patent Outlook

Patent expiration within the next 2–4 years will catalyze the proliferation of generics, driving down prices. Regulatory agencies like FDA and EMA continue to scrutinize safety and efficacy standards, potentially impacting market access and pricing strategies.

Conclusion

The Feledipine ER market is poised for gradual decline in branded pricing as patent expiries and generic proliferation intensify competition. While the compound maintains essential cardiovascular benefits, the looming patent cliff and market saturation will exert substantial downward pressure on pricing, particularly in mature markets.

Companies seeking to optimize profitability should focus on differentiating offerings—through formulation, targeted marketing, or combination therapies—and exploring emerging markets with less price elasticity.

Key Takeaways

- Market Demand: Strong in aging populations, with a shift toward generic formulations reducing prices.

- Pricing Trajectory: Anticipated decline over the next 5 years, especially in generic segments.

- Strategic Focus: Innovate with combination therapies, enhance supply chain efficiencies, and explore emerging markets.

- Regulation Impact: Patent expiries and policy changes will substantially influence price points.

- Market Entry: Opportunities exist in developing nations where affordability expands access.

Frequently Asked Questions

1. When are the patents for Feledipine ER expected to expire?

Patents are projected to expire between 2025 and 2027 in major markets like the US and Europe, facilitating generic entry and price reductions [1].

2. How does Feledipine ER compare to other calcium channel blockers in pricing?

Feledipine ER generally commands a higher price than more established agents like Amlodipine due to brand premiums, but generic versions significantly reduce costs across all CCBs.

3. What factors could mitigate the impact of patent expiry on prices?

Stringent regulatory barriers, supply chain complexities, and limited generic manufacturing capacity can sustain higher prices temporarily.

4. Are there regional variations in drug pricing?

Yes. Prices are higher in North America and Europe due to regulation and reimbursement policies, while Asian markets tend to have lower prices owing to cost-effective manufacturing and government price controls.

5. What are potential future innovations in Feledipine ER formulations?

Development of patented extended-release mechanisms, fixed-dose combinations, and biosimilar versions could create niche markets and command premium pricing.

Sources:

- Transparency Market Research. (2022). Global Antihypertensive Drugs Market.

- Global Data. (2023). Calcium Channel Blockers Market Overview.

More… ↓